This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Retained Earnings Concept in NetSuite

Retained Earnings represents the portion of a company’s Net Income at the end of a reporting period that is retained for investment back into the business. At the end of a fiscal year, a company will close Net Income (less any dividends paid out to shareholders) or, if there is a loss, the loss to Retained Earnings. This is usually done by creating a Journal Entry that zeros out all Profit and Loss Accounts and closes those accounts to Retained Earnings.

NetSuite uses a system-generated account for Retained Earnings that cannot be deleted and should not be renamed. However, you can assign an account number of your choosing to the account by editing the account and adding a number to the “Number” field. In a OneWorld environment, this system-generated account should be used across all Subsidiaries. In addition, for best practice, multiple Retained Earnings accounts should not be set up and the system generated account should be the only Retained Earnings Account used. The exception to this would be in Not For Profit Environments where you will have Restricted vs. Unrestricted Net Assets. This article will not go into detail on the Not For Profit treatment of Retained Earnings.

NetSuite Retained Earnings

In NetSuite, an entry to close Profit or Loss to Retained Earnings is not required. Instead, NetSuite’s standard reporting is designed to reflect the appropriate Retained Earnings Balance based on the period you are running your reporting for. This way, a user is able to run an Income Statement for prior period balances because the Profit and Loss accounts will not be zeroed out. On the standard Balance Sheet report in NetSuite, the Retained Earnings Account coupled with the Net Income from prior years, makes up the cumulative beginning Retained Earnings balance at a specified point in time.

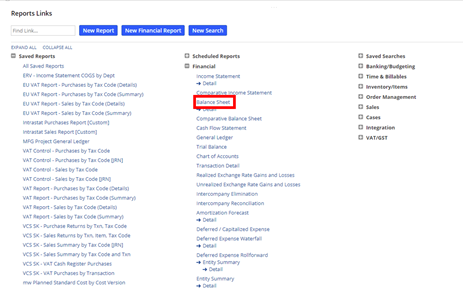

To illustrate this point, you can review the standard Balance Sheet report in NetSuite. From the Classic Center menus you will navigate to Reports > Reports Overview. On the Reports Links page, you will expand the Financial section and select the Balance Sheet Report.

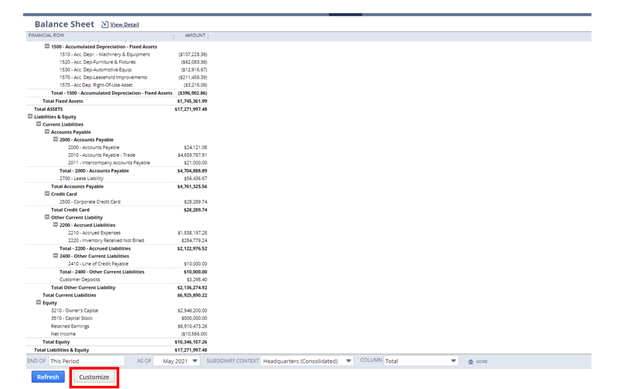

Once the report opens, click on “Customize” at the bottom of the screen to review the design of the report.

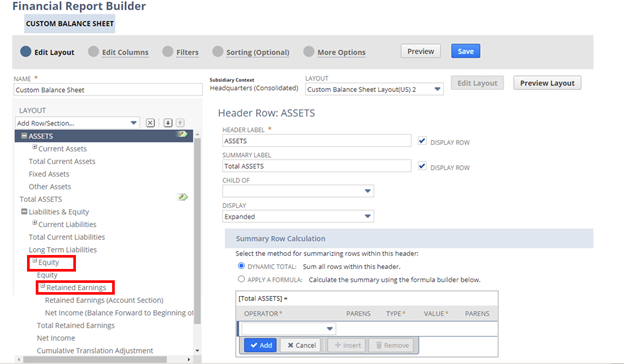

On the Financial Report Builder page, expand the Equity section under “Edit Layout” and then expand the Retained Earnings section by clicking the “+” sign next to each.

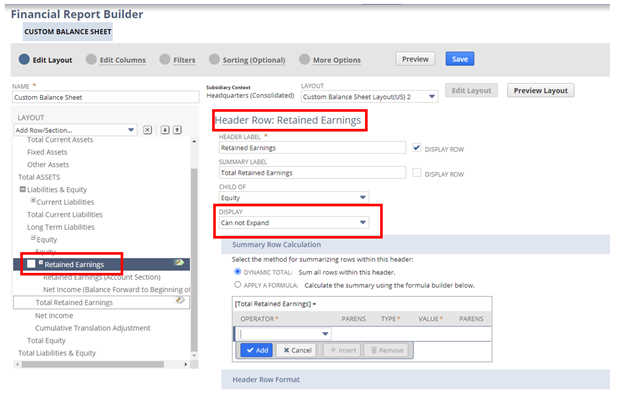

Notice that the Retained Earnings section is a Header type row and it is set in the “Display” field to “Can not Expand.” Therefore, on the standard Balance Sheet you are seeing a line for Retained Earnings that is a rollup of the lines within that section (discussed below) but it appears as a single line within the report. Should you wish to review the detailed amounts from each row within this section, you can change the “Display” field on the Retained Earnings Header Row to either “Collapsed” (this will display the section collapsed but will allow the user to expand it to see detail) or “Expanded” (this will display the entire Retained Earnings section expanded to every row).

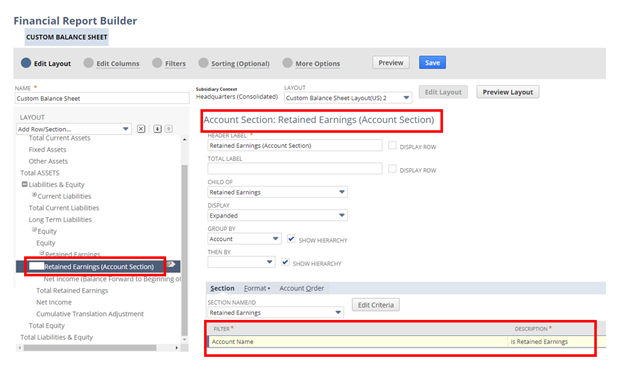

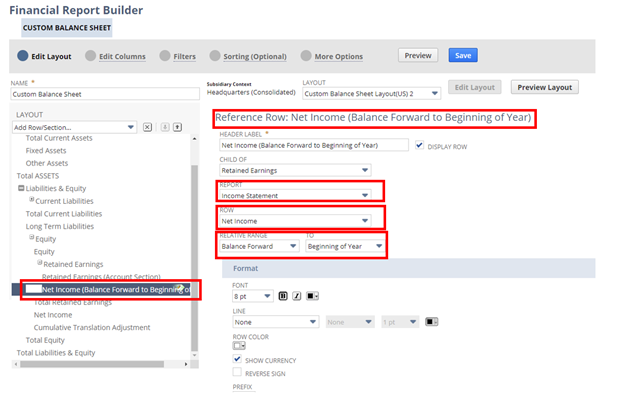

When you review the lines within the Retained Earnings section, you will find an “Account Section” type row which references the system generated account as well as a “Reference Row” type which pulls in the cumulative total of all prior years’ Net Income (Loss) through the beginning of the fiscal year that you are running the report for. The “Reference Row” references the “Net Income” row from the standard Income Statement report. The cumulative income from the inception of the business is pulled in via the relative range specified as Balance Forward through the Beginning of Year (based on the report date used to run the Balance Sheet).

Even if you create a custom Balance Sheet, it is recommended to use the above explained section as your Retained Earnings section since the standard Income Statement Report will always capture all Profit and Loss Accounts by utilizing the account types on the rows which will include any Income Statement Accounts.

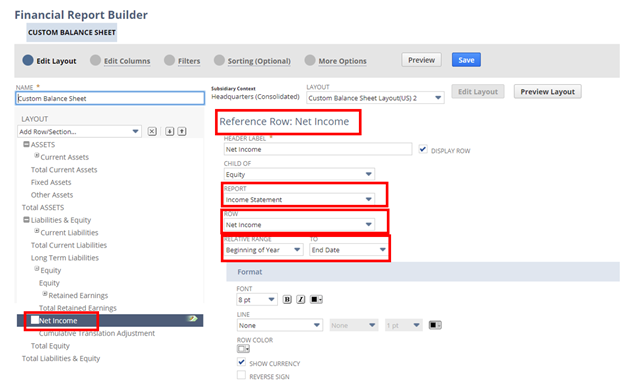

In addition, Net Income for the current year is referenced on the Standard Balance Sheet by again using a “Reference Row” type referencing the Standard Income Statement report. For this row, since it is specifying current fiscal year Income (Loss), the Relative Range specified is from the Beginning of Year to End Date. The “End Date” would be the date specified in the “As of” field on the Balance Sheet Report.

Since Retained Earnings is a calculated row within the Standard Balance Sheet report in NetSuite, users should keep in mind that any general ledger entries made directly to that account will effect the balance within the account. As a general rule, when implementing NetSuite and bringing in prior years historical balances, after bringing in an initial balance for Retained Earnings, there should be no additional postings directly to the Retained Earnings account.

Have any questions about how NetSuite handles retained earnings or any other questions about NetSuite? Please contact us at any time!

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.