This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How to Track Revenue Recognition in NetSuite

Are you tired of manually tracking revenue recognition outside your ERP system? With NetSuite, you can easily account for any contract under any revenue standard, for any given set of products and services.

NetSuite’s Advanced Revenue Recognition automates your company’s revenue recognition and complies with new accounting standards, such as ASC 605 and 606, and IFRS 15. With this revenue management module, you can easily defer revenue for recognition across future periods per the rules you configure. NetSuite pushes revenue through this rule based workflow, and automates the creation, update, and posting of revenue records, eliminating manual errors.

The life cycle of revenue recognition starts with the construction phase, or the creation of revenue elements from a source transaction (such as a sales order). Some records and transactions that are used in advanced revenue management include:

- Revenue Arrangements: Transactions that represent the customer revenue contract. Arrangements tie together all source documents such as sales orders, invoices, credit memos, and arrangements with multiple revenue sources can be consolidated. As soon as a business contract (sales order/any other source) is signed with the customer, the contract is automatically processed as a revenue arrangement in the system and converted into revenue elements

- Revenue Elements: Records that correspond to individual lines in a source transaction. Revenue elements are attached as lines on a revenue arrangement.

- Revenue recognition rules: User configured rules that defines the revenue recognition method, revenue amount source, and start/end date sources.

- Revenue recognition plans: Derived from individual revenue recognition rules, this record is used to indicate the posting periods in which revenue should be recognized, and the amount to be recognized in each period.

- Fair value price list: Contains the rules that determine the fair value prices of an item or item revenue category, which in turn is used to allocate revenue in revenue arrangements.

Setup Tips

It’s critical to correctly configure the revenue recognition attributes on Item records to ensure revenue properly flows through the revenue recognition workflow. The revenue management module supports the following item types:

- Assembly including Serialized and Lot Numbered

- Download

- Kit/Package

- Inventory including Serialized and Lot Numbered

- Non Inventory for Sale/Resale

- Other Charge for Sale/Resale

- Service for Sale/Resale

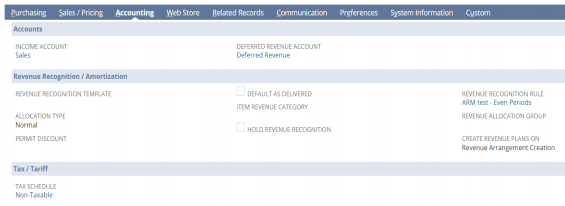

There are several key fields on items that must be configured for proper revenue recognition, including:

- Deferred Revenue Account: This will default from your accounting preferences

- Revenue Recognition Rule: This rule sets the revenue criteria to be used for this item in a revenue arrangement.

- Create Revenue Plan on: Defines the event that triggers the creation of revenue recognition plans

- Item Revenue Category: This is the classification for items that have similar characteristics and revenue allocation requirements.

Below is an example of the different revenue recognition related fields available to configure on an item, found on the accounting subtab:

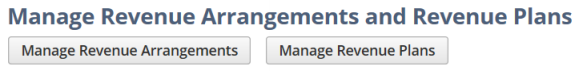

Once Items have been configured, Arrangements and Plans can be created to properly defer revenue.

These can be set to run automatically, or they can be created manually, whenever necessary.

- Both Forecast and Actual Plans can be created and linked, for easy comparison.

- Always ensure that the “update revenue plans” button, found on the revenue arrangement record, is used when there is a change in the source transaction, so the changes are reflected in the forecast and/or actual plans.

Even with a tool as capable as NetSuite, Revenue Recognition can be a headache. If you’re struggling to properly manage your revenue with NetSuite, Sikich can help! If you would like more information about NetSuite, please contact us at any time! You can also learn about more great tips for NetSuite on our YouTube playlist or our other blog posts.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.