This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How is the Value of a Business Estimated?

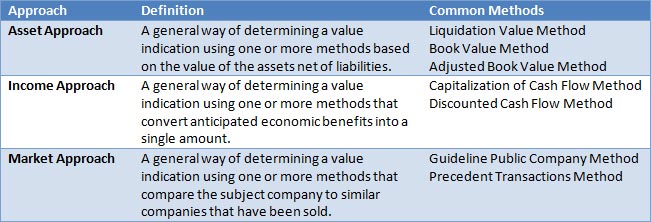

The value of a business is often defined as the present value of its future earnings discounted at a risk-adjusted rate. While this may sound simple, the application of this process can be very complex. There are three approaches to valuing a business: the cost approach, income approach and market approach. There are many methods within each approach.

Asset Approach

The asset approach estimates the value of a business by adjusting the values of the assets and liabilities. The value of each asset, including intangible assets, and each liability must be separately determined. Appraisals may be required for real estate or other fixed assets. The value of the business is equal to the fair market value of the assets less the fair market value of the liabilities. This approach is not commonly used to value companies that have intangible assets. Instead, this method is most appropriate for asset holding companies or companies with significant investments in fixed assets and little or no intangible assets.

Income Approach

The income approach is a forward-looking valuation approach that converts future income into a present value. The two most common methods within the income approach are the discounted cash flow method and the capitalization of cash flow method. The discounted cash flow method utilizes discrete projections for a number of years―usually five. The discounted cash flow method is preferred when the company’s earnings and growth are projected to vary for some period of time into the future. On the other hand, the capitalization of cash flow method is most appropriate when there is little variability in projected earnings and growth. This is because the capitalization of cash flow method converts a single period of representative earnings into a present value by assuming a constant growth rate in perpetuity.

Market Approach

The market approach (sometimes called a sales comparison approach) is a relative valuation method and is based on the principle of substitution. The value of a business is estimated by examining the prices paid for comparable businesses. This is done by calculating trading multiples for publicly traded companies as well as transaction multiples for privately held companies. Market price indications can be an excellent empirical source of data. However, the market approach is limited by the difficulty in finding comparable companies. Public companies are often significantly larger and more diverse than private companies, and transaction data for private companies is not widely reported.

While all three approaches are considered in any valuation, only certain approaches may be relevant. The asset approach is not commonly used for a profitable service based business that does not have a significant investment in fixed assets. It may be difficult to find comparable companies and transactions. Earnings may be volatile and difficult to forecast. The unique facts and circumstances of each company determine which methods an appraiser will use and the weighting to place on the selected methods.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.