This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Federal Reserve Releases Guidance on “Main Street Lending Program”

With all the buzz around the COVID-19 pandemic hardship loan programs, the Main Street Lending Program (MSLP) is probably one that you’re least familiar with. The recent CARES Act ushered in the Payroll Protection Program (PPP) and its loan forgiveness incentive and the Economic Injury Disaster Loan (EIDL) with its $10,000 grant program. These programs have garnered most of the attention this year, and rightfully so, as they have provided tremendous relief for countless businesses and their employees. Recent changes to the MSLP, however, will provide opportunities for many businesses and organizations still looking for financial relief as a result of the pandemic.

What is the MSLP?

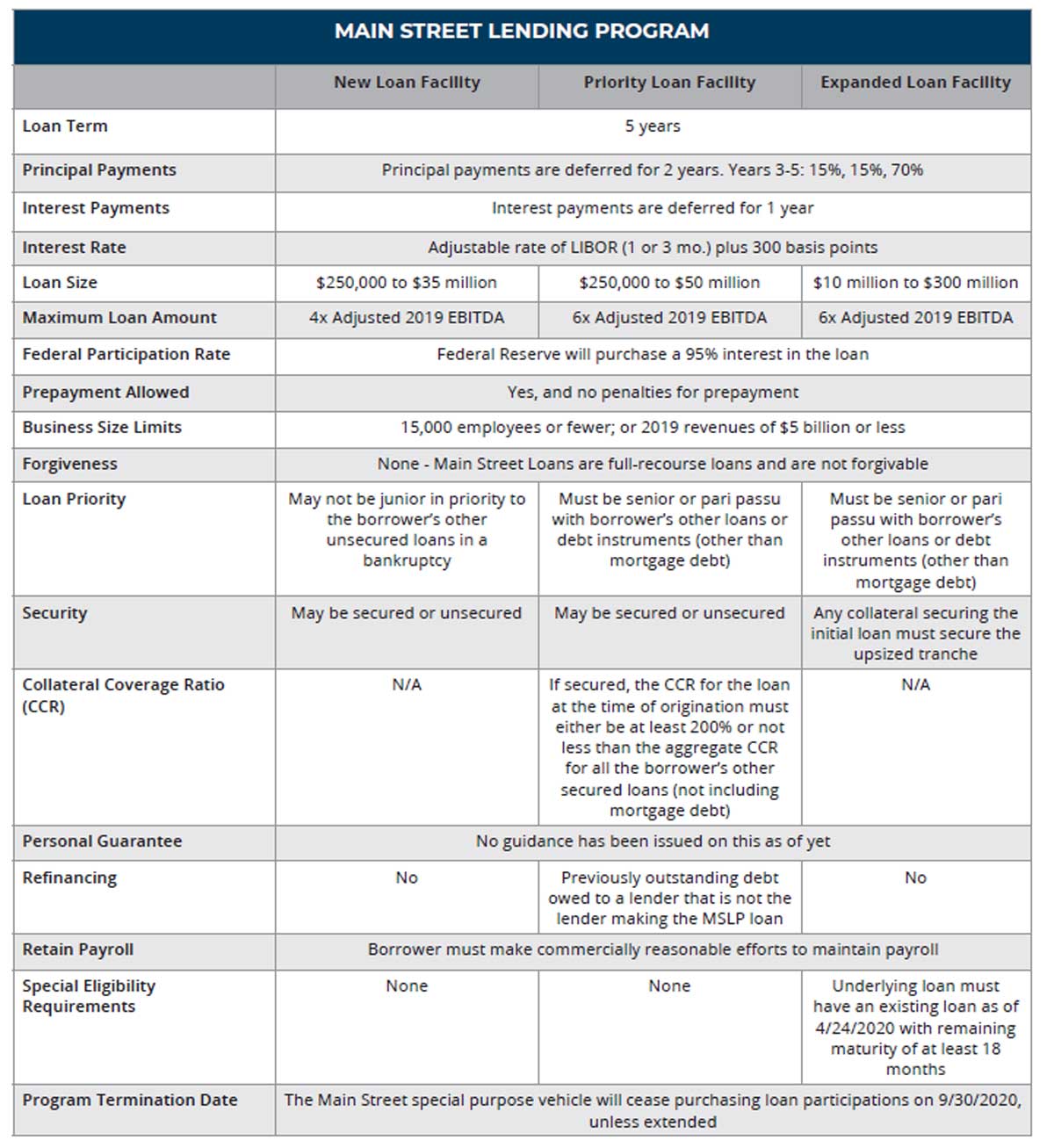

The MSLP was announced in April 2020 and recently updated in June 2020. The basic design of the MSLP is that the Federal Reserve (“the Fed”) will purchase loans that eligible lenders issue to small and mid-sized businesses that were in sound financial condition prior to the onset of the COVID-19 crisis. The Fed will spend up to $600 billion buying 95% of each eligible loan from the lenders to assist businesses through these tumultuous economic conditions. Eligible lenders will participate in 5% of the loan. Stated in the June 2020 update, the MSLP will be administered through a single “special purpose vehicle” (SPV), but the program consists of three different types of loans, each with their own characteristics as shown below:

Who can Borrow under MSLP?

A business must meet the criteria listed below to qualify for funding through the MSLP. The eligibility criteria are the same across all three loan types.

- The business was established prior to March 13, 2020 under the laws of the United States.

- The entity is an eligible business:

- Ineligible businesses include those listed at 13 CFR 120.110(b)-(j), (m)-(s) as modified by the Small Business Administration (SBA). Please see this link to review the SBA guidance listing these ineligible businesses.

- Not-for-profit organizations were not initially eligible to borrow under the MSLP. On June 15, 2020, the Fed announced its intentions to evaluate availability to not-for-profit organizations.

- The business must have 15,000 employees or less; or the business must have 2019 annual revenues of $5 billion or less.

- The business must be a U.S. company with significant operations and a majority of its employees based in the U.S.

- The business may only participate in one of the MSLP programs and must not also participate in the Primary Market Corporate Credit Facility (PMCCF).

- A business can receive more than one loan under a single MSLP facility, provided the sum of the loans does not exceed the maximum amount.

- A business can participate in the MSLP and receive PPP and EIDL funding.

- The business must not have received specific support pursuant to the Coronavirus Economic Stabilization Act of 2020 (Title IV of the CARES Act).

The Fed provides a detailed FAQ (click here to download) that addresses many aspects of the MSLP.

Key Takeaways

Businesses that were ruled ineligible for (or decided not to pursue) funding through the PPP or EIDL may have another option with the MSLP. Those previously ruled ineligible for other programs due to the SBA’s “affiliation rule” (i.e., private equity portfolio companies), still must adhere to the calculation of number of employees. However, there is a much higher threshold for the MSLP compared to the other programs.

The MSLP could be an opportunity for a business to refinance its debt structure at a lower interest rate with deferred payments through the MSLP’s Priority Loan Facility. Keep in mind that a business would need to apply with a different lender than the initial lender of the debt being refinanced.

There are restrictions on use of the funding for compensation, stock repurchases, and distributions, as set forth by the CARES Act, and apply during the outstanding period of the loan plus one additional year. Further, employers cannot use the funding to increase the compensation for employees earning above $425,000 annually, and there are strict cutbacks for employees above $3 million in annual compensation. Additionally, stock repurchases, dividends, and other distributions are not allowed, although pass-through entities (S Corporations and Partnerships/LLCs) are permitted to make tax distributions.

If a business received PPP or EIDL funding, it can still borrow funds through the MSLP as long as it meets the eligible borrower criteria noted above.

The MSLP is a viable option for businesses and organizations still looking for funding to lessen the immense burden from the COVID-19 pandemic. The lender registration for the program is open now, and the submission of loans to the program will soon follow (the Fed also released a lender portal on June 12, 2020 for the MSLP). If you have questions about the Main Street Lending Program or which of the loans is right for your situation, please contact your Sikich advisor.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.