This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

What You Need to Know About the Upcoming NetSuite 2018.2 Update

As a NetSuite user, you are probably aware of the upcoming 2018.2 NetSuite update, but may not know exactly how it will influence your system. As usual, this semi-annual release will provide users with improved functionality throughout their system and begins tackling matters which have been issues in the past. We have compiled a listing of ten of the most significant features and developments that will be available in the new version of NetSuite.

Two-Factor Authentication (2FA) will be required for all administrator and other highly privileged roles.

NetSuite implemented this requirement that may be overlooked if just glancing at the release notes, but will require the most attention in the upcoming months prior to the release go-live date. Integrations that use the Administrator role to log in, will be required to use 2FA. If you have not already, speak with your integration consultant or provider and make sure to switch over to token-based authentication to avoid possible headaches. It must be noted that although only administrators and other highly privileged roles will be required to use 2FA this release, it is seemingly inevitable that all NetSuite users will be required to utilize 2FA in upcoming releases.

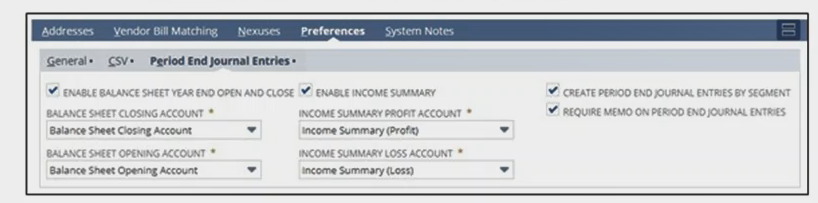

Period End Journal Entries

Limited to OneWorld accounts, this update is suited for those users who require all GL impacting transactions to be stored in their accounting system. It will allow users to include consolidation and year end closing journals in the general ledger extracts to third-party systems. This process will be run out of the period end closing checklist and helps document the previously automatic closing out of income to Retained Earnings.

Project Accounting Improvements

Project Revenue Recognition had been a limitation for NetSuite’s Project Management due to the inflexible revenue recognition accounting rules. With the new release, users can override the percentage of which a project is complete. The preference “Use System Percentage of Completion for Schedules” is now respected and when enabled, the project progress percentage is calculated based on the time tracked against the project. When this is disabled, the percentage of project completion must be entered manually on the project records.

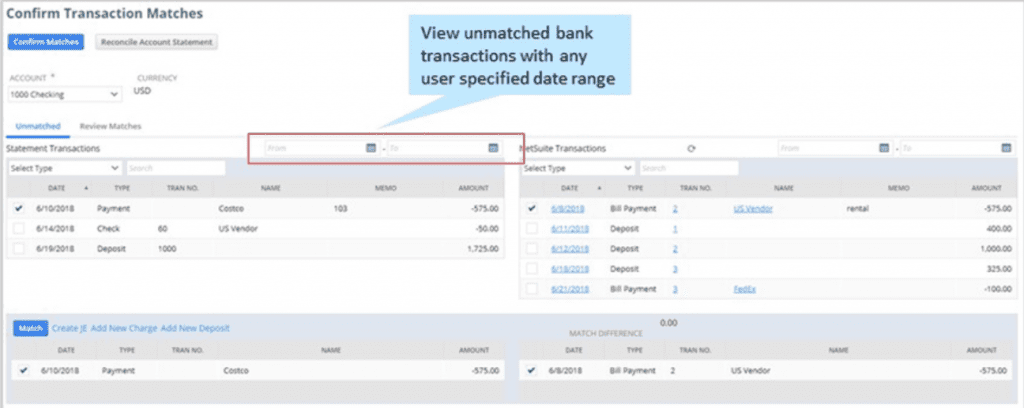

Bank Account Reconciliation Layout Upgrades

A new layout for bank account reconciliations will be coming in 2018.2. The new layout will better help users review and change bank transactions. The new layout will allow users to create entries for missing transactions within the reconciliation process utilizing auto-filled pop ups that appear when a missing transaction is triggered. Users will also be able to access all unmatched bank transactions by having the ability to change user defined dates, a limitation in the previous releases.

In-Transit Payments for Accounts Payable

A new recommendation from countries including Brazil, China, and Germany, is the adaptation of In-Transit Payments. This is a new workflow in NetSuite that allows users to postpone payments from hitting their general ledger until the vendor’s bank receives them. Utilizing a non-posting journal entry system and In-Transit bank sub accounts, the feature provides updated accuracy on when your cash is not really your cash.

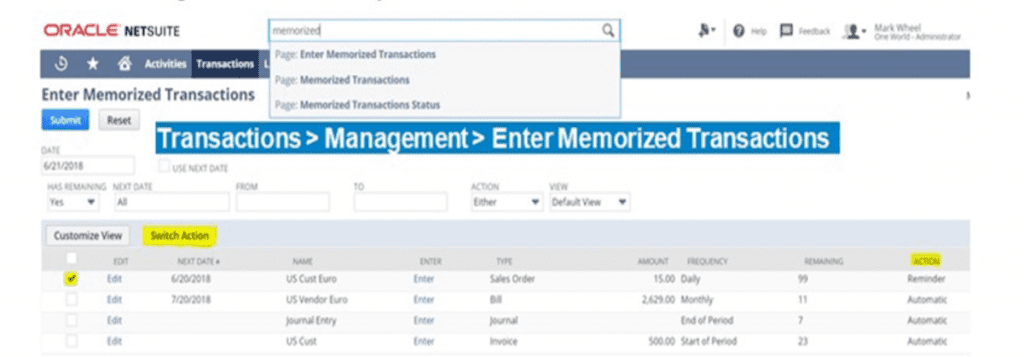

Memorized Transactions

There are two small, but helpful, features being added to memorized transactions in 2018.2. The first is the addition of System Notes to the record. Now, any time you create, edit, or delete a memorized transaction, the update is tracked and available for viewing to the user. The second enhancement is the addition of a Switch Action button to the Enter Memorized Transactions page. Users will now be able to click this button to easily change all memorized transactions from Automatic to Remind Me and vice versa.

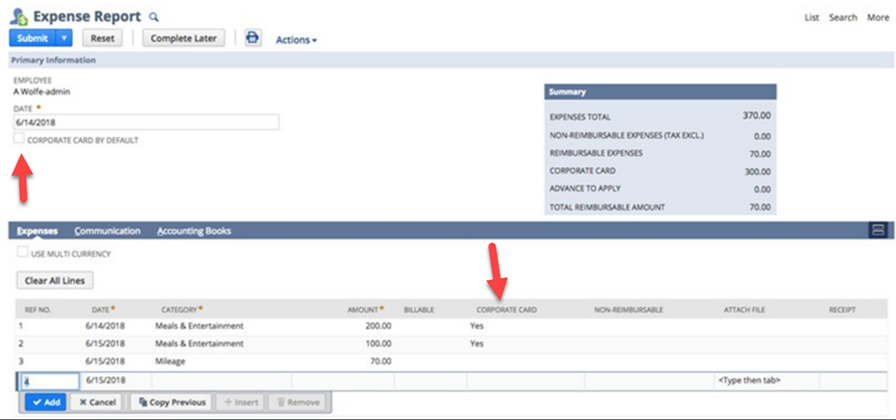

Corporate Card Expenses

Previously in NetSuite, corporate credit card transactions could only be managed with non-reimbursable expenses requiring manual journal entries to reconcile. With this update, expense reports including corporate card expenses can now debit an expense account while crediting a selected credit card account. This enables corporate card expenses to automatically show up as a journal entry when reconciling a credit card statement.

1099-MISC and 1096 Forms

One thing to note in this update is that NetSuite will no longer support 1099-MISC and 1096 forms. If you are currently utilizing these forms through NetSuite, we suggest finding a new provider as soon as possible. However, you will still be able to track and report on 1099-MISC payments. Reports and saved searches can be created for vendor payments from 1099 eligible boxes on the Vendor and Account record. NetSuite recommends Yearli as its complete filing solution. More info can be found here: https://yearli.greatland.com/

SuiteAnalytics Workbook Beta Feature

In 2018.2 NetSuite is releasing a beta version of their new, highly customizable analytical tool. With the SuiteAnalytics Workbook, users will be able to combine queries, pivot tables, and charts to leverage all their data in NetSuite. This tool is being designed to ensure consistency across all data fields and results. With drag-and-drop editing functionality, formatting and visualization of data can be customized in a meaningful way to the user.

Multi-Subsidiary Entity Improvements

The last enhancements to highlight in this release are to multi-subsidiary entities. The first improvement is the ability to mass create and mass update multiple subsidiaries for customer and vendor records via CSV import. This ability was not available in previous versions of NetSuite and forced users to add multiple subsidiaries manually or through complex scripting. The second improvement to these entities is the ability to customize and search for data on the specific entity-subsidiary record. This enhancement allows the user greater visibility and insight into data generated from these individual record types.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.