This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Why Migrate to Financial Services Cloud from Sales Cloud?

Many organizations in the financial services industry that migrated to Salesforce prior to 2015 were limited to standard Sales and Service Cloud options. Those outside of wealth management have not had industry-specific functionality available until much more recently. As you continue formulating your operational strategy, take the following points about migrating to Financial Services Cloud (FSC) into consideration for your existing Salesforce org.

The Perfect Excuse to Move to Lightning

Much of the functionality specific to FSC has been curated for Lightning Experience, requiring it to function properly (or at all). If your organization has been living in the 2000s or you have a hybrid of some users adopting Lightning and others resistant to change, then migrating to Financial Services Cloud could be the right opportunity to train all users on Lightning and the new industry-specific features.

Keep in mind that you will still have access to all of your Sales and Service functionality!

Revisiting your Security Model

If you implemented for your current instance of Salesforce prior to 2015, chances are your organization has changed drastically since then. This may mean that the maintenance of your security model has become much less systematic and much more manual.

Additionally, it probably means that you either have a custom encryption solution or none at all. Salesforce Shield can replace it, which allows an admin to maintain the solution rather than a team of developers. Switching to FSC could allow for a reexamination of security best practices. It could even allow you to restart from the ground up.

Treat Your Contacts Like Accounts

FSC comes with Person Accounts enabled. This data model allows you to access your two-legged individuals from almost anywhere that Sales/Service Cloud only allows an Account or only allows a Contact.

Want to add your individual to an Event invitation or a Campaign? Can do with Person Accounts. Don’t want to have to associate your individual to an Account record? Want to be able to track its relationship to other records via a Group Account like a Household? This all can be done with Person Accounts.

Person Accounts are especially relevant for wealth managers, consumer bankers, and insurance agencies, where the primary model is B2C.

Leverage Standard Industry-Specific Functionality

FSC comes jam-packed with additional Objects. Lightning Components are explicitly designed with the advisor, banker, insurance user, or relationship manager in mind. There are also Action Plans for handling sets of tasks required for a common process (such as onboarding a new client), and an advanced analytics suite available that can provide management with the necessary insights to make informed decisions about the business.

Here are a handful of the primary items used across FSC:

- Action Plans – Create more uniformity around your internal processes with predefined sets of tasks.

- Financial Accounts – Display Custodian data in the context of your Salesforce records via integration (AppExchange or otherwise).

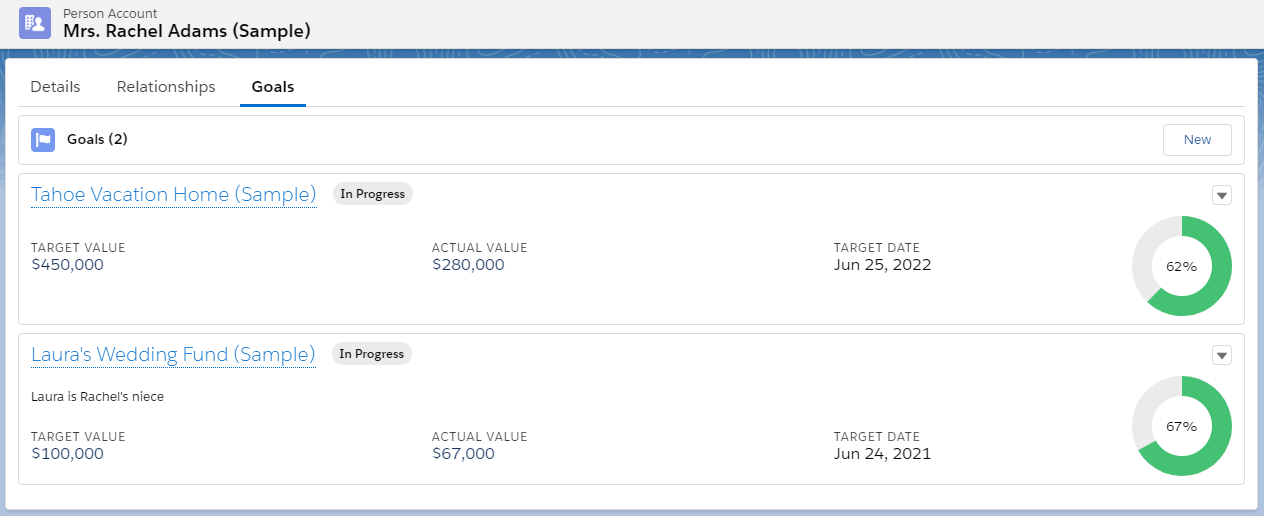

- Financial Goals – Partner with your customers to help them track and achieve financial independence.

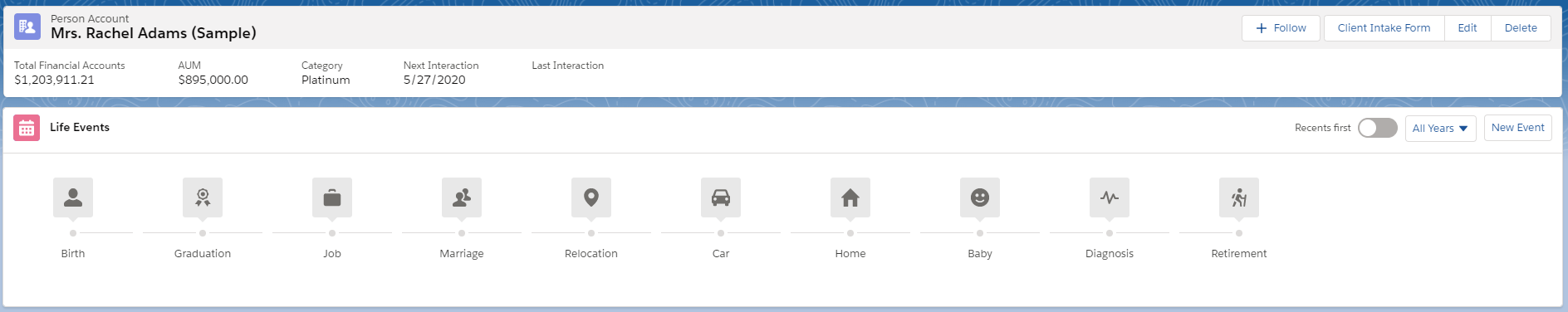

- Life Events – Show your customers you care by tracking major life milestones and checking in with them as necessary (e.g., congratulations on your one year of retirement!).

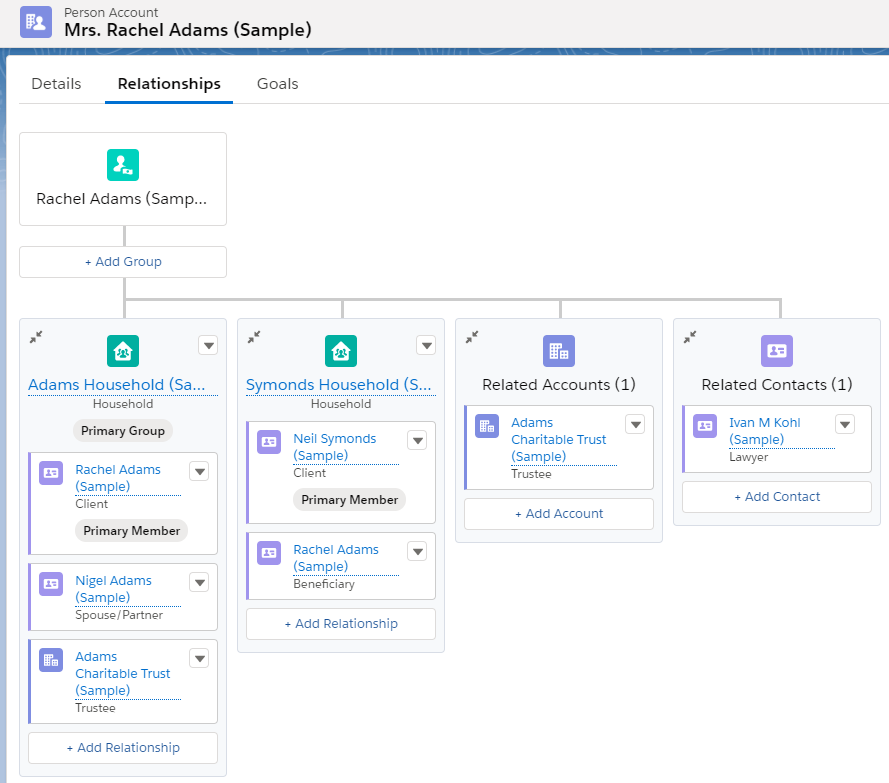

- Relationship Map – Keep the complex web of associated individuals, groups, and businesses straight for warmer introductions.

Have any questions about Financial Services Cloud or Salesforce in general? Please contact us at any time!

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.