This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Expense Deferral and Amortization with Microsoft Dynamics 365 Finance

Have you ever considered optimizing your expense deferral and amortization processes? By leveraging advanced features within Microsoft Dynamics 365 Finance, you can streamline these processes while gaining valuable visibility into balance details for reconciliation purposes. With new features such as Revenue and Expense Deferrals and Subscription Billing, Dynamics 365 Finance offers powerful tools to not only streamline your expense deferral and amortization processes, but also provide reporting accuracy and ensure compliance with accounting standards.

How to Use the Expense Deferrals Features

- First, we will need to activate two new features under Feature Management:

-

- Subscription Billing:

- Revenue and Expense Deferrals

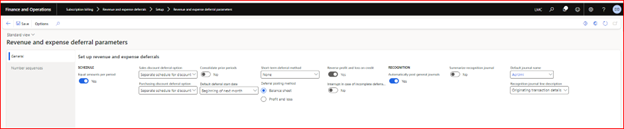

- Set up Revenue and Expense Deferral parameters. Specify a new number sequence for the Deferral schedule.

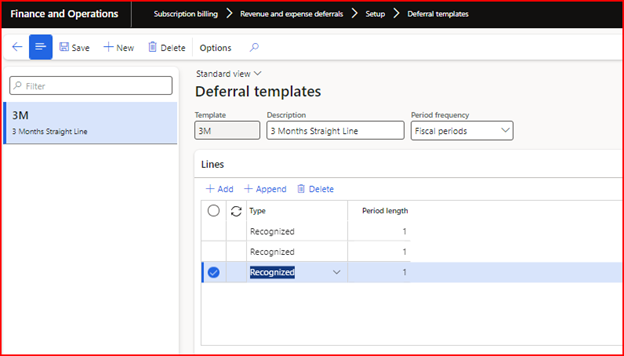

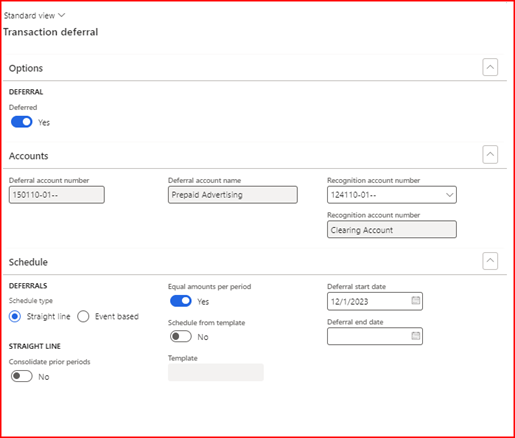

- Set up a deferral Template. Define straight-line templates within the Deferral Template setup to establish deferral schedules. Template lines differentiate between Recognized and Skipped amounts, offering flexibility in revenue recognition across periods.

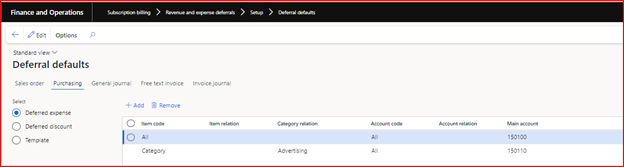

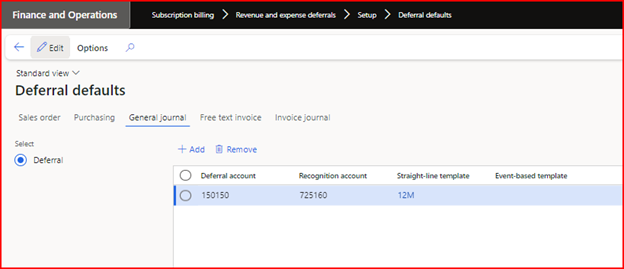

- Deferral Default Setup. Utilize the Deferral Defaults page to set up default deferral configurations for various modules, including Purchasing, General Ledger, and Invoice Journal. This ensures consistent deferral treatment across different financial transactions.

- Deferral Process

-

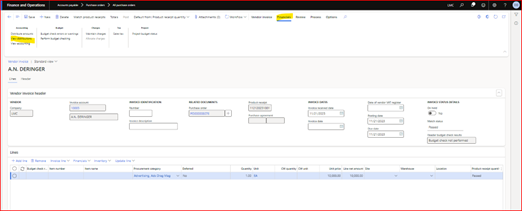

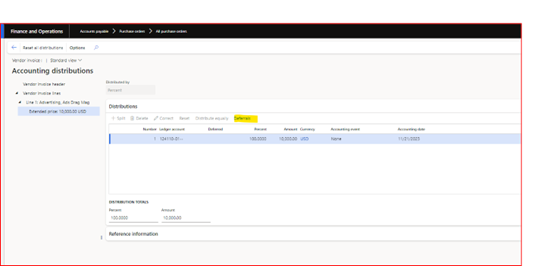

- Purchase Order Invoice: Access the Deferral menu item under View Distribution to manage deferral transactions associated with purchase order invoices.

-

- Invoice Journal and General Journal: The deferral menu item should be conveniently located above the journal line in both Invoice Journal and General Journal forms, facilitating easy access during transaction processing.

![]()

-

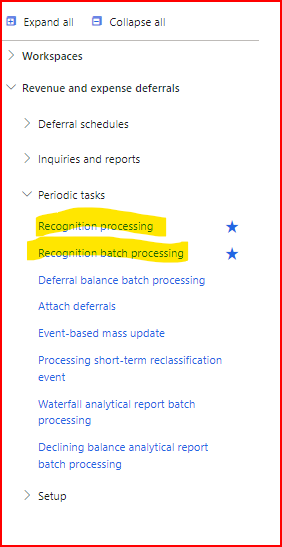

- Monthly Amortization: After creating initial deferral transactions, businesses can process monthly amortization manually or automate it using recurring batch jobs, enhancing efficiency in financial operations.

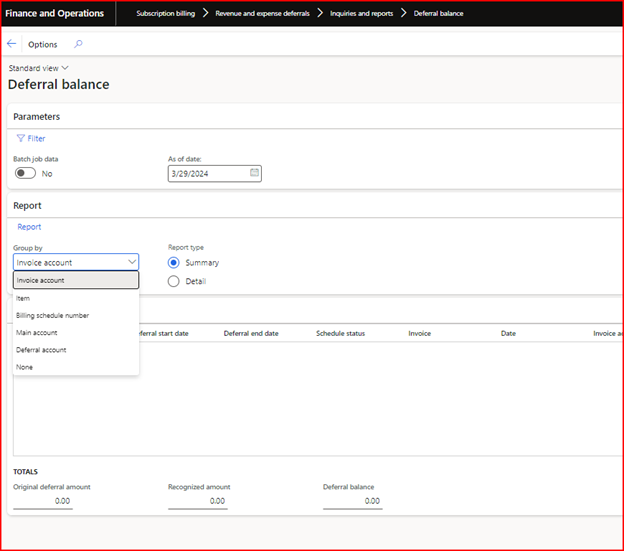

- Deferral Balance Reporting: Gain insights into deferral balances by accessing detailed or summarized views categorized by Invoice Account, Item, Main Account, or Deferral Account.

Have any questions about using the new Expense Deferrals and Amortization features in Dynamics 365 for Finance? Please reach out to our experts at any time!

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.