This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

LIFO Inventory Opportunity for Agribusinesses

With both monetary policy and pandemic-related supply chain disruption driving current and future price increases, safeguarding inventory – often a company’s largest asset – from the detrimental effects of inflation is now on the minds of many business leaders, particularly those in the agricultural sector.

With both monetary policy and pandemic-related supply chain disruption driving current and future price increases, safeguarding inventory – often a company’s largest asset – from the detrimental effects of inflation is now on the minds of many business leaders, particularly those in the agricultural sector.

Whether you are a retailer of agricultural equipment or farm supplies, or if you manufacture or distribute fertilizers, pesticides or animal feeds, you have the opportunity to mitigate the current negative impact of price increases and save money annually by using the last-in, first-Out (LIFO) inventory method. Adopting LIFO removes the negative consequences of inflation, lowering your tax liability and creating cash flow for reinvestment. Any business with over $2 million in inventory that experiences inflation is a qualified candidate for electing LIFO.

LIFO Background. LIFO is an alternative inventory valuation method to the traditional first-in, first-out (FIFO) method. The LIFO method assumes the most recently purchased items are sold first. As a result, the inflationary impact of the inventory is deducted from taxable income and removed from the balance sheet. The inflationary impact is recorded as an inventory reserve, which continues to grow with the annual inflation on a company’s product costs. Note: An inventory valuation method, such as LIFO, is a costing method used to calculate a company’s cost of goods sold and inventory value on the balance sheet. It does not reflect the actual physical flow of goods.

Tax Benefits of LIFO. The primary benefit for a business to change to LIFO is the current tax savings it produces. LIFO allows businesses to deduct the most recent higher costs of purchased inventory against their current sales. LIFO matches current sales with the current costs of those sales. If inflation triggers higher product costs, the cost of goods sold is increased under LIFO. This creates a higher cost-of-goods-sold deduction and, thus, lower taxable income. This tax benefit is, in effect, an “interest-free loan” from the government, and tax savings grow every year. As with most tax-savings opportunities, it is important to realize that the tax savings created by adopting LIFO during an inflationary period represent a deferral of income and the corresponding tax on this income. If inflation vanishes and product prices decline or if the inventory is liquidated, the deferred income from LIFO will be recognized and the related tax paid.

LIFO Opportunity Now. With inflation on the rise, now is the time to look at LIFO for your business. Whether already utilizing LIFO or not, one other opportunity with LIFO is to analyze the Inventory Price Index Computation (IPIC) method for 2021. The IPIC method of LIFO uses inflation published by the Department of Labor’s Bureau of Labor Statistics (BLS) to measure inflation to your inventory. Currently this year, inflation is on the rise, and businesses of all sizes can experience substantial tax savings.

Consider this LIFO Example. A retailer of agricultural machinery with $5 million in inventory adopted LIFO in 2019. With even modest inflation each year, the LIFO reserve for 2021 should be nearly $500,000. The adoption of LIFO generated over $150,000 in tax savings that the retailer can reinvest into their business.

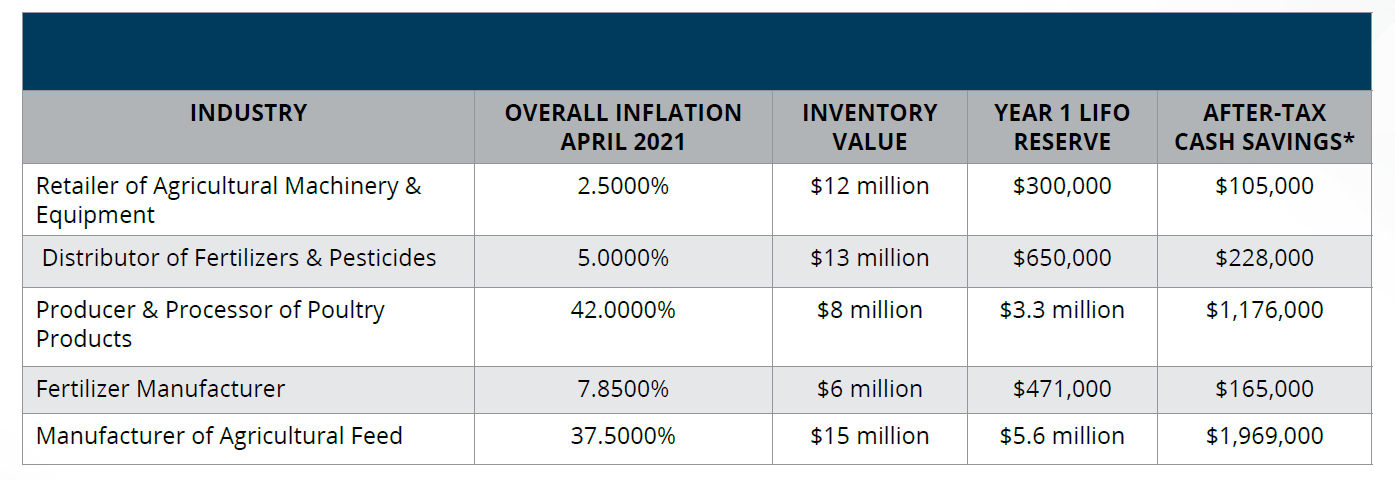

Below is a chart highlighting the LIFO impact of various agribusinesses at several inventory levels.

*After tax-cash savings are measured using a 35% tax rate.

Agribusinesses of all types are taking advantage of LIFO, and an analysis of LIFO benefits is a seamless process. For more information, please get in touch with your Sikich advisor.

Please let us know if you’re interested in a LIFO estimate:

About our authors

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.