state and local Tax

MULTI-STATE TAX ADVISOR SERVICES KEEP YOU COMPETITIVE

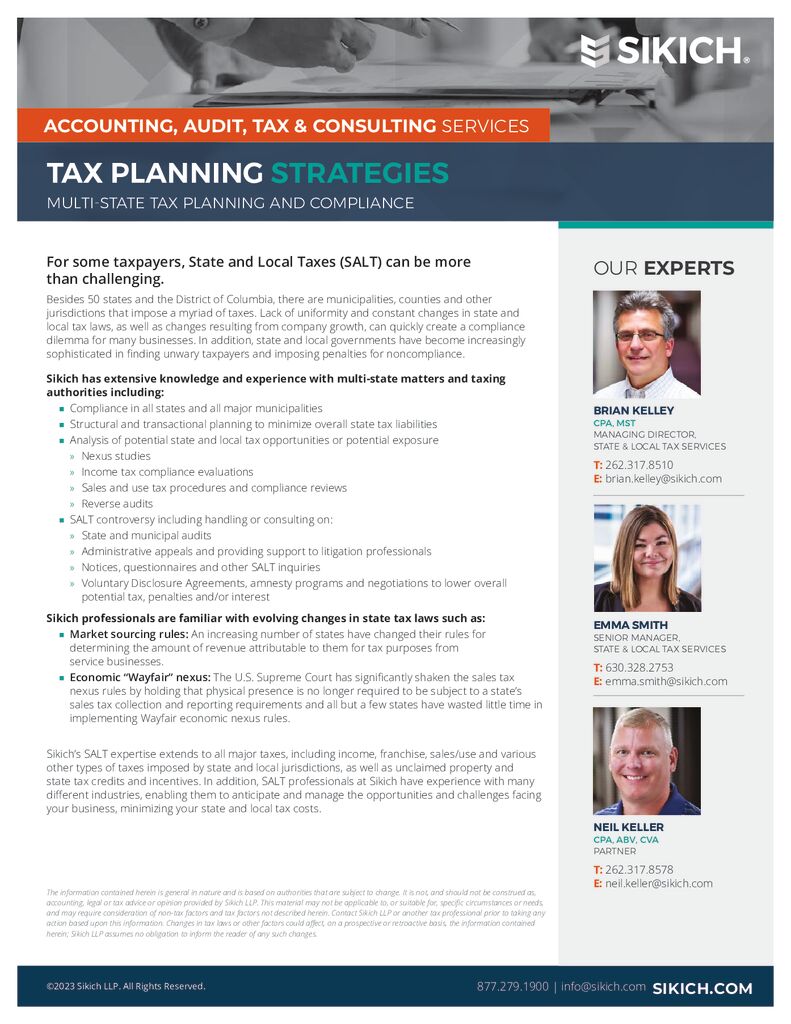

To stay competitive in the marketplace, companies need to search for new opportunities wherever they may arise – near or far. In fact, geography is hardly ever considered when selling products or engaging new vendors. However, it’s important to remember that when transactions occur across state lines there are income, franchise or sales and use tax issues that may affect your business. In our experience, most businesses are unaware of the state and local tax requirements and liabilities that cross-state transactions can create. For this reason, we help companies identify, document, and address the liabilities that may impact them. The most important thing is to stay ahead of these issues to limit your risks of a state tax audit.

Sikich works with companies across the country to address state and local tax planning and compliance concerns. Our state and local tax services team can guide your business through a state tax audit or conduct a proactive assessment to make you aware of unaddressed liabilities that could trigger an audit. We advise companies in a variety of situations including: nexus determination for franchise and income tax, sales and use tax matters, and transactional tax issues.

Reduce your federal tax burden by taking full advantage of tax deductions, credits, and planning strategies.

Count on expert advisement for well-planned, cross-border tax strategies that positively impact your bottom line.

Meet your short- and long-term objectives with a comprehensive financial plan designed just for you.

Understanding what credits are available and what it takes to qualify can ease your tax burden and help with your company’s cash-flow.

Service Overview Multi-State Tax Planning

STATE AND LOCAL TAX SERVICES AND SOLUTIONS

Constantly changing state and local tax laws and regulations pose a number of challenges for business owners. Not only is it difficult to keep up with these changes, it can be confusing as well. Not content to solve an issue after it happens, Sikich is always monitoring judicial, legislative, and regulatory activity to stay ahead of state and local tax changes that could affect your business. Sikich’s state and local tax services include:

It can be difficult to navigate the waters of sales and use tax. What is or isn’t taxable can be quite confusing and operating in multiple states only further muddies the waters. Our state tax experts can assist you in your efforts to minimize the sales and use tax burden while staying in compliance with the tax law.

PLAN FOR STATE AND LOCAL TAX OBLIGATIONS

WITH HELP FROM SIKICH

The rules around taxes often vary by state and locale. For this reason it’s essential to work with a Sikich multi-state tax advisor who understands how these tax regulations will affect your business and can help you plan for them. If you have recently expanded operations into other states, or are planning to do so, contact Sikich today!