This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Side-by-Side Bank Reconciliation Tools in NetSuite 2017.2

NetSuite’s new release (2017.2), comes with enhancements to cash management, making bank reconciliation faster and easier than ever before. The release also will help users manage their cash positions in real-time while providing an exceptional user experience.

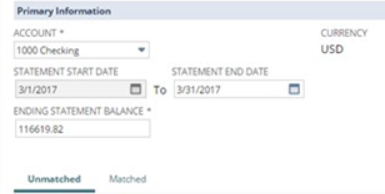

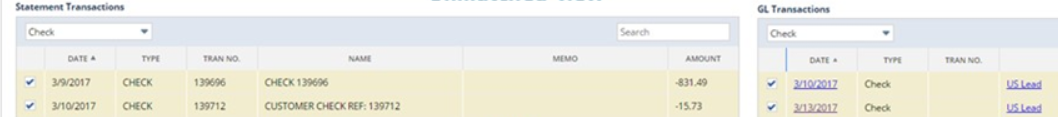

There is now a new “side-by-side” page in NetSuite called the Account Reconciliation Page, which gives users an alternative to the Reconcile Bank Account and Reconcile Credit Card Account pages.

- Easily compare statement transactions with GL transactions

- Create necessary Journal Entries on the fly

- Unmatched and Matched views allow you to separate transactions that have/have not been cleared

Keep in mind that only GL Bank and Credit Card Accounts that have the USE IMPORTED STATEMENT RECONCILIATION FORM flag set in the Account Details page will be available to reconcile in the new page.

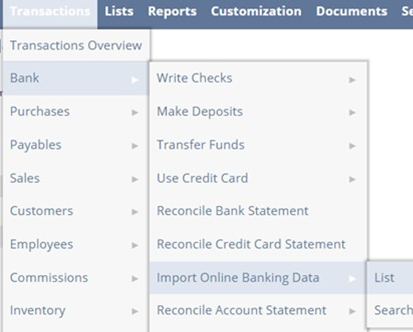

Another way NetSuite has improved their bank reconciliation experience is by improving the Bank Statement Import.

- NetSuite now supports more bank statement formats (No Longer Supports QIF):

- ISO20022,

- CAMT053.001.006, and

- BAI2.

- These formats report prior-day transactions and cash balances

- Controlled at Bank Import Mapping Subtab (on Account page)

- There is also a New Bank Statement Import Record:

- Replaces Online Banking Statement Page

- Easily view and track when statements were uploaded and by whom

Bank reconciliation can be a headache, but NetSuite is a very capable tool that can make your life easier. If you would like more information about NetSuite, please contact us at any time! You can also learn about more great tips for NetSuite on our YouTube playlist or our other blog posts.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.