This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Business Central and 1099 IRS Electronic Filing

If you expect to generate 10 or more 1099s for the 2023 tax year, there are some new IRS regulations you need to know.

In February of 2023, the Department of Treasury and IRS issued final regulations amending the rules for filing returns and other documents, which includes 1099s. These regulations are additionally reducing the e-filing requirement from 250 informational forms down to 10 or more.

According to the Department of Treasury, these final regulations set the following for e-filing:

- Reduce the 250-return threshold enacted in prior regulations to generally require electronic filing by filers of 10 or more returns in a calendar year. The final regulations also create several new regulations to require e-filing of certain returns and other documents not previously required to be e-filed;

- Require filers to aggregate almost all information return types covered by the regulation to determine whether a filer meets the 10-return threshold and is required to e-file their information returns. Earlier regulations applied the 250-return threshold separately to each type of information return covered by the regulations;

- Eliminate the e-filing exception for income tax returns of corporations that report total assets under $10 million at the end of their taxable year; and

- Require partnerships with more than 100 partners to e-file information returns, and they require partnerships required to file at least 10 returns of any type during the calendar year to e-file their partnership return.

The good news for Dynamics 365 Business Central users is that Business Central does have functionality for e-filing 1099s.

How to Set Up Your Free IRS e-Filing Account

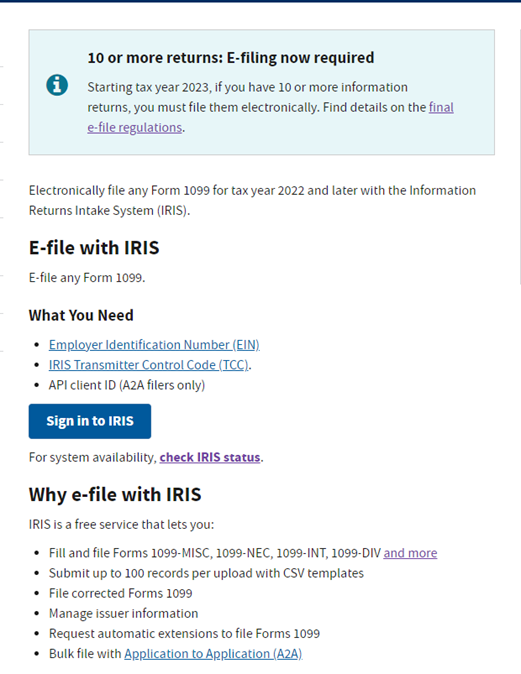

To set up an e-filing account with the IRS, you must have the following:

- A free account with the IRS on its Information Returns Intake System (IRIS). Click the link below, and then click on “Sign into IRIS.” From there select “Create a new account.”

https://www.irs.gov/filing/e-file-forms-1099-with-iris#forms-1099-you-can-file - Employer Identification Number (EIN)

- Transmitter Control Code (TCC). Once your IRIS account is set up, you will receive a TCC code, generally by mail. In the past, you had to submit your e-file application by November 1st to be guaranteed an account and TCC code. This was for the IRS Filing Information Returns Electronically (FIRE) system used in previous years for e-filing. The FIRE site will remain in use at least through the 2023 filing season. However, starting with the 2023 filing season, the IRS intends to use the new IRIS system for most all e-filing purposes.

Don’t forget to give yourself time to test the e-filing process! Both Business Central and the IRS have the capability to run a test file.

If you have any questions about setting up Business Central to e-file your 1099s, we can help with your software setup as well as functional training for your teams. Please contact us at any time for assistance, but don’t wait too long, because we all cannot get through the checkout line at the same time.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.