This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Aftermath of Wayfair – State Tax Nexus Update: Part Two

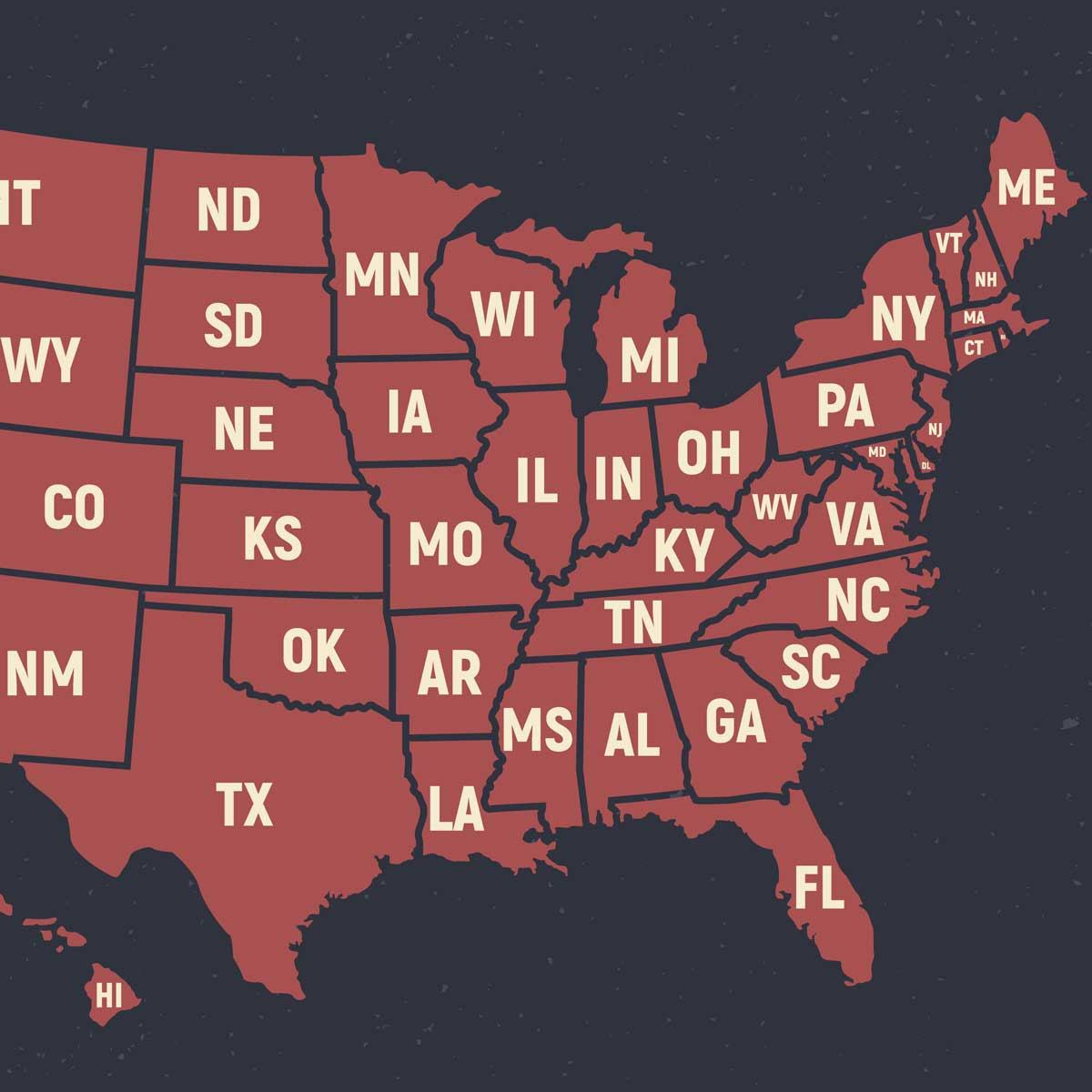

In part one of this series, we discussed Wayfair developments, changes at the state level and marketplace facilitator updates. As it’s been over two years since the U.S. Supreme Court altered the state tax world in South Dakota v. Wayfair (Dkt 17-494, 6/21/2018), it has held that physical presence is no longer required for a state to impose a sales tax collection responsibility on out-of-state businesses. Since that time, all but two states (Florida and Missouri) have adopted Wayfair economic sales tax nexus thresholds with various effective dates largely beginning on October 1, 2018, January 1, 2019 or sporadically throughout 2019.

In this article, we will discuss the developments in the Wayfair economic nexus area, namely, the states’ attempts to practically eliminate the protections provided by Public Law 86-272.

Business Entity Level Taxes including Attack on Public Law 86-272

Economic sales thresholds are not just confined to sales tax collection responsibilities. Several states (and cities) impose entity level gross receipt, net worth and income taxes if certain bright-line sales thresholds are met. Many of these thresholds existed prior to the Wayfair holding, as states have regularly interpreted the pre-Wayfair physical presence standard to only apply for sales tax collection responsibilities and not for other state taxes (such as net income taxes). Below is a summary listing of states that impose economic nexus thresholds for business entity tax purposes. Note that the thresholds could apply for certain taxes and not others (example: Massachusetts imposes their threshold for corporate income tax purposes but not for individuals, partnerships or limited liability companies):

- $4,000,000 sales thresholds: Nevada Gross Receipt Commerce Tax;

- $1,000,000 sales thresholds: New York Corporate Franchise Tax, Oregon Gross Receipt CAT Tax (though registration is triggered at $750,000 of sales);

- $500,000 sales thresholds: Alabama, California (higher as it is increased for inflationary adjustment each year), San Francisco, Colorado, Connecticut, Massachusetts (Corporation Tax), Ohio (Gross Receipt CAT Tax), Pennsylvania (Corporation Tax first effective 2020) and Tennessee;

- $350,000 sales thresholds: Michigan; and

- $100,000 sales thresholds: Hawaii, Philadelphia Business, Income and Receipts Tax and Washington Business and Occupations Tax.

However, meeting the above thresholds do not trump the protection provided by federal Public Law 86-272 for net income taxes. Public Law 86-272 (“PL 86-272”) applies to prevent a state from imposing its net income tax when an out-of-state company sales to customers in the state are limited to sales of tangible personal property; and in-state activities are limited to solicitation of orders of tangible personal property that are accepted and delivered from outside of the state.

With the U.S. Supreme Court making it clear in Wayfair that state tax nexus can be established solely via economic ties, the states are looking to get rid of this last remaining impediment from imposing their state net income taxes on most out-of-state companies that sell to customers in their state. Unlike the legal approach used to eliminate the physical presence standard that was taken by South Dakota, the attack on the protections of Public Law 86-272 is led by the Multistate Tax Commission (“MTC”).

The MTC’s approach is to propose substantial changes to its “Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States Under Public Law 86-272” to address common activities done by businesses online and conclude that those activities are unprotected. This would thereby eliminate the protection of PL 86-272 for most companies—even if there is no physical activity occurring in the respective state or other overt business activity, such as licensing the right to use a copyright or trademark. As seen by the following paragraph from the MTC’s introduction to their proposed changes, the impetus for these proposed changes is the holding in the U.S. Supreme Court in Wayfair:

“The Supreme Court recently opined, in South Dakota v. Wayfair, Inc., construing the Commerce Clause that an Internet seller ‘may be present in a State in a meaningful way without that presence being physical in the traditional sense of the term.’ 138 S. Ct. 2080, 2095 (2018). Although the Wayfair Court was not interpreting P.L. 86-272, the Supporting States consider the Court’s analysis as to virtual contacts to be relevant to the question of whether a seller is engaged in business activities in states where its customers are located for purposes of the statute.”

The proposed changes to the statement include adding a section that addresses activities conducted via the internet based on this overriding principle:

“As a general rule, when a business interacts with a customer via the business’s website or app, the business engages in a business activity within the customer’s state. However, for purposes of this Statement, when a business presents static text or photos on its website, that presentation does not in itself constitute a business activity within those states where the business’s customers are located.”

Examples of unprotected activities, which create nexus for income tax purposes, include:

- Providing post-sale assistance via online chat or email;

- Soliciting and receiving online applications for branded credit cards;

- Website that allows individuals to complete and submit non-sales employment application forms and resumes;

- “Cookies” are placed onto computers or other electronic devices of in-state customers that gather information that will be used to adjust production schedules, inventory amounts, develop new products or identify new times for sale;

- Remotely fixes or upgrades products by transmitting code or other electronic instructions; or

- Offering and selling extended warranty plans via its website.

Examples of protected online activities, which would not, in of themselves, create income tax nexus, include:

- Business provides post-sales assistance via static frequently asked questions posted on their website;

- “Cookies” are placed onto computers that gather customer information to be used solely for purposes entirely ancillary to the solicitation of orders of tangible personal property including: remember items customers have placed in shopping cart during a current web session; store customer information in order for the customer to not have to re-enter information; and to remind customers of prior purchases; or

- Providing a website that only offers sales of items of tangible personal property and only enables customers to search for such items, read product descriptions, select items for purchase, choose among delivery options and submit payment.

As a result, companies should review how they are interacting online with their customers, prospects and potentially even vendors to determine if there could be issues with their current positions of claiming Public Law 86-272 protection for net income tax purposes. Most recently the proposed changes were approved by the MTC Executive Committee in November 2020 and now await formal approval by the MTC before presenting the updated Statement to the states. At that point, we expect substantial developments to occur in this area through 2021 – so stay tuned.

Other State Nexus Related Updates

Somewhat surprisingly, there have not been a large number of states imposing new economic nexus thresholds to state income or other taxes in addition to their state’s sales and use tax. One area that has seen increased activity is with local taxing jurisdictions. Specifically, the home rule cities in Colorado and various cities in Alaska have created a centralized system to ease the compliance for out-of-state companies to collect and remit those local taxes. In addition, the City of Chicago formally addressed the nexus standards for several of its taxes by providing a safe harbor that generally no collection of the tax is required when an out-of-state company has less than $100,000 from Chicago customers.

For questions or to discuss the state tax nexus matters in more detail, please contact your Sikich representative or Brian Kelley.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.