This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

SuiteTax Improvements for the 2019.1 NetSuite Upgrade

When SuiteTax was introduced during SuiteWorld 2018, it was met with excitement from users. Now, during the 2019.1 release, improvements have been made to increase the functionality and usability of SuiteTax.

As this is still a new feature of NetSuite, it is important to understand the structure of the new feature. NetSuite has created a SuiteTax API that sits on top of the native functionality of NetSuite and in between NetSuite and your third-party Tax Engine. Important to also note, is that you can run multiple Tax Engines and call out each Tax Engine on your different subsidiaries.

For solely U.S. based companies who do not have VAT requirements, some key benefits that we have identified are:

- Enhanced tax determination logic for both origin and destination-based states and intrastate and interstate sale

- Zip+4 accurate tax determination

- Automatic tax rates update and effective dates

- Exemption certificate and taxability rules support

- Multiple Tax Registrations per entity – with default registration called out

Some enhancements for companies with VAT requirements:

- Supports multiple Tax Engines and multiple Tax Engines per Subsidiary

- Multiple Tax Registrations per Subsidiary

- Added Tax Total to the Transaction Summary Box on Invoices and Bills

- Editable Tax Return Template

- Tax Registration number validation

- Compliance Text on Invoices

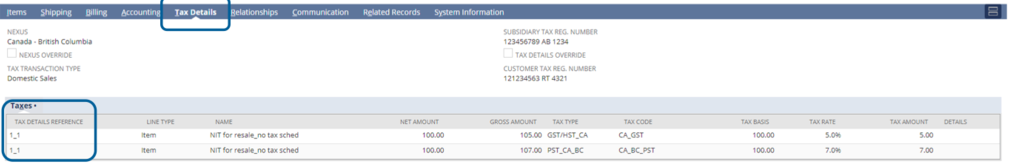

So how will this change your normal day-to-day transactions? For one, it removes the tax-related information on the Items Subtab, all information that was once held under this tab has been moved to their own subtab “Tax Details.” Here, you will be able to see the Tax Type, Tax Code, Tax Basis, Tax Rate, and Tax Amount of each Line Item. After saving the transaction, SuiteTax will lookup logic to determine which Tax Engine to use, and the calculation will be displayed in a much more detailed Transaction Summary Box on all transactions.

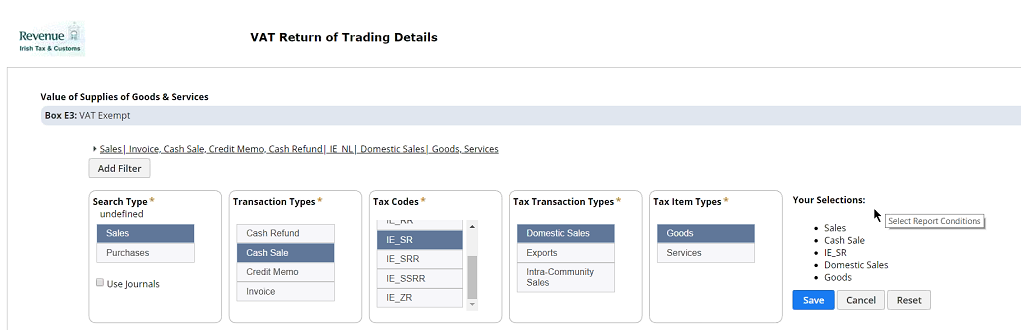

One of the most convenient upgrades of SuiteTax is the Editable Tax Return Template. With this feature, the controller or internal tax team can go through each line of a Tax Return, calling out which transaction or tax code would make up that box from within NetSuite. This usability combined with the power of individual Tax Engines makes SuiteTax one of the most exciting upgrades for NetSuite in 2019.1. Below is an example of the Editable Tax Return Template.

While many accounting teams may be licking their chops over this improved functionality, it is important to note that SuiteTax is currently a hidden feature. The user must undergo a qualification process through your NetSuite account manager to unlock access. Some bundles are also not supported in SuiteTax, as it replaces their functionality. These bundles include the International Tax Bundle, Tax Audit Field Bundle, and Withholding Tax Bundle. Before consulting with your NetSuite account manager, also gain an understanding on how switching over to SuiteTax will affect your day to day processes.

If you’d like to learn more about this or anything else about NetSuite, please contact us at any time! You can also learn about more great tips for NetSuite on our YouTube playlist or our other blog posts.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.