This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Lease Accounting Standards for Agribusinesses

When the new lease accounting standards went into effect for nonpublic business entities in December 2021, the intention was to increase transparency of an entity’s financial condition and to improve comparability of financial statements between entities.

Under the new standards, entities will report lease liabilities and related “right-of-use” (ROU) assets on their balance sheets for nearly all leases, including both operating and finance (formerly “capital”) leases. There are a few scope exceptions under the new standards – the most notable for agribusinesses being leases of biological assets, including timber. Entities also have the option to exclude short-term leases (leases having a term of 12 months or less, including renewal periods reasonably certain to be exercised) and leases below a reasonable recognition threshold (similar to a capitalization threshold applied to property, plant and equipment).

The new standards also emphasize that leases may be embedded into other contracts not labeled as a lease, such as service contracts or supply arrangements that include the use of identified assets. In implementing the new standards, care should be taken to consider the possibility of contracts containing leases that were not previously identified as such.

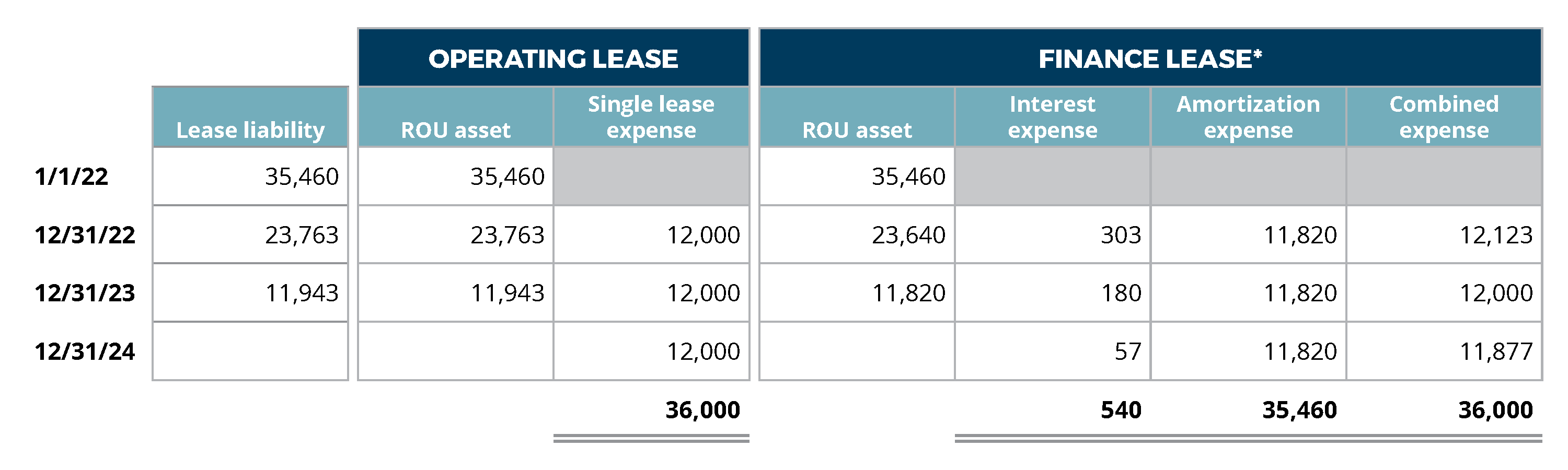

While balance sheets may be significantly impacted, income statements will not be. Operating leases will continue to have straight-line single lease expense reported. Finance leases will result in expense recognition that decreases over the lease period, comprised of interest on the lease liability and amortization of the ROU asset. Generally, the amount of expense recognized will be the same as, or comparable to, the expense recognized under the prior standards.

Lessee Example

Suppose an entity leases an asset for $1,000 per month for one year, with options for two 1-year renewals. The entity determines it is reasonably certain to exercise the two 1-year renewal options; therefore, the short-term lease exception does not apply. The entity needs to record a lease liability equal to the present value of lease payments over the total 3-year term.

To determine the present value, the entity will need to apply the appropriate discount rate to the series of 36 $1,000 payments. The discount rate will be the rate implicit in the lease if readily determinable. If not readily determinable, the entity will use an incremental borrowing rate or, if it has made the accounting policy election, a risk-free rate. In this example, we will use a risk-free rate for a 3-year period as of the lease commencement date, determined to be 1.04% based on U.S. Treasury par yield curve rates.

Applying present valuation calculation techniques, the lease liability at commencement (prior to any payments) is $35,460. The related ROU asset is then calculated using the lease liability as the starting point. Certain items may need to be added or subtracted to determine the starting ROU asset. For this example, assume no such items exist, and the starting ROU asset is also equal to $35,460.

The subsequent accounting for the ROU asset and expense recognition will depend on whether the lease is classified as operating or finance. Operating leases will result in a straight-line single lease expense, achieved through increasing periodic ROU amortization over the lease term. Finance leases will have interest expense and amortization expense separately reported, with amortization of the ROU asset calculated on a straight-line basis.

Prepare for Implementation

For entities that lease assets, balance sheets and related financial ratios will be impacted. This could potentially result in violation of lending ratios or covenants, even though there has been no change in the fundamentals of the business. Terms of lending agreements may need to be revised to exclude the effects of implementing ASC 842 to adjust required ratios to consider the new liability balances.

There will be additional accounting effort to prepare and maintain lease-related calculations. Entities will need to design and implement new processes and controls to ensure all contracts that are, or contain, leases are identified and properly accounted for. As compliance with ASC 842 is an ongoing effort, an accounting software solution is recommended. Calculations do not necessarily get easier after initial implementation, as there are additional considerations for potential remeasurement events and contract modifications. Implementation of the new standards also allows for several policy elections not discussed here that will impact the recognition and measurement of these balances. It is important to understand those policy elections and how they will affect accounting efforts and financial statements.

Entities will also need to take a close look at related-party leases. ASC 842 states that related party leases should be accounted for on the basis of legally enforceable terms and conditions, the same as all other leases. The classification and measurement of related party leases should be the same as leases between unrelated parties. Determination of what is “legally enforceable” can be more difficult between related parties. Auditors may consider a number of factors to assess whether entities properly accounted for related party leases. To avoid ambiguity and scrutiny, it is recommended that entities formalize and document related party leases using terms comparable to arm’s length transactions.

PENDING GUIDANCE: In September 2022, the FASB decided to amend ASC 842 related to leasing arrangements between entities under common control. An Exposure Draft of the amended guidance is expected to be issued in the fourth quarter of 2022, followed by a 45-day comment period. Under the proposed amendments, entities would have a practical expedient for arrangements between entities under common control to use only the written terms and conditions in determining whether a lease exists – and, if so, the classification and accounting for the lease. However, if no written terms exist, the entity would still be required to determine the legally enforceable terms and conditions. Additionally, leasehold improvements that are associated with leases between entities under common control would be amortized over their economic lives as long as the lessee continues to use the underlying asset. Upon termination of the lease, any remaining leasehold improvement balance would be accounted for as a transfer between the entities.

Need More Help?

Sikich experts are available to help answer your ASC 842-related questions and support your implementation efforts. We have a wealth of information available on our website, including access to an ASC 842 Lessee Handbook and an accounting policy election template. We would also be happy to share more information on our Excel-based lease accounting solution, ASC 842 Lessee Ledger. Please contact us below to get started:

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.