This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Consolidations in Microsoft Dynamics 365 for Finance and Operations: Part 2

In a previous post I reviewed the flexibility in the various consolidation functionalities offered by Dynamics 365 for Finance and Operations (“D365FO”). The focus of that post was around the “Hard” consolidation or “Consolidate online” (or online consolidation) function. I covered, at a high level, ways that this option addresses some of the common challenges surrounding consolidations. In this post I will continue by getting into more specifics about configuring the D365FO system for online consolidation. We will cover exactly what and how to use parameters to achieve more common and practical goals in a consolidation of legal entities.

Configuring the legal entities

The only piece of configuration that is absolutely necessary to start utilizing the consolidations module, as well as the Consolidate online form, is to create a legal entity and mark it to be used for financial consolidation. This was shown in the previous post. Additional configuration around this process is dependent on to what extent a corporation plans to use the online consolidation. Examples would be an environment where there are companies using different currencies, or if it is decided that elimination rules will be used within the consolidation process. Also, what if a certain amount of detail is required on where transactions originated from and what dimensions were involved in those original transactions? Certain considerations and setups need to be accounted for in these situations. To address these and demonstrate how to run a consolidation end to end, we will examine each tab of the consolidate online form. We will also visit some menus outside of but still relevant to the consolidation process.

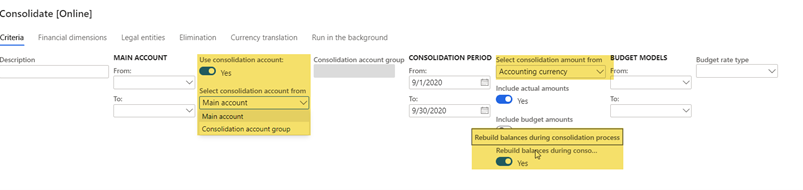

The online consolidation form must be accessed from the legal entity that is noted as the consolidation company. The first tab, Criteria, of the consolidation form lays out some basic details of what and how you want to consolidate. Here you can choose things like account and date ranges as well as whether or not to include budgeted amounts. There are a few key options to highlight on this form though. Firstly, you will only be able to use an account range by itself if the chart of accounts between the legal entities being consolidated (as well as the consolidation entity) is shared. Otherwise, this is where you can choose to use a consolidation account specified on each individual ledger account (shown on previous post). You can also choose what account to consolidate to for any given account depending on what is called a consolidation group. This is another option on the ledger account that was not shown in the previous post but is useful if the target account depends on what entities are being consolidated. Another thing to note on this screen is that you can choose here whether you want to consolidate the subsidiary’s accounting or reporting currency. Lastly, it is very important to note the “Rebuild balances during consolidation process”. This option allows you to run the consolidation multiple times. It cancels the previous consolidation for the given period and re-posts everything. This will prevent subsequent consolidations from duplicating what was previously done.

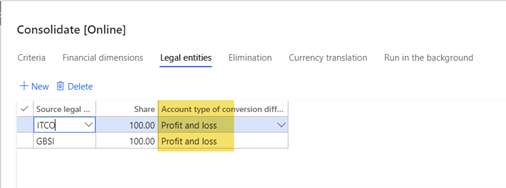

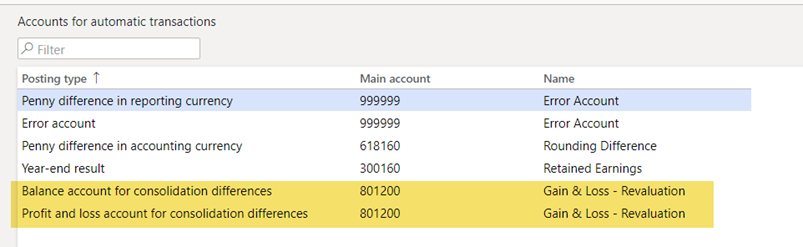

The Legal entities tab will of course designate what legal entities are included in the consolidation. Because of that, this tab really works in conjunction with all of the other tabs. Here you can choose what percentage of the legal entity balance you will consolidate as well. By doing multiple consolidation runs you can have different percentages of different ranges of accounts consolidated as needed depending on the relationship to a subsidiary. This tab also has a special relationship with currency translation. This is half of where you setup the account that will be used to post to for any consolidation differences due to currencies of subsidiaries differing from the currency of the parent. Here you designate whether the account to be posted to will be the P&L or balance sheet account setup elsewhere (This is set to P&L in most instances but has the flexibility of using a different account from the balance sheet depending on accounting standards in a given country/area). The other half of this is setup in accounts for automatic transactions.

Currency translation setup

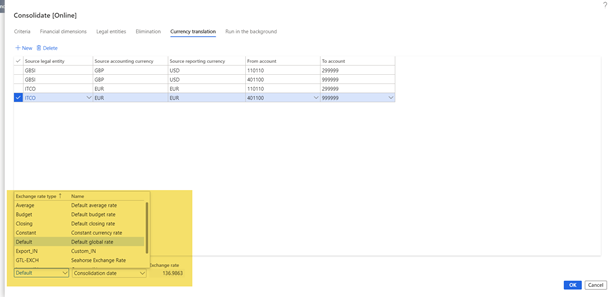

The rest of the currency translation logic is of course in the Currency translation tab. This tab was covered in the previous post, but as a reminder, this tab gives you real flexibility in how you want to manage currency translation. For balance sheet accounts you may want to just use the exchange rate at the consolidation date (this will be the “To” date field under Consolidation period section from the Criteria tab), but for your P&L accounts you can choose to manage this as a designated average rate for a given period, or manage your average rates as a separate exchange rate type. In some cases, it may also be appropriate to use the transaction date for these purposes. Utilizing different exchange rate types can also be used for balance sheet accounts, as well as if a different set of exchange rates is required for different consolidations (dependent on standards of the jurisdiction). The advantage of using exchange rate types for translation of P&L and balance sheet is that you get a simple repository of what exchange rates were used in the past for purposes of translation. This is akin to how you get the history of exchange rates for individual transactions which use a list of exchange rates in an exchange rate type by default.

Remember that this process also is translating either the accounting or reporting currency to the consolidation company depending on the selection in the Criteria tab. This is extremely useful if, for example, there are statutory requirements in a subsidiary company that require detail in one currency, but the functional currency of the subsidiary that needs to be consolidated (according to accounting standards) is different.

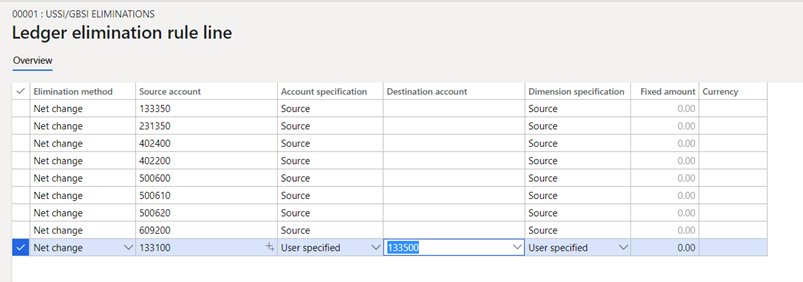

Consolidation eliminations

Another area to elaborate slightly on is the Elimination tab. Most of the setup for this is done on the elimination rule itself. Here you can choose your elimination rules that you want to apply. If you chose to post right away, then you can choose a posting date, and if it is a proposal, you can choose a release date when the journal is allowed to be posted. The Destination company is set in the elimination rule, but if you are doing eliminations as part of the consolidation, then the consolidation company should usually be the elimination company as well. As far as the source companies go, these rules will be applied to all legal entities chosen in the tab of that name. As far as the actual elimination rules go, the options are mostly around the financial dimension strings being used. In this form, the source account is chosen. The destination account can match the source (shared COA) or you can designate an account to which these amounts are eliminated in the elimination company. The same goes for the financial dimensions. Here you can also choose to designate an amount to eliminate instead of the net change in a period.

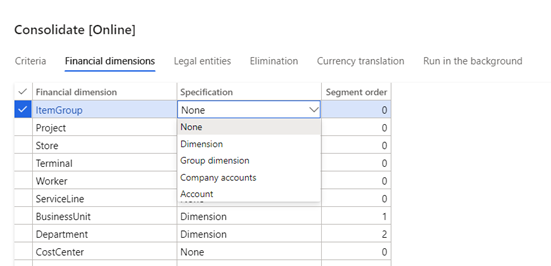

Many companies will want to have all the detail they can get in the consolidation company. This includes transaction details like what legal entity the transaction originated from. This brings us around to the Financial dimensions tab of the consolidate online form. This is where you chose the dimensions shown in your consolidation company, and in what order they are shown. In addition, you can choose to include the actual dimension number from the subsidiary (“Dimension” option), or the value from the group dimension field on the financial dimension value (“Group dimension” option). This is similar to the default consolidation account field from the main account form, and the location was shown in the earlier post. If you are using the consolidation account instead of a shared COA, this tab also allows for transferring of the original account to the consolidation company as a financial dimension through the “Account” option. Lastly, you can always simply add the legal entity as a financial dimension to get the history and tracking ability of where a consolidation transaction came from. Then it is just a matter of adding the financial dimension in this screen. But you can also avoid having the legal entity financial dimension included in the subsidiary ledgers by using the “Company accounts” option here. It transfers the legal entity identifier to the consolidation company as a financial dimension on a transaction.

As you can see D365FO covers a wide range of consolidation possibilities. There are options that can be molded to fit the needs of a corporation no matter their requirements in this area of finance and accounting. Hopefully this guide through the Consolidate online function, forms and configuration provides a baseline to understand this end to end process within D365FO.

Have any questions about configuring D365FO online consolidation or the variety of consolidation options? Please contact us at any time.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.