This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Donating Appreciated Stock to Save Money and Give to Charity

I have appreciated stock that I don’t think I should sell. What should I do with it? How can I save money on taxes?

Donating appreciated stock is a strategy you can explore that allows you to donate to charity and save money on your taxes.

Let’s start with a scenario. You have stock currently worth $25,000 that you purchased for $10,000. This being a significant gain on your investment, it’s important to understand what you can do with these funds. If you want to use them, you might think you have to sell the investment and recognize a $15,000 capital gain that you pay tax on (approximately $3,000 if at a 20% long-term capital gain tax rate – note an additional 3.8% Net Investment Income Tax may also apply). Having appreciated stock is a good problem to have. While you could certainly sell the stock, pay tax on the capital gain, and then write a check to a qualified charity – in this scenario, the amount of funds available to donate are reduced to $21,430.

Stock Value

Cost Basis

Gain

—

LTCG + NIIT (20% + 3.8%)

—

Available Funds

$25,000

$10,000

$15,000

—

$3,570

—

$21,430

Although the investment example above yields funds to deploy as you desire, including a potential charitable donation, it could have worked out a couple of other ways.

Donating Appreciated Stock

There are a variety of ways to donate appreciated stock to a qualified charitable organization and receive tax benefits. You can donate appreciated shares directly to a 501(c)(3) organization or you can donate shares into a Donor Advised Fund (DAF). In either scenario, you don’t actually sell the stock, nor do you realize the capital gains on your holding. You transfer ownership from yourself to the charity or the DAF.

Below is an example of how donating appreciated stock can work for you.

You want to donate $10,000 to Charity A and $15,000 to Charity B. You could write checks to both organizations. The charities receive the money for their cause, you made donations to something important to you, and you may qualify for a tax deduction.

Alternatively, in your investment account, you own Stock ABC that was purchased for a total of $10,000 with a current value of $25,000. You can arrange to transfer shares of Stock ABC valued at $10,000 to Charity A and transfer additional shares valued at $15,000 to Charity B. Both organizations receive the donations that you intended, just in a different way.

Taking this approach, your potential charitable deduction is the value of the stock at the time of donation. You avoid selling the appreciated stock and incurring a $15,000 capital gain. By donating the stock, you save approximately $3,000 in capital gains tax and may receive a tax deduction for the charitable donation. It’s important to note that by doing this, you are not shifting the tax burden of the capital gain to the qualified charitable organization either, as it is a tax-exempt entity. You also still have your regular savings and cash flow intact.

A Donor Advised Fund (DAF)

A DAF allows for similar tax savings and can be a great mechanism for fulfilling your philanthropic goals. A DAF can accept cash and/or stock donations. You receive the tax benefit in the year the contribution is made to the DAF, and the account can run for many years with the donor controlling where donations go.

For example, a donor can contribute $25,000 of stock/cash into a DAF. The DAF can be disbursed at the donor’s discretion over a number of years to a variety of qualified charitable organizations. The donor does not pay capital gains tax on the donated appreciated stock. If the stock continues to grow while held by the DAF, there is no capital gain recognition on that appreciation either. The gifts to charity can potentially increase beyond the initial donation into the DAF. Note that as the donor, you only receive the tax deduction on the donation into the DAF, and you do not receive a tax deduction with each individual gift from the DAF to the charities. DAFs are an excellent vehicle for implementing tax planning strategies.

Bunching Your Charitable Donations

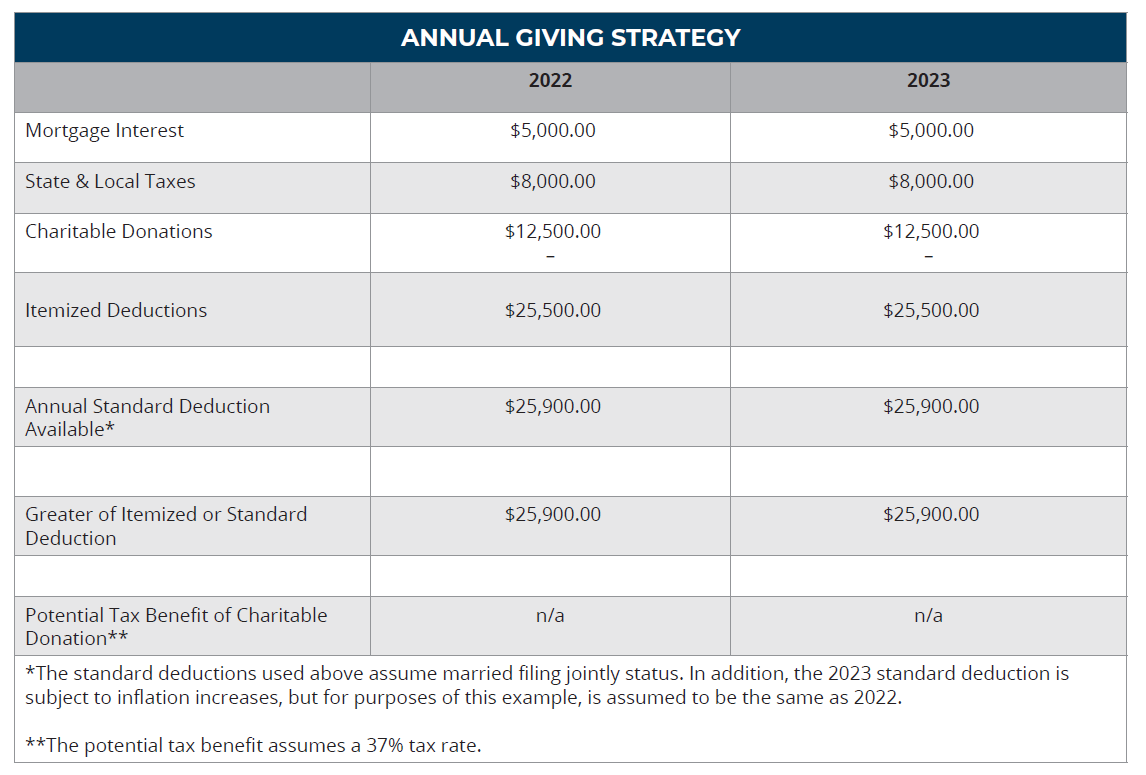

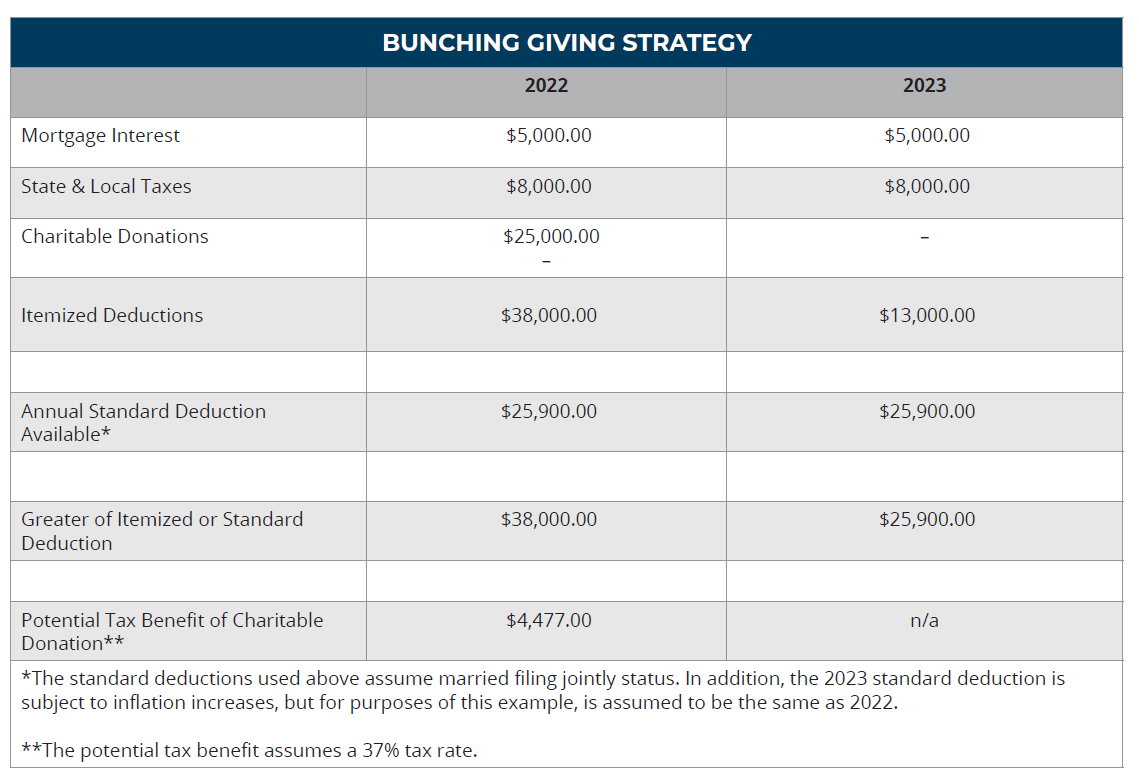

One strategy to consider is bunching your charitable donations. This would involve doubling your charitable donations in one tax year and claiming the standard deduction in the alternate year. As charitable donations are considered itemized deductions, the doubling of charitable donations would be beneficial from a tax standpoint, so long as the charitable donations push you over the increased standard deduction thresholds.

Other itemized deductions include, but are not limited to, home mortgage interest deductions, as well as state income and real estate taxes. You can use this strategy whether or not you utilize a DAF. However, a DAF can be a powerful tool to help facilitate a bunching giving strategy to help reduce income taxes by preplanning multiple years of donations into one, especially in high income years. If you fund the DAF in the current tax year, you can make grant requests out of the DAF for the following year if you intend to utilize the increased standard deduction the next year.

In our next example, you are a married filing joint taxpayer with home mortgage interest of $5,000 and state and local taxes paid of $8,000. Your itemized deductions would be $13,000, which is less than the $25,900 standard deduction rate for 2022 married filing joint taxpayers. Let’s assume you plan to donate $25,000 to charity over the next two years but have flexibility with the timing of the donation. You may choose to spread it evenly over the two years by donating $12,500 each year, or you may consider a bunching giving strategy by lumping the $25,000 donation into a single tax year. As you’ll notice below under the annual giving strategy, there is no federal tax benefit for making the charitable donations, since the standard deduction exceeds your itemized deductions. However, by utilizing a bunching giving strategy there is tax savings to be had.

Now let’s assume your $25,000 donation is a donation of appreciated stock. You have stock valued at $25,000 with an original purchase price of $10,000 that you’ve held for more than a year ($15,000 long-term capital gain). If aligned with your charitable intentions, you can purge the capital gains through a stock donation to your DAF and save approximately $3,000 in capital gains tax in addition to the tax benefit of making the charitable donation. The deduction for donations of appreciated assets are limited to 30% of adjusted gross income (AGI). However, any charitable donations made in excess of the applicable threshold would carry over to future tax years for up to five years.

The Advantages of Donating Stock

If you are charitably inclined, it might be to your advantage to donate stock rather than cash. Utilizing this strategy, the charity receives the same value of donation, and you could see additional tax savings by avoiding the stock liquidation and capital gains treatment. For more information or to speak with our team of tax and financial planning experts, please contact us.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.