This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Opportunity Zones: A Case Study

The Tax Cut and Jobs Act of 2017 created a new tax saving vehicle, Opportunity Zones (OZ). The intention of the OZ law is to encourage investment in low income and impoverished areas. Since its inception, there has been an overwhelming amount of attention paid to the new tax incentive and its potential for taxpayers, due to the following tax breaks:

- Temporary deferral of capital gains that are reinvested in qualified OZ property: Taxpayers can defer capital gains tax due upon sale or disposition of a property if the capital gain on the disposition is reinvested within 180 days into an OZ fund. For gains from property held in a pass-through entity, the partner or shareholder has 180 days from the end of the pass-through entity’s year-end to reinvest the gain.

- Step-up in basis for investments held in OZ funds: If the investment in the OZ fund is held by the taxpayer for at least five years, the basis on the original gain is increased by 10 percent of the original gain. If the OZ asset or investment is held by the taxpayer for at least seven years, the basis on the original gain is increased by an additional five percent of the original gain. The reinvestment needed to be made by December 31, 2019 to achieve the maximize 15 percent step-up; however, post-2019 investments will still qualify for the 10 percent step-up if held for five years.

- Permanent exclusion of capital gains tax on qualified OZ investments held for at least 10 years: Investments maintained: (a) for at least 10 years, and (b) until at least December 31, 2026 will be eligible for permanent exclusion of capital gains tax on any gains from the qualified OZ portion of their investment when sold or disposed.

Investments can only be made with eligible funds from a sale or exchange before January 1, 2027.

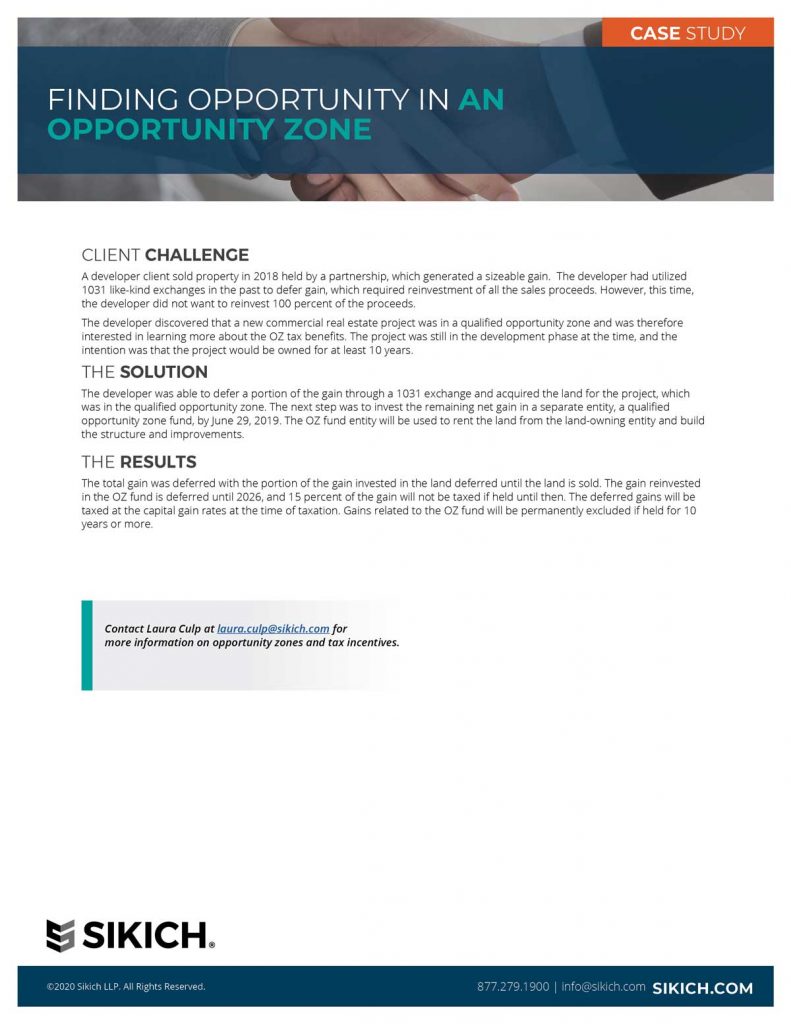

Below is a real example of how one taxpayer used a combination of a like-kind exchange and the opportunity zone incentives to defer taxes.

Click on the case study below

To learn more about the tax incentives of opportunity zones, contact our experts today.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.