This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How You Accrue Rebates With D365FO Rebate Management

With the April 2021 release of Dynamics 365 for Finance and Operations (D365FO), new rebate functionality was introduced. This new functionality wasn’t just new fields or parameters for the existing Rebate agreement functionality; this was a brand new Rebate management module that condenses vendor rebates, customer rebates, and customer royalties in one place! In a previous blog post, I explained and provided examples for the new Calculation method feature. In this blog, post I want to answer one of the questions I asked at the end of that blog post: how do you accrue rebates with the new D365FO rebate management module?

How to Accrue Rebates with D365 Rebate Management

Anytime a Supply Chain Consultant like myself starts talking about accruals, we’re probably already in trouble. No need to fear, as I did vet the accrual process with a Finance Consultant. The first step is to configure a posting profile in D365FO.

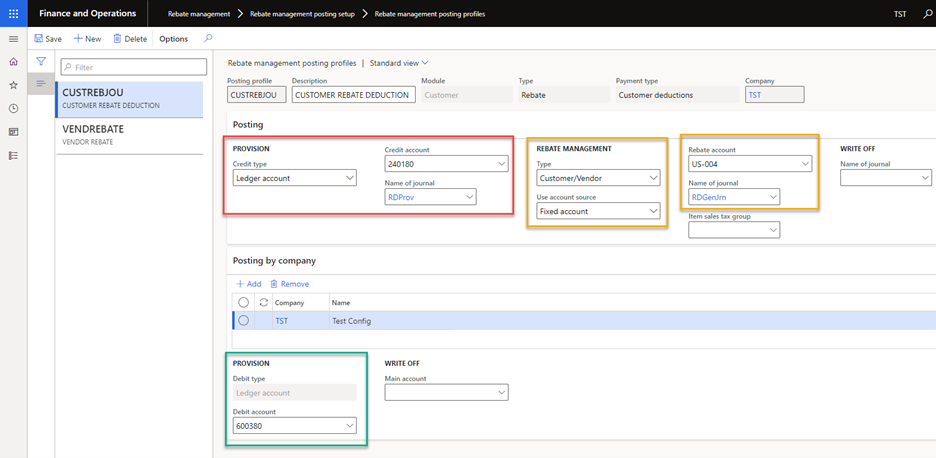

To configure the General ledger journal and Credit account that D365FO will use for the accrual journal, make selections in the dropdowns in the red boxes below. To configure the Debit account that F&O will use for the accrual journal, make selections in the dropdowns in the green boxes below. The hardest thing for me to wrap my head around was the use of the word “provision” in D365FO, so my suggestion is that wherever you see “provision” in the rebate management module, you should think “accrual.” Once I did that, how the functionality should be used started to click into place.

After creating the accrual journal, the next step will be to post a journal to the Customer or Vendor account for the actual monies. That configuration is also done in the posting profile, so make your selections in the yellow boxes below.

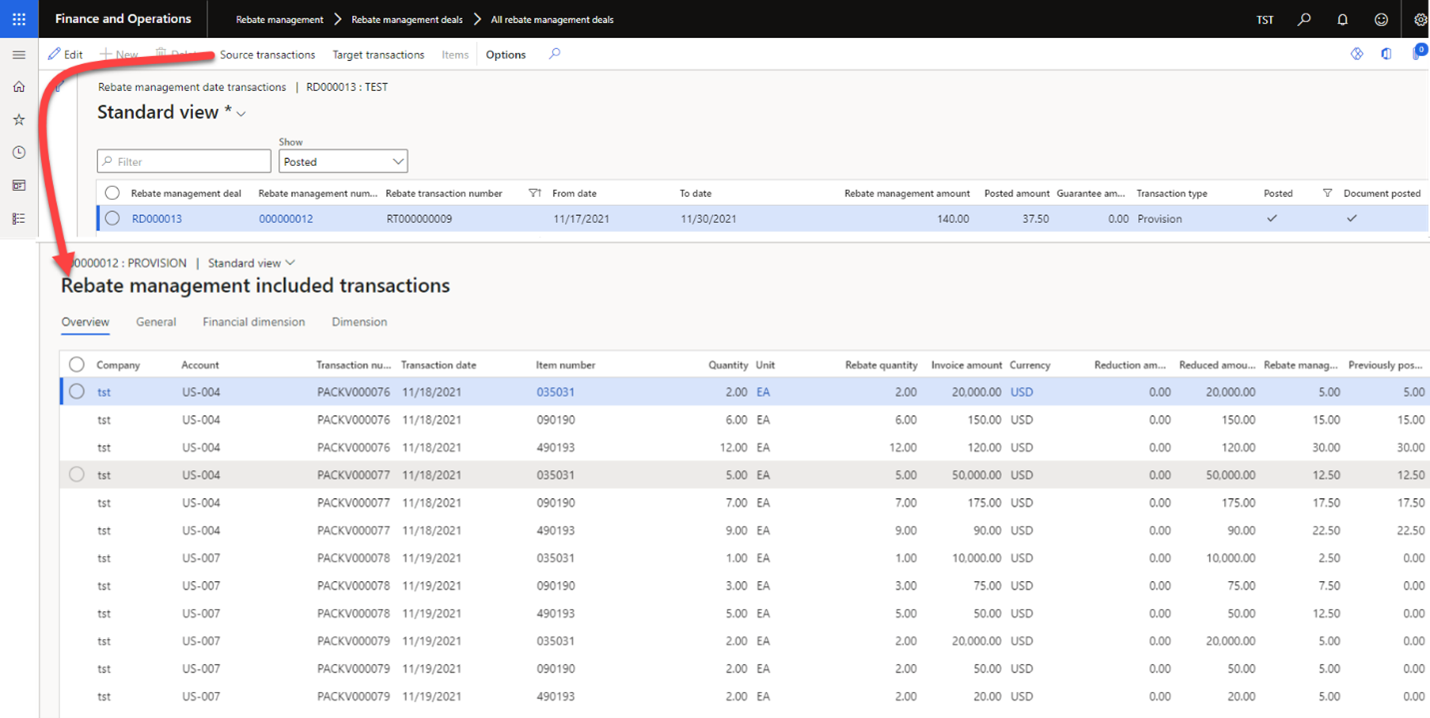

I’m using Customer rebates in this example, so the next step would be to create, ship, and invoice the Sales orders. Once that is done, D365FO will process or create the rebate accrual. The output of the Process/create is a Rebate transaction number. A Rebate transaction number represents the Orders that qualified against the Rebate management deal, so a single Rebate transaction number can and will have many child records. Below you’ll see my Rebate transaction number, and if you click the Source transactions button, you’ll see the detail of the Orders that qualified against the Rebate management deal.

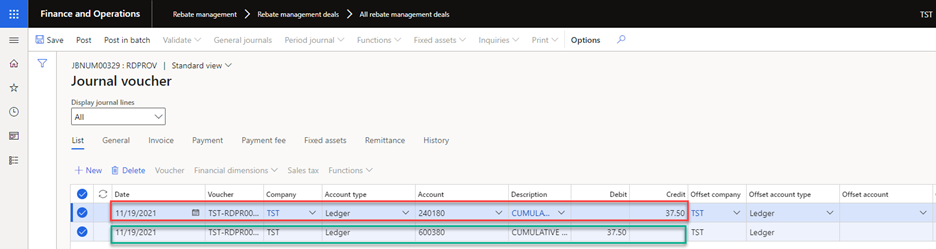

The general ledger will still have nothing posted when the process/create step is complete. When reviewing the accrual journal, guess which debit and credit accounts were used? The ones we configured on the posting profile!

How to create a rebate monies journal

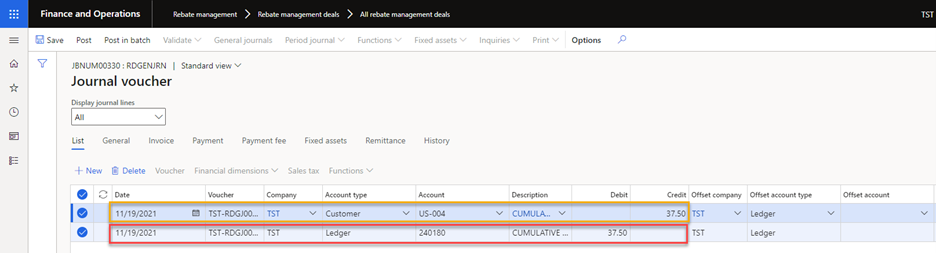

We’ll follow similar steps to create a journal for the actual monies. When the sales order is invoiced, D365FO will process/create the rebate, which will be another rebate transaction number. Once the process/create step is complete, the general ledger will have nothing posted again. The post step will once again create a journal. When reviewing the journal, guess which Accounts were used? The ones we configured on the posting profile!

And there you have it, Part 2 of the new D365FO rebate management functionality! I still have one of my questions unanswered, so I’ll pose it again here. Hopefully, someone out there can help! Please, contact us at any time.

The new Rebate management module allows you to configure how often to cumulate/accrue and how often to claim a rebate. What I’ve typically seen is clients wanting to cumulate/accrue on a monthly basis and claim the rebate at the end of the contract. Does anyone out there know how this would be configured in the Rebate management deal, Dates section?

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.