This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How to Use NetSuite Vendor Installments

Welcome back to Part II of Sikich’s introduction to Installments in NetSuite. In this blog, we will be going over Installments from the Accounts Payable side. To start, as mentioned in the previous blog, turning on Installments for the accounts receivable and accounts payable. You’ll then need to create some installments terms. As a tip, you can use the same terms on both the A/P and A/R sides, so create some general terms that can be used for both.

Using NetSuite Vendor Installments

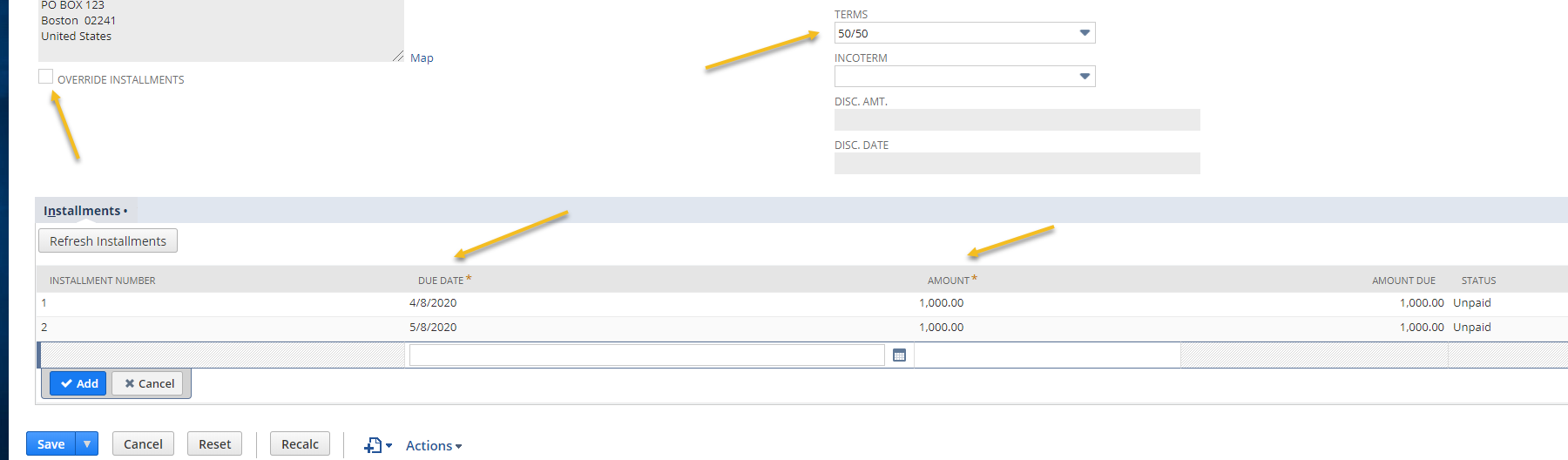

Using Installment terms for accounts payable transactions is very similar to using them for accounts receivable. You will be able to select the Installment term in the Billing subtab on a purchase transaction. It is important to note that you will not be able to override the Installments from the Purchase Order. It is only once the Purchase Order has been billed that you can then change the Installment terms on the Vendor Bill itself. When the Purchase Order is ready to be billed, you will create a Vendor Bill the way you normally would. Checking the Billing subtab, you will be able to see the scheduled Installments. Confirm that the scheduled installments correctly show the due dates and amounts or percentages due. If they do not align with the installment plan, you could override any of the installments by clicking the Override Installments box. Just make sure that if you are to override any installments, the total adds up to the total amount on the bill.

Paying the Installments

When you are ready to pay Installments, the process of paying will be very similar. You’ll still be able to use the Paying Multiple Vendors feature, and the difference is that each installment will be treated as a separate bill, each with their own reference number. When you pay an installment, the status of the bill will change. If you overpay an installment, the overage will be applied to the next installment. If the overage amount does not completely cover the next due installment, then the status for that installment will be partially paid. Paying an installment late , then the aging balance will show that the install payment amount is past due. However, it will exclude the entire balance.

A few more things to note. First of all, NetSuite will always add taxes to the first installment payment. The second, as alluded to above, is that your A/P aging details report will age for individual installments. Each installment will be considered based on its own due date. Lastly, when editing installment payments from a vendor bill, the only ones that you will be able to edit are those that have not occurred yet. You will not be able to edit installments once they have been paid, so keep in mind how much the installment is for when you go to pay!

If you’d like more information on any NetSuite releases or would like to know more about Installments, please contact us at any time for assistance!

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.