This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How to Add Employee Details in NetSuite Charge-Based Invoices

A Project record in NetSuite allows for several different billing types: Fixed Bid Interval, Fixed Bid Milestone, Time & Materials and Charge-Based. The first three options (Fixed Bid Interval, Fixed Bid Milestone and Time & Materials) are basic options for projects that only allow for one billing type throughout the life of a project. The last option, Charge-Based Billing, handles more complex billing scenarios through rule based configurations. Some examples of billing scenarios handled by Charge-Based Billing include, contracts will different billing types (i.e. milestone and time and materials) and subcontractor mark-ups (i.e. charge 20% markup on all subcontractor costs).

When enabling Charge-Based Billing on a project, do not assume NetSuite’s native invoices will mirror the functionality found with the other billing types. Specifically, charges related to time will not print employee level detail on invoices without additional configurations. Natively, time will be grouped by service item, which is not enough detail for a typical T&M invoice.

The configurations below allow for capturing this detail on invoices:

- Add a custom field, such as Invoice Description, to the Charge record.

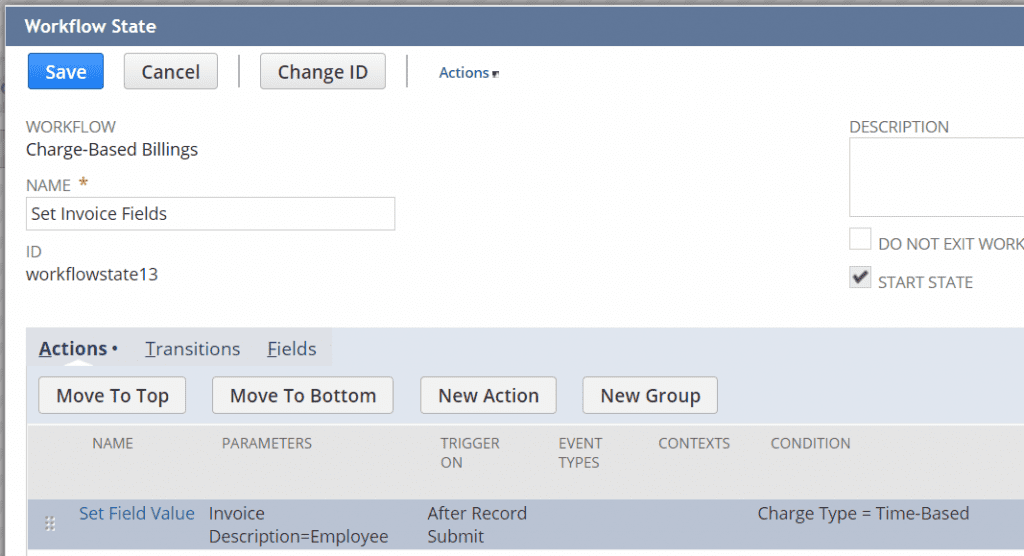

- Using workflow, set this field value to the Employee field value on the Charge record.

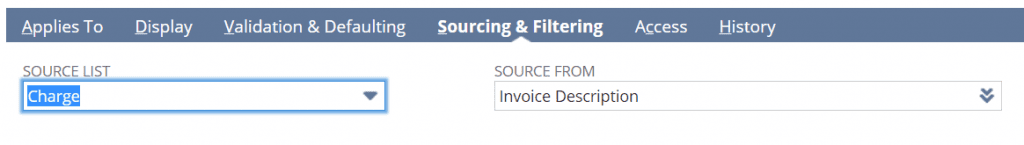

- Add a custom Transaction Line field to the invoice that sources the custom field value from above.

- Update the Advanced PDF/HTML Invoice form to include the field for printing.

The steps above can be used to capture additional details for charge based invoices. Some examples include milestone descriptions, expense report details, and vendor bill details.

If you would like more information about charge-based invoices with employee details or anything else with NetSuite, please contact us at any time! You can also learn about more great tips for NetSuite on our YouTube playlist or our other blog posts.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.