This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Determining the Value of a Business

Many business owners claim to know their company inside and out. Indeed, they often know the operations of their company better than anyone. However, there are some areas that can be a mystery to even the most experienced business owner. One such area is the “value” of his or her business.

Some business owners may think they have an idea of the value of their company. They may have received an offer from another company, heard deal multiples from other companies in the industry or heard of a “rule of thumb.” We often hear clients say they attended an industry conference and heard from another owner that they sold their businesses for a certain multiple of EBITDA (earnings before interest, taxes, depreciation and amortization). Assume for a moment that the business owner was being honest about the multiple and not exaggerating to impress friends―these rules of thumb might not be appropriate for your business. For one, multiples change over time based on industry and economic factors. The multiple may also be adjusted for differences in size, growth and profitability.

In addition, EBITDA multiples are applied to “normalized” earnings. Your company’s EBITDA needs to be adjusted for certain non-recurring events or owner discretionary spending. It is not uncommon for a small business owner to set his or her salary arbitrarily or based on tax considerations rather than based on a market salary reflective of the amount and quality of work provided to the company. These items may skew the reported EBITDA of the company. Was the multiple you overheard based on reported EBITDA or adjusted EBITDA? In addition, application of an EBITDA multiple does not represent what a business owner receives in a transaction because the debt of the company must be subtracted to arrive at the proceeds to the seller. There may be other adjustments for non-operating assets and excess or deficient working capital that impact value.

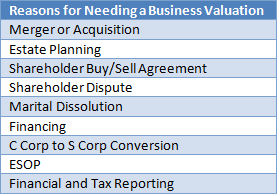

For most business owners, determining the value of their business is not part of their every day duties. However, it is an important part of long-term business planning and wealth management. Valuations are useful when selling your business, adding an equity partner or resolving a shareholder dispute. They are necessary when executing an estate planning strategy or if you a converting your company from a C Corporation to an S Corporation.

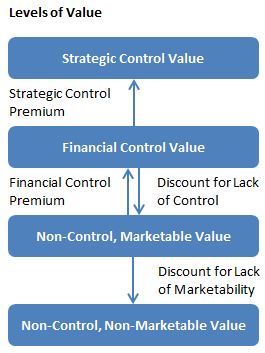

Value is relative, and can be different depending on the purpose of the valuation. People most often think of the value of their business as what they would receive if it was sold. This is a “control” level value and may be a “strategic control value;” that is, it reflects the value to a specific buyer who can take advantage of synergies. The level of value appropriate for a valuation depends on the nature of the valuation. If someone is selling his or her company, the valuation should be prepared on a control level. However, this value on a pro rata basis would not be appropriate if an owner wanted to sell a 25 percent interest to a new business partner. This is because a 25 percent interest lacks control and marketability. Discounts for lack of control and lack of marketability are necessary to arrive at a value on a non-controlling and non-marketable interest basis.

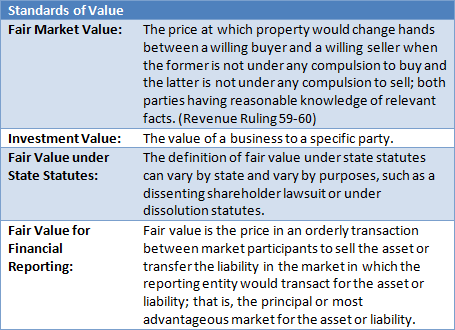

There are also different standards, or definitions, of value. The purpose of the valuation often dictates the standard of value that will be used. Fair market value is used for valuations prepared for gift and estate tax purposes; however, fair market value is generally not appropriate for mergers and acquisitions. Rather, investment value, or the value to a specific party, is generally used for mergers and acquisitions. Fair value is different than fair market value and has multiple definitions depending on the context; it is often required for dissenting shareholder lawsuits. While fair value under this context is defined by state statutes, the statutes may not provide a clear definition and case law must consulted. In addition, the term “fair value” is also used for valuations for financial reporting purposes. Fair value under this context is different than fair value under state statutes.

Whatever your reason for needing a valuation, Sikich has experienced and credentialed appraisers to guide you through the process.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.