This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Better Understand Your Client Relationships with Households in Salesforce Financial Services Cloud

Since releasing Financial Services Cloud (FSC) in 2016, Salesforce has broadened the focus from Wealth Management to include the many facets of the Banking and Insurance industries as well. This is a logical move given the overwhelming trend of the competitive need for convergence of traditional banking and wealth management offerings.

As banks, RIAs, and the like continue to make this transition, FSC can provide an excellent option for your client management and process assimilation. Arguably the most useful feature Salesforce has to date is Household Accounts and how it presents all involved Relationships in tree form.

Taking Mapping to the Next Level

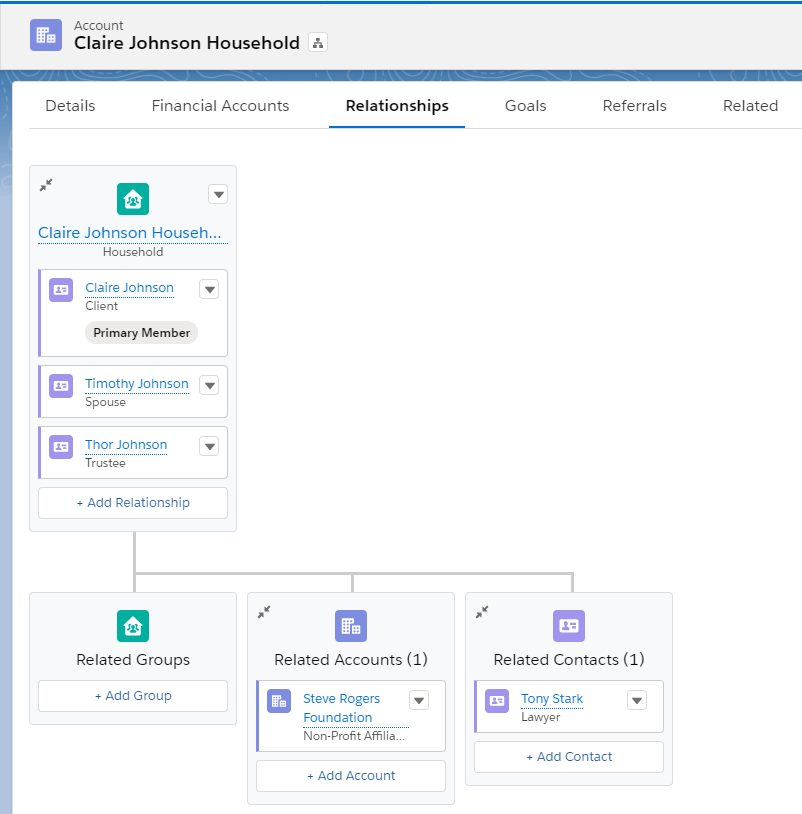

Households and their Relationships are an incredibly powerful association of family members, their information, their financial accounts, and so much more. You can even configure relationships such as lawyers or accountants (reciprocal roles) and view their records to see who all their clients are in your org.

Additionally, the family members do not have to be immediate family (or even family at all). You could relate a Person Account to a Household as a close friend or a neighbor, so that you have a network established amongst your clients. In this case, however, you wouldn’t want the friend/neighbor’s assets or interactions to display as part of the Household. You can exclude them from the Household’s rollup.

Any given Person Account can be associated to one or many Households, meaning that a neighbor related to Household A can be the primary member of Household B, and the legal representative for Households C, D, and E. The possibilities are extensive, which makes it that much easier for you to identify potential touchpoints and develop more meaningful relationships with your clients.

Salesforce Financial Services Cloud Best Practices

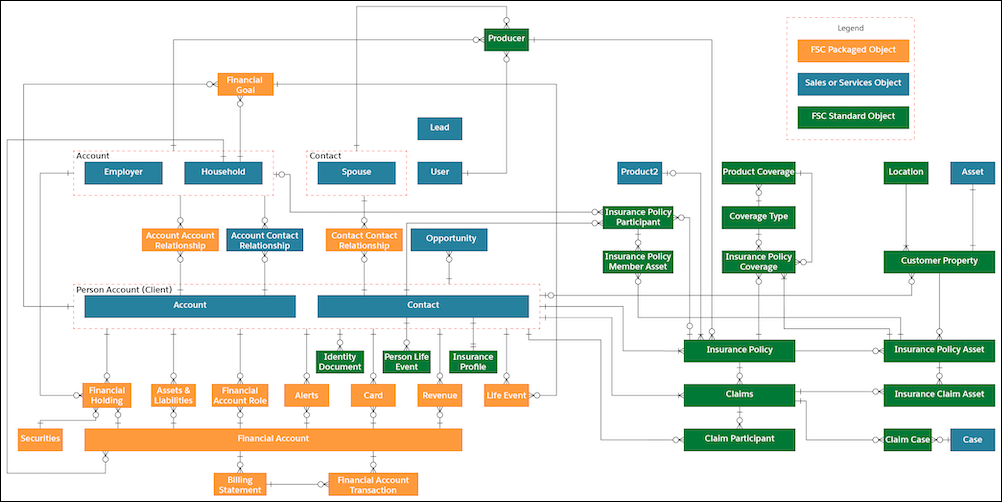

When moving from your planning/design phases into build/implementation, there are a few best practices to keep in mind. For instance, there are certain details that should be tracked at the Household level vs. the individual level. Even if you have one person with no relationships, your org should associate them to a Household account for consistency and reporting. Another important point to keep in mind is the complexity of the data model. Data migration can prove to be one of the more challenging parts of implementing FSC due to the heavy dependence on relationships. It is worth putting in extra effort to research and understand this beforehand.

Since many existing CRM systems in financial services can provide the household structure, migrating data into your Salesforce org usually becomes much simpler. The incremental effort is generally around the mapping of centers of influence (lawyers, accountants, etc.) as Salesforce is providing a solution long sought after in the financial services world. Imagine how many more warm introductions this functionality will afford you!

Have any questions about Financial Services Cloud or Salesforce in general? Please contact us at any time!

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.