This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Dynamics AX 2012 | Purchasing RFQ Functionality Details

The Purchasing RFQ is very useful functionality but it is not the easiest to get comfortable with. Some navigations are unique, and the interaction with the purchase requisition deserves special attention.

Request for quotations, or RFQ are a great feature within Dynamics AX 2012 because they allow you to:

- Create a quotation for items or services that you want to purchase

- Receive and compare several vendors offers based on defined data criteria such as delivery times, prices, purchase charges, quantities, ect.

An RFQ can be created three different ways:

Creating an RFQ

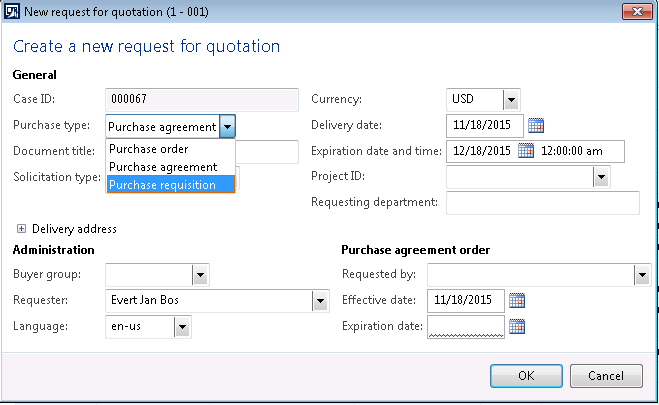

1. Manually

- The user can select between Purchase order or Purchase agreement as the outcome of an RFQ. Purchase requisition cannot be manually chosen.

- We can link an RFQ to a project

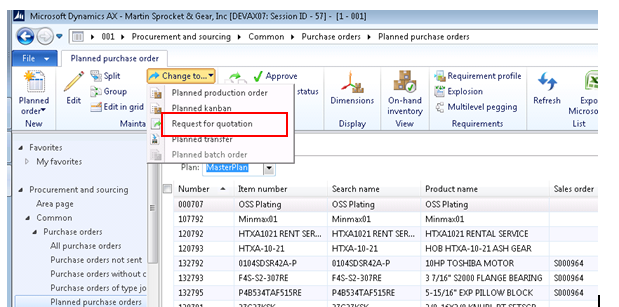

2. From a planned Purchase order

- The RFQ copies the item, quantity and vendor from the planned purchase order.

- The planned purchase order is now gone. The PO is going to come from the approved RFQ.

- A Master Planning parameter in the Master Plan determines whether an RFQ shows up in Net Requirements as a Purchase order. (This is rather pro-active behavior! We are asking to change the reference to “RFQ,” because this is confusing).

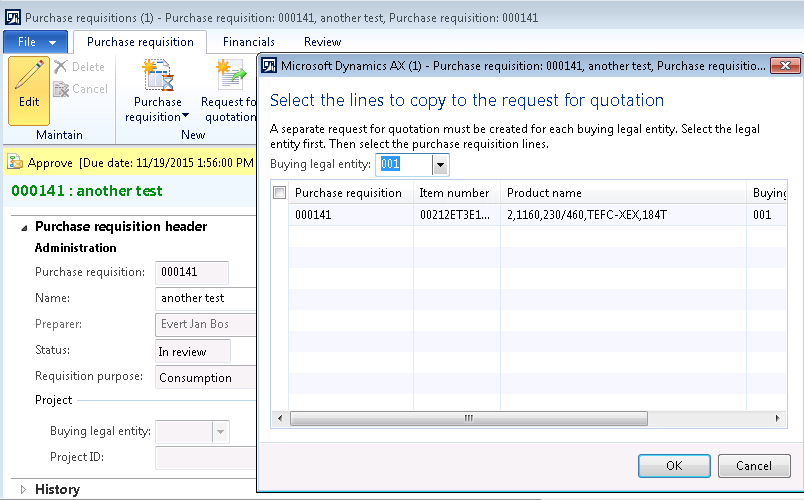

3. From a Purchase requisition that is ‘in review’

The Purchase requisition has to be submitted, so the status is “in review.”

The Purchase requisition has to be submitted, so the status is “in review.”

- Because Purchase requisitions are a shared table, you have to indicate the legal entity first.

- The RFQ copies item, quantity, vendor from the Purchase req line. The user would add more vendors. After accepting one of the vendor replies, the Purchase requisition is updated.

- ONLY THEN is the Purchase requisition moving to the status “approved.”

NOTE: The RFQ has NO workflow ability.

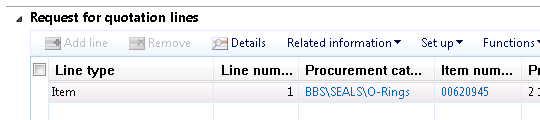

The RFQ line type allows to switch to “categories”.

You can enter as many vendors as you want.

NOTE:

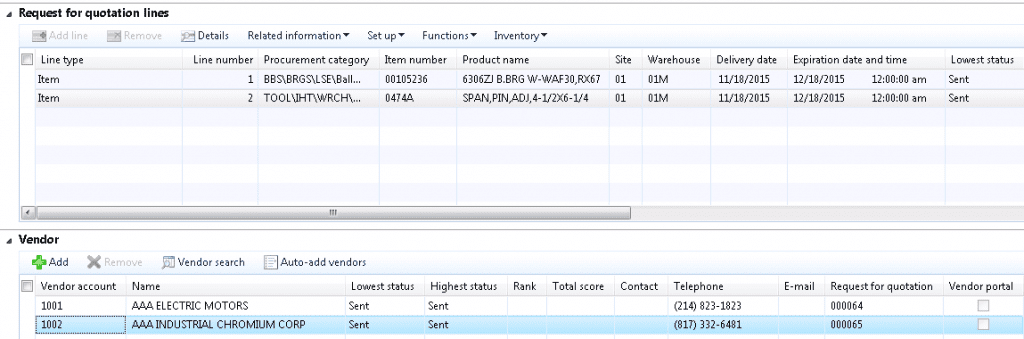

- The system assumes ALL items are sent for quoting to ALL vendors. You cannot define vendors for specific lines while creating the RFQ lines and vendors. But you can do that right before sending. See below.

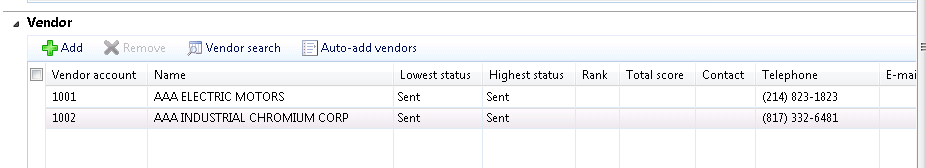

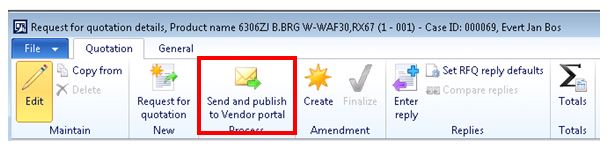

Send to vendor

- When sending to vendor, you can delete those lines you don’t want a certain vendor to respond to and this will be remembered by the vendor reply functionality. In vendor reply, you will see all lines that were send to vendors.

- The system does not care whether a vendor is authorized for a certain item. (Process functionality) This functionality is not present in the RFQ. When the PO is created, it will not check the authorized vendor list either.

Vendor reply

Entering vendor reply is not very intuitive, but the start is easy enough. The best is to position cursor on vendor and click REPLY. You will see all items that the vendor has sent replies for (hopefully).

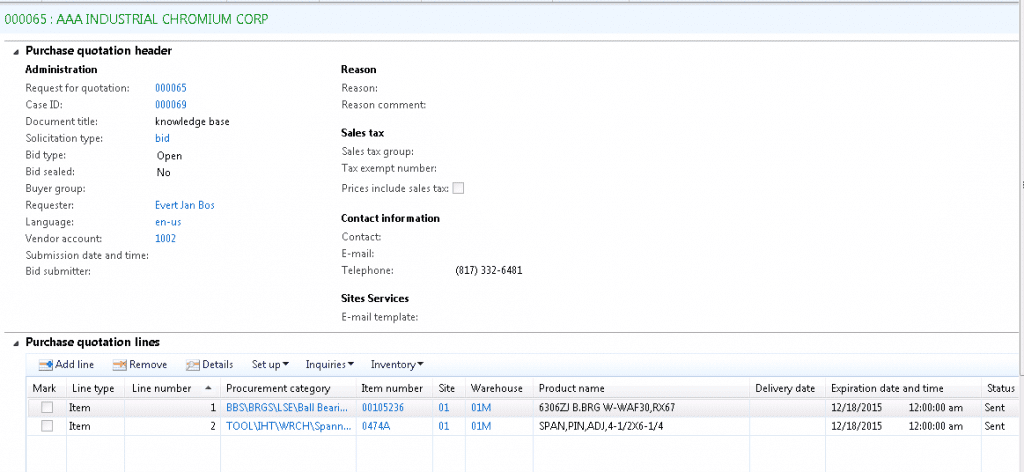

Highlight the vendor, in this case 1002 and click ‘Enter Reply’. Proceed like this for each vendor.

- You can see the VENDOR NAME you are working on in GREEN LETTERING in the blue bar on top. – – The vendor id shows in the purchase quotation header section.

- Enter the vendor replies for each line, the fields are on the far right of the line

- When done, close the screen or click the cute RETURN icon

Compare Replies

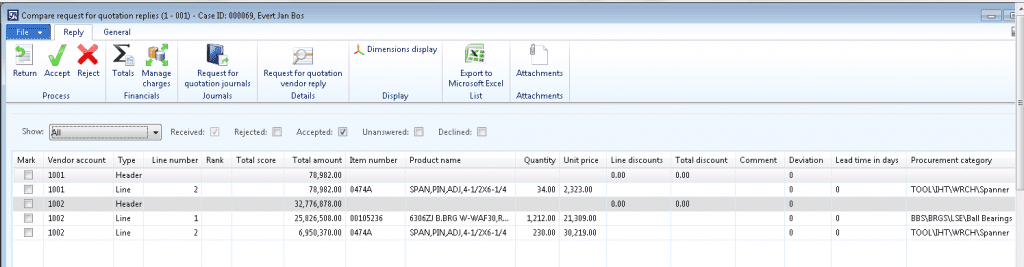

Hit F5 when the choice is not lit up. The status of all lines has to be “received” before we can “compare replies.”

Hit F5 when the choice is not lit up. The status of all lines has to be “received” before we can “compare replies.”

- Here you see an overview of all the answers. The header line shows a grand total amount for the lines.

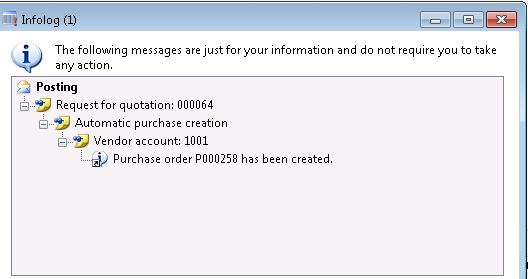

- Right here you can select which vendor gets the cigar, clicking ACCEPT. The PO will be created instantly. And the other vendor(s) will be rejected. It is not possible to leave vendor replies open for “a next time.” One vendor wins and the others will lose and the RFQ is done!

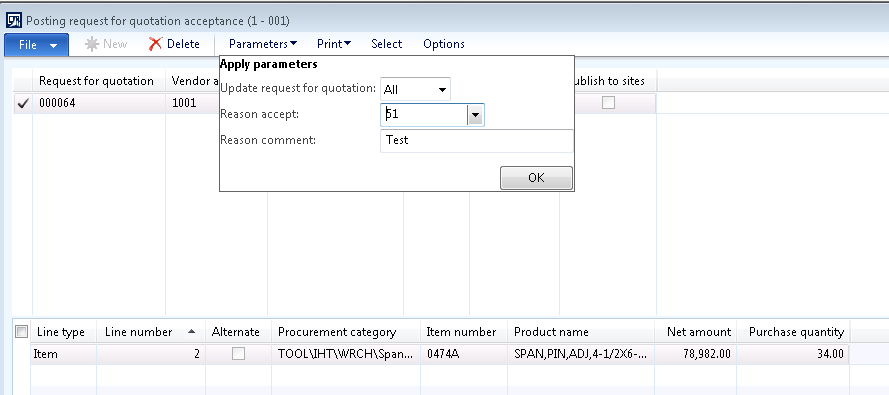

By selecting the “parameters” pull down we can add a reason for the acceptance, after we have accepted.

That is the end result. It could have been a Purchase Agreement also.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.