This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How to Manage Multi-Subsidiary Intercompany Transactions in NetSuite

Do you issue sales invoices and/or vendor bills from one subsidiary to multiple subsidiaries for services whereby you need to allocate costs and collect money? Are you using NetSuite? Have you discovered that the native functionality in NetSuite is limited to transaction records being specific to one subsidiary, whereby you cannot allocate transactions from one subsidiary to several other subsidiaries at the same time? If your answer to these questions is yes, then Sikich has a solution for you!

Solution 1: NetSuite Manual Intercompany Journal Entry

After entering a customer invoice, credit memo, vendor bill or vendor credit transaction, costs can be reallocated by creating an intercompany journal entry per subsidiary.

Many companies like the straightforwardness outlined in this solution, where there is a journal entry for each transaction line that must be allocated. However, creating these journal entries can be cumbersome, so the Sikich NetSuite Team developed a solution to automate this process.

The process is outlined below in Solution 2a:

Solution 2a: Automate Creating NetSuite Intercompany Journal Entries for Sales Invoices and/or Credit Memos

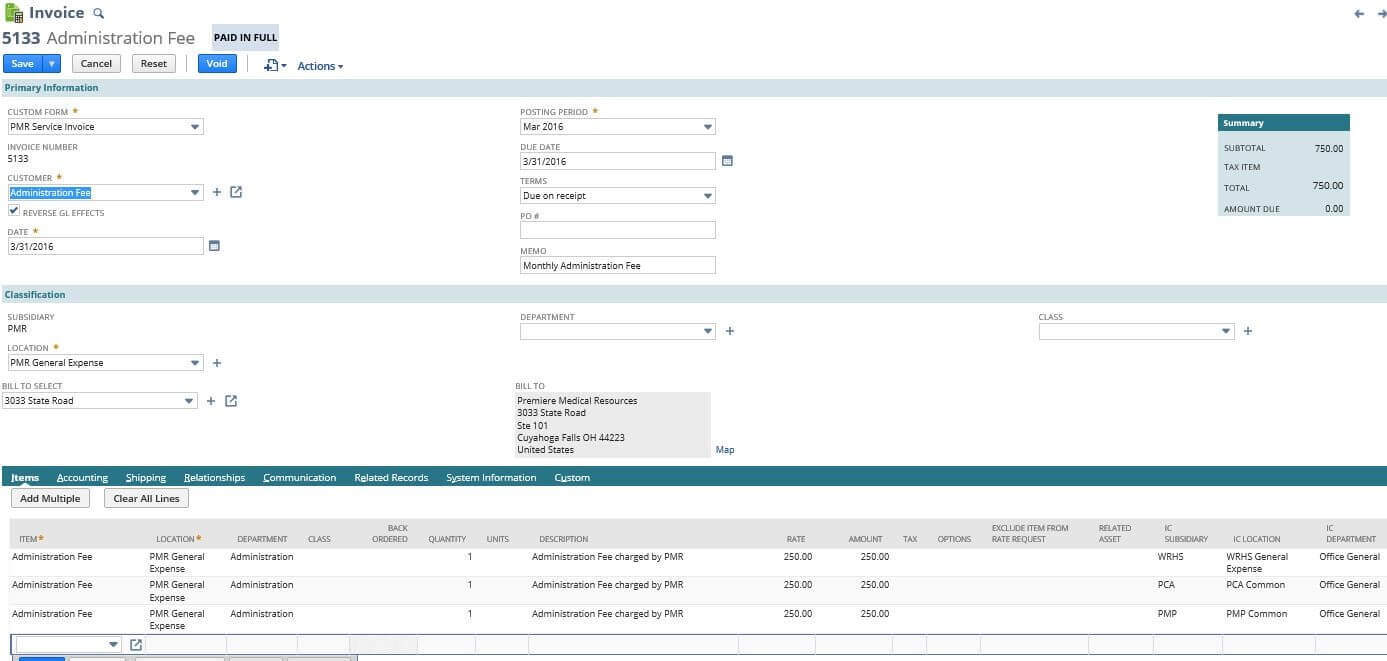

- When entering a sales invoice transaction that must be allocated to multiple subsidiaries and related locations/departments, use a generic customer and specify the intercompany subsidiary, intercompany department, and/or intercompany location in custom fields where the line must be allocated. Looking at the example below, the PMR subsidiary is issuing a sales invoice to an Administration Fee customer for the administration fee item to be allocated to the WRHS, PCA, and PMP subsidiaries as well as various locations and departments within each subsidiary.

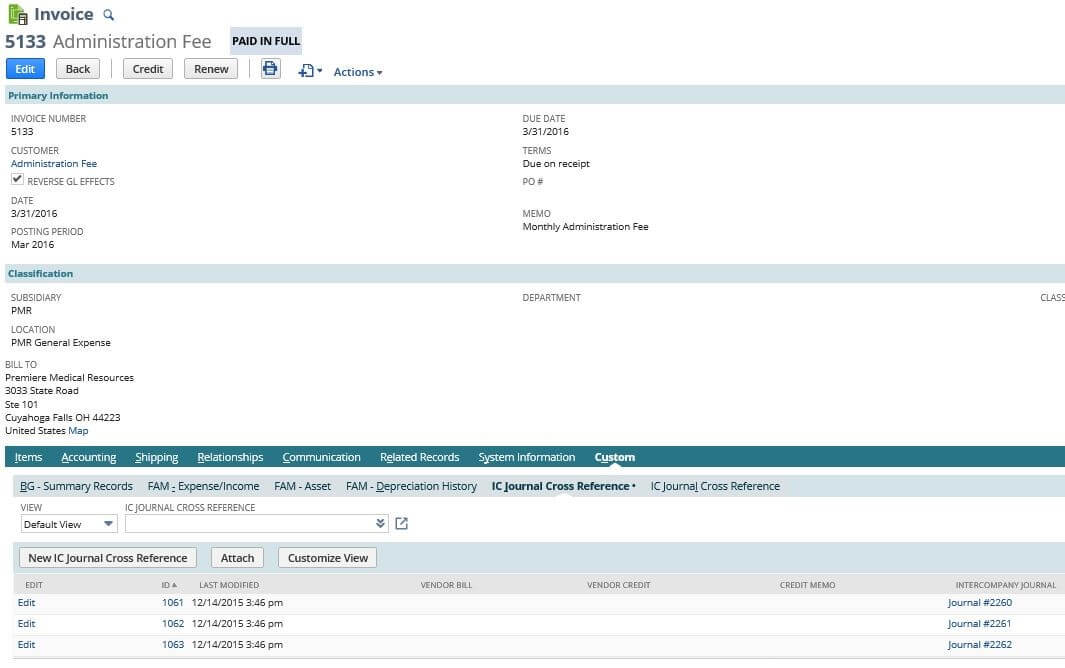

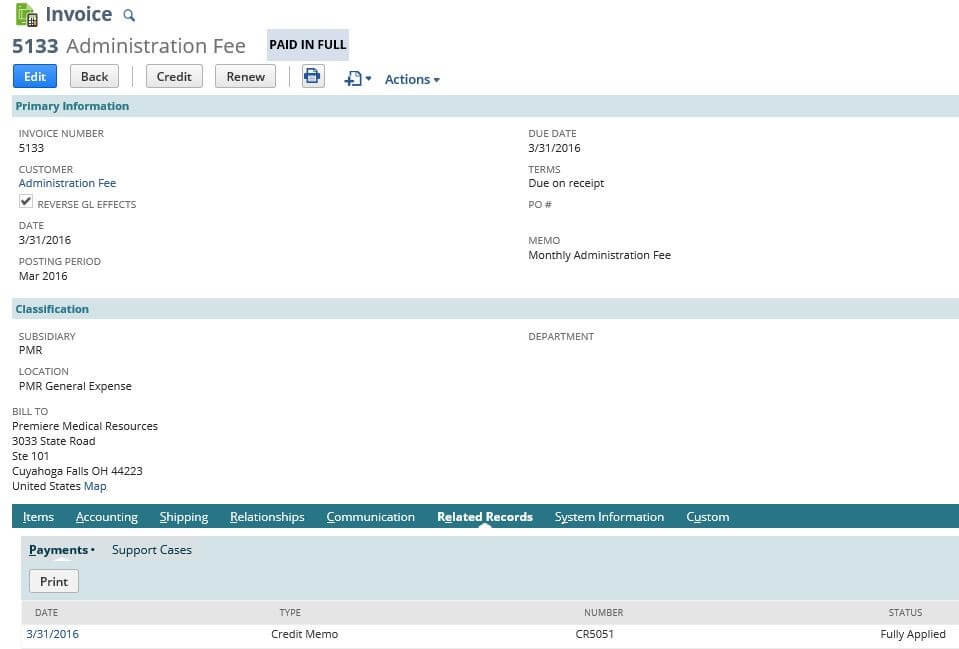

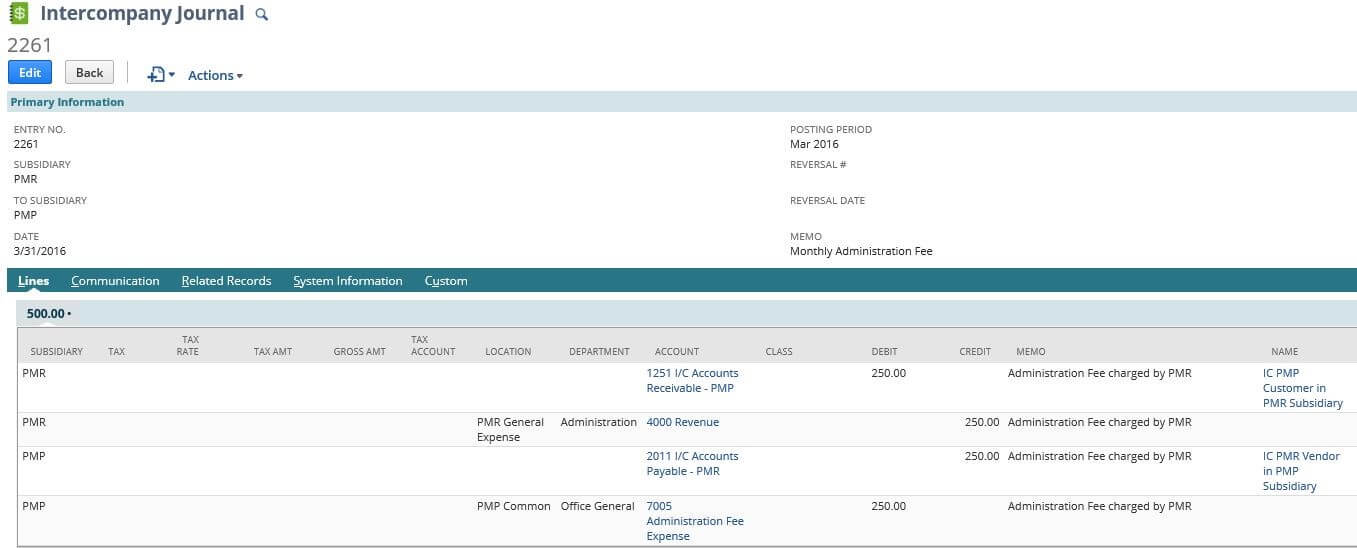

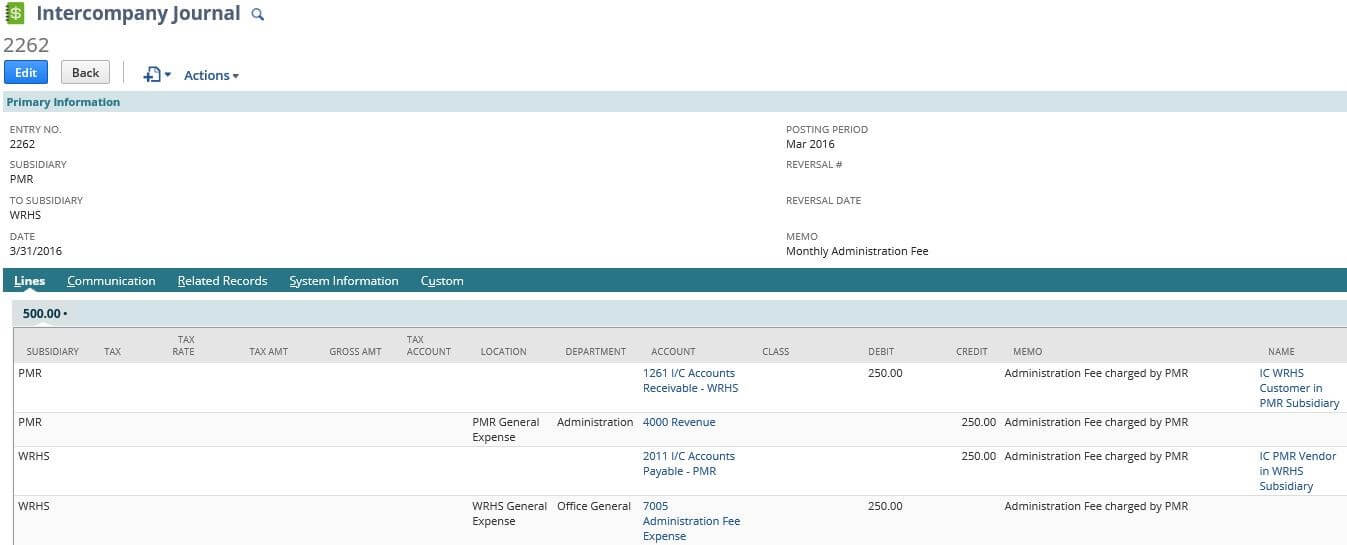

- Save the sales invoice transaction. Upon saving the transaction, intercompany journal entries (#2260, #2261, and #2262 in the above example) are created per subsidiary and a credit memo (#CR5051) is also created. The transaction will then have a custom tab including a link to the NetSuite intercompany journal entries, and the credit memo will appear under the related records tab of the transaction.

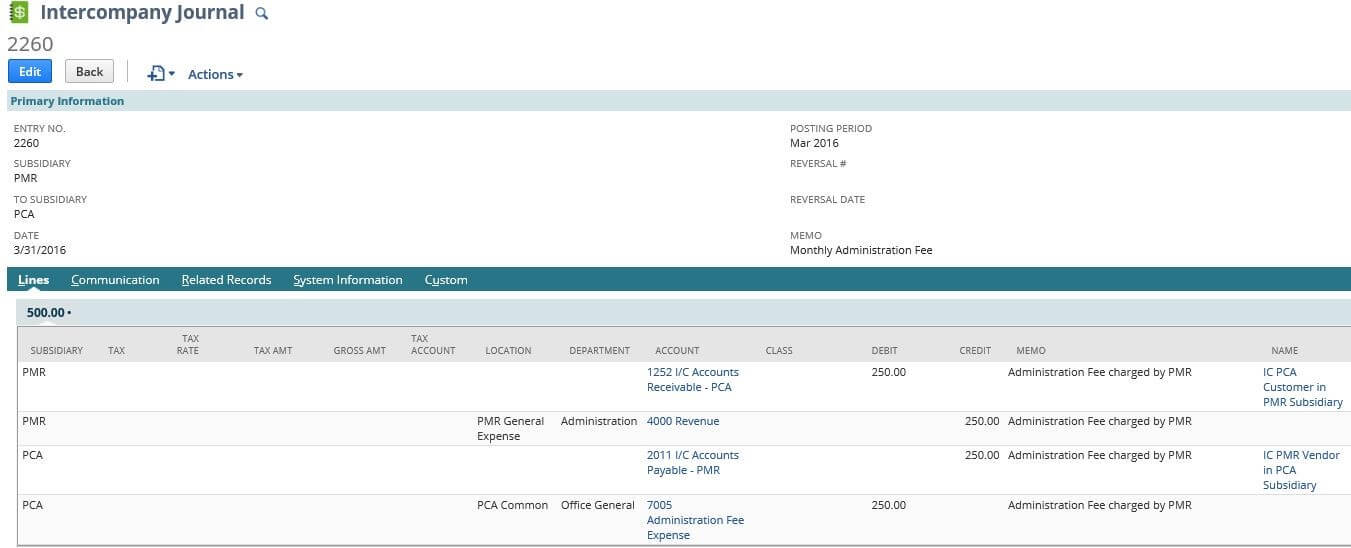

- NetSuite applies the credit memo to the sales invoice, thereby negating the GL impact of the sales invoice in the originating subsidiary (PMR), essentially reversing the non-intercompany AR and sale in the general ledger. The intercompany journal entries record the Intercompany AR and sale in the originating subsidiary (PMR) and record the Intercompany AP and expense in the subsidiaries of the custom fields on the originating sales invoice transaction (WRHS, PCA, PMP).

- Not only are the GL entries recorded correctly, but the intercompany payable/receivable balances are coded to a vendor and customer record. For example, this transaction will show up in the A/P aging reports, reporting the balance as due to the intercompany vendor that represents PMR. This detailed general ledger impact allows PMR to view the receivables from WRHS, PCA and PMP on the A/R register, while WRHS, PCA and PMP each have a payable to PMR on their A/P registers.

- The customization outlined above can be used when entering a credit memo transaction that must be allocated to other subsidiaries and related locations/departments as well.

Solution 2b: Automate Creating Journal Entries for Vendor Bills and/or Vendor Credits

Many companies like the automation outlined above in Solution 2a for Customer Invoices and Credit Memos. Therefore, Sikich developed a similar solution for Vendor Bills and Vendor Credits. This solution is most helpful when one subsidiary is acting as a Pay Master for other subsidiaries within your NetSuite account. For example, Subsidiary A may pay the telephone bill for all subsidiaries, yet costs need to be allocated to and money collected from Subsidiary B and Subsidiary C. Our custom solution, similar to the Customer Invoice/Credit Memo solution above, can automate this for you.

Solving multi-subsidiary intercompany allocation issues can be time-consuming. As indicated in the solutions shown above, which reflect a customization that Sikich would like to share with you, the entire process can be automated. This allows companies to free up their accounting staff to concentrate on other areas of the business.

If you are experiencing issues in NetSuite with recording multi-subsidiary intercompany sales and expenses, and you’d like automation of simple business processes, please contact us to help you get started.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.