This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Advantages of a Cross-Tested 401k Plan

Your 401(k) plan can provide a benefit to more than just your employees; when designed properly, it can also benefit owners and targeted groups, such as key personnel and managers.

If you are currently making a profit sharing contribution within your 401(k) plan, it is likely being allocated based only on employee compensation. A cross-tested allocation formula, on the other hand, allows you to specify different allocation percentages to different pre-defined groups of participants. These pre-defined groups can be classified in a number of different ways – job description, length of service, ownership, and more.

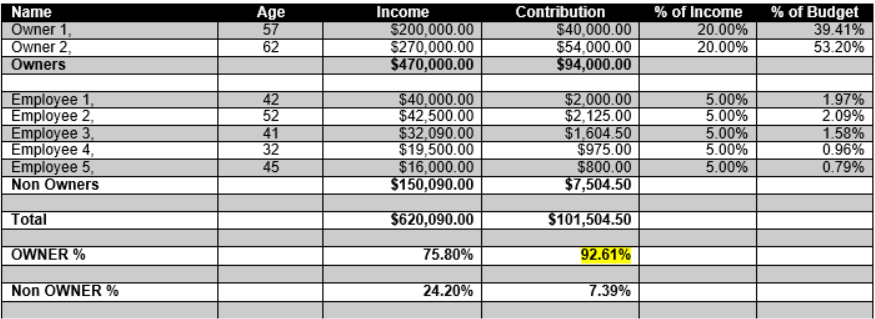

A cross-tested plan will provide more flexibility than a traditional formula, but it works best (on average) when the targeted group is older than the rest of the employees. Owners are often older than many of their employees, therefore this formula can have extremely favorable results. See the following illustration:

In this illustration, the owners receive an allocation of 20 percent of their compensation, and the employees receive 5 percent of their compensation. Furthermore, over 92 percent of the total contribution is allocated to the owners, and the contribution is fully tax deductible.

Like all profit sharing contributions, a decision on the amount to contribute to each group or whether to contribute at all can be made each year. This is a totally discretionary contribution, and the decision can be deferred until the filing of your company tax return.

There are underlying compliance tests that must be passed, but Sikich LLP will review those tests and insure the allocation meets current IRS requirements.

In summary, a cross-tested profit sharing formula within a 401(k) will provide targeted contribution opportunities to favor owners/key personnel, offer an additional tax deduction to the company, and present an additional benefit to employees at a reasonable cost.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.