2025 Volume 2 Manufacturing Industry Pulse Survey

Manufacturer Confidence Hits Record High as Investment and Efficiency Take Priority

Industry outlook

In a time of heightened uncertainty, manufacturing executives’ business outlooks are still optimistic. On a scale of one to 10, the average confidence score of business prospects over the next six months is 7.27, a 6% increase from May 2025 and our highest recorded optimism score.

Over half of respondents report consistent or increasing customer demand and 81% are expecting revenue growth this year, a sign that there are potential opportunities for targeted investments in capacity, supply chain optimization, technology enhancements and more. Even as tariffs and geopolitical uncertainty weigh heavily on outlooks, executives remain focused on growth through efficiency, innovation and smart planning.

“Manufacturers continue to prove they’re built to adapt, and this report reflects that resilience. The optimism we are seeing is backed by real action through investments in people, technology and operations. The combination of confidence and action is what propels the industry forward.”

– Jerry Murphy, CPA, CMA, CGMA; Principal and Manufacturing Services Leader

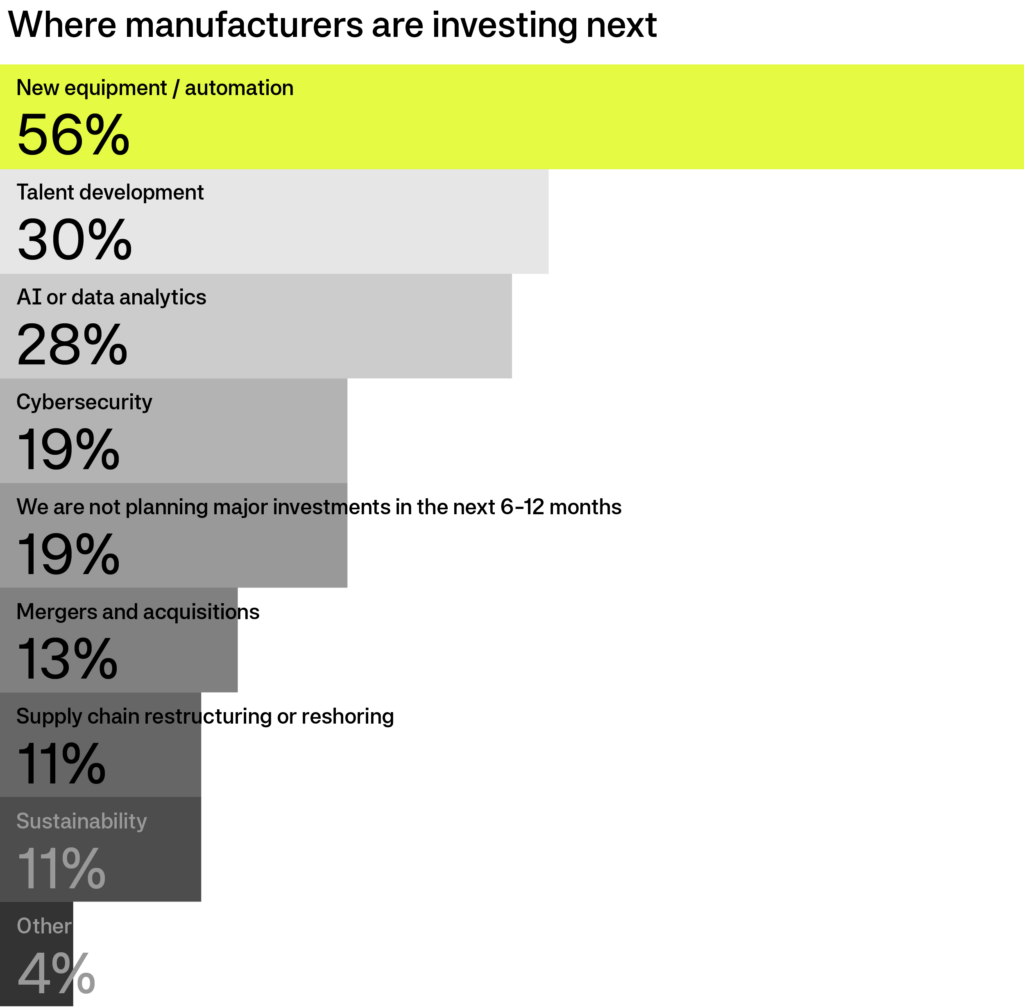

Automation and AI Lead the Next Wave of Investment

More than one in two (56%) manufacturers are planning major investments in new equipment and automation in the next 6-12 months, a clear signal that digital transformation is moving from theory to action. Another 30% plan to invest in talent development and 28% in AI or data analytics, as companies seek real-time insights to improve decision-making, forecasting and productivity.

AI adoption continues to gain traction. Many manufacturers are determining where it can maximize value. Ray Beste, Sikich’s Principal AI Strategist, shared a framework in a recent article for identifying high-ROI AI opportunities that enhance efficiency and decision-making.

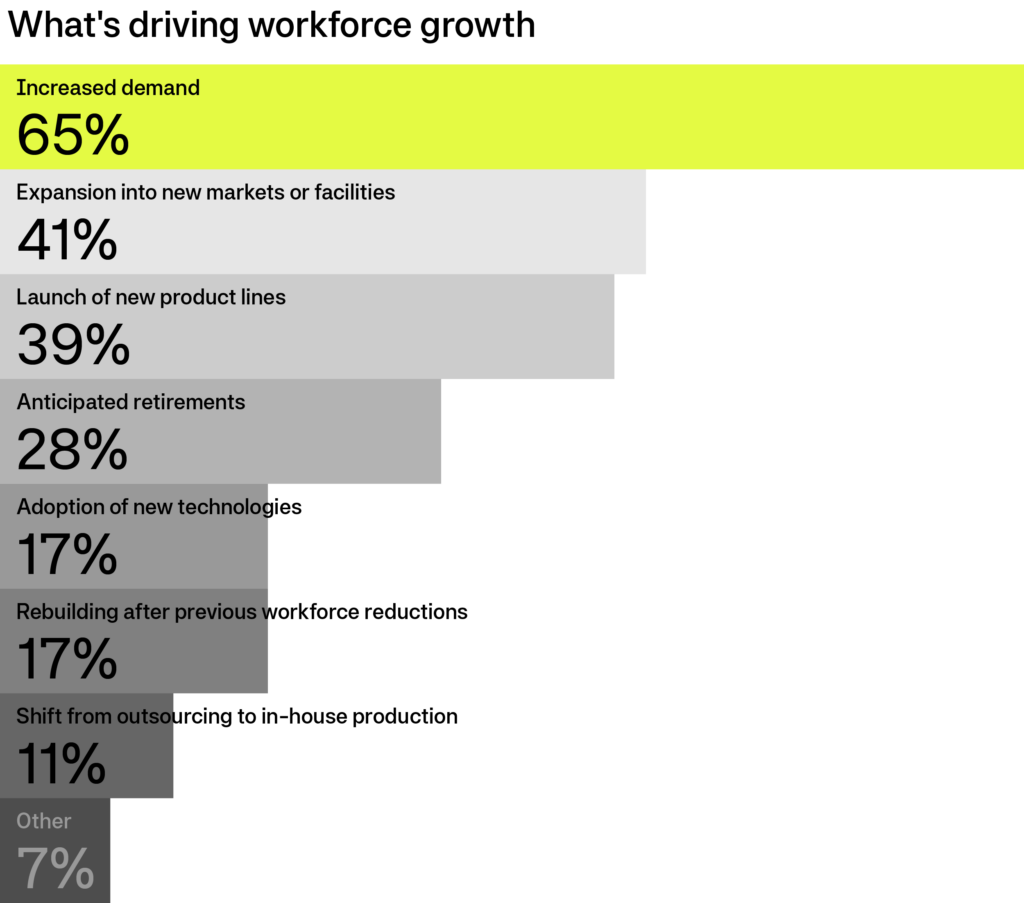

Talent Remains a Strategic Priority

Most respondents admit that finding and developing qualified talent remains an obstacle. It was reported as a top-three challenge they expect to face this year, alongside inflation and tariffs. Still, more than half (58%) are expecting to grow headcount in the next 12 months, driven primarily by increased demand.

“After a year of uncertainty, U.S. manufacturers are cautiously optimistic that 2026 will bring continued growth. That outlook is expected to drive increased investment, fueled by expectations of solid economic conditions and a workforce transformation shaped by automation, AI and evolving skill needs.”

– Michael Weidokal, Founder & President, International Strategic Alliance

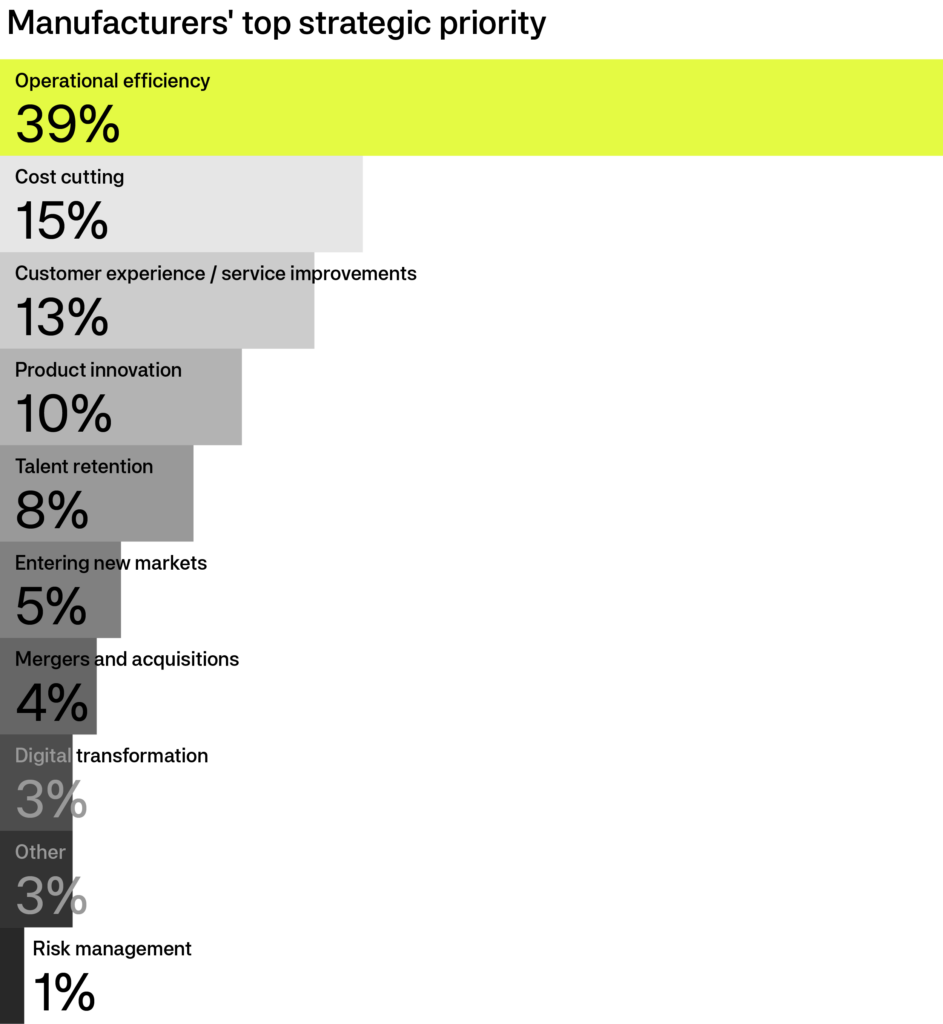

Efficiency Takes Center Stage

Operational efficiency (39%) emerged as the top strategic priority heading into the end of 2025, far outpacing cost cutting or innovation. These findings reflect an industry focused on strengthening its foundation, modernizing processes, improving margins and positioning for sustainable growth.

The Bottom Line

Operational excellence and strategic investment are defining the next era of manufacturing. We partner with businesses to navigate this changing landscape with clarity and confidence. Whether it’s improving efficiency through process optimization and automation, identifying smart investments in AI and data analytics or overcoming demand and regulatory pressures, our multidisciplinary teams are here to help. Our services also span tax strategy, technology integration and digital transformation.

We’re committed to helping you not only adapt to industry change but lead it.

Want to discuss The Pulse further?

Want to talk through our findings? Or discuss how our Manufacturing experts can help support your business?

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.