Valuation Services

Accuracy is paramount in valuation services. Turn to proven professionals who understand the nuances of fair market value and fair value of businesses, equity interests, and intellectual property. Our valuation experts have experience in testifying on complex valuation matters in federal and state courts, U.S. Tax Court, and bankruptcy courts. Our valuation services are focused in the areas of litigation, bankruptcy, financial reporting, intellectual property, tax, M&A, property tax, and family law.

Request A Consultation

[gravityform id=43 title=false description=false ajax=true tabindex=49]

ANSWERS TO THE MOST CRITICAL QUESTIONS FACING BUSINESS LEADERS

Something as important as determining the fair market value of your business assets requires the experience and expertise of a proven professional. That’s why leaders from a wide range of industries turn to the highly experienced specialists at Sikich to handle their most complex and critical valuation cases. Whether we’re working directly for a corporation or with counsel, we provide a wealth of expertise and a level of support that is unrivaled in the industry. And our proven track record illustrates that our support is vital to optimizing outcomes. Our valuation team has provided expert witness testimony in state and federal litigation matters, bankruptcy courts, U.S. tax court, and alternative dispute resolution forums.

Our team will help you find the critical answers you need by identifying data, analyzing information and producing a clear and simple statement of conclusions.

Providing objective expertise to clients and their outside counsel to solve a range of legal issues such as intellectual property, insurance claims, and family law.

We provide comprehensive data collection services and assistance with fraud management and risk mitigation.

We serve as independent experts, testifiers or consultants, with specialized expertise in fair market value and fair value.

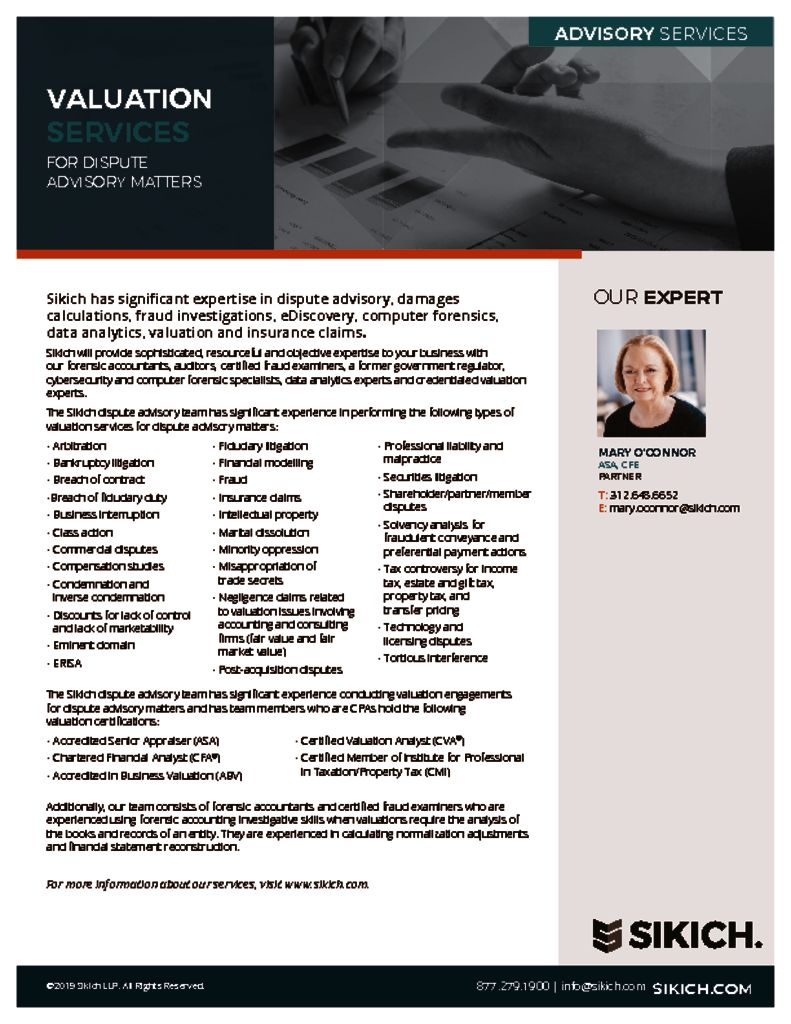

Service Overview Valuation Services for Dispute Advisory Matters

AUDIT SERVICES TO MEET YOUR BUSINESS NEEDS

- Estate and gift tax

- Charitable contributions

- Income tax

- Intangible assets

- C Corporation conversion to S Corporation

- Ad valorem / property tax services

- Discount studies

- Excess compensation/private inurement opinions for not-for-profit transactions

- Goodwill impairment

- Intangible and fixed asset impairment

- Fair value presentation

- Purchase price allocation

- Portfolio valuation and fund advisory

- Stock option and equity interests as compensation

- Illiquid investments

- Strategic planning and pre-deal advisory

- Buy-sale and shareholder agreements

- Succession planning

- Exit strategy

- Staging a business for maximum value upon sale

- ESOP valuation

- Collateral analysis

- Fairness and solvency opinions

- Investment analysis

- Financial modeling

- Related party transactions

- Corporate reorganization

- Physician practices

- Ambulatory surgical centers

- Hospitals and healthcare systems

- Nursing homes

Our valuation team professional hold the following valuation credentials: Accredited Senior Appraiser (ASA), Accredited in Business Valuation (ABV), Certified Public Accountant (CPA), Chartered Financial Analyst (CFA), Certified Valuation Analyst (CVA) and Certified Member of Institute for Professional in Taxation/Property Tax (CMI).

Related Insights

REQUEST A CONSULTATION

Fill out the form and our Forensic & Valuation team will schedule a free consultation to discuss your forensic or valuation needs.

Contact Us

[gravityform id=43 title=false description=false ajax=true tabindex=49]