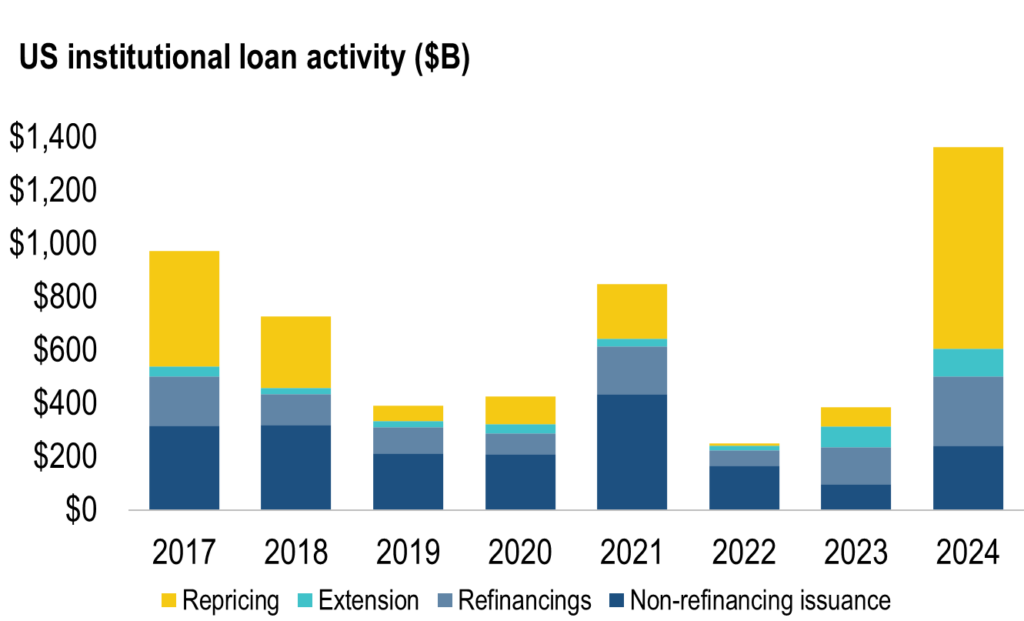

Recent findings from the Q4 2024 PitchBook Credit Markets Quarterly Wrap show the U.S. institutional loan market’s total loan activity reached $1.4 trillion in 2024. Largely driven by repricing and amendment activity, this represents a 250% increase in activity from the previous year.

Key Drivers of Market Dynamics

This record-setting volume reflects both new issuance and an increase in repricing and extension activity. The latter two accounted for over 60% of the overall loan activity in 2024. Several factors contributed to this growth:

Federal Reserve Rate Cuts: The Federal Reserve’s decision to implement three rate cuts during the year provided borrowers with an opportunity to take advantage of market conditions and secure more favorable terms on their loans. These rate adjustments eased borrowing costs and led to increased market activity across the board.

Slowing M&A Activity: A slowdown in M&A transactions shifted focus toward repricing and extensions, as companies prioritized financial stability over expansion.

Proactive Management of the Maturity Wall: Borrowers took proactive measures to push 2025 and 2026 maturities into 2028 and beyond by strategically using loan extensions to manage the impending maturity wall in 2024. This effectively mitigated near-term refinancing pressures.

- Near-term maturity decline: Loans due in 2025 dropped by 84%, leaving just $13.4 billion outstanding. Similarly, 2026 maturities fell by 75%, now totaling $44 billion.

- Strategic impact: This provided breathing room for borrowers to move about a still-volatile credit environment while minimizing default risk in the near term.

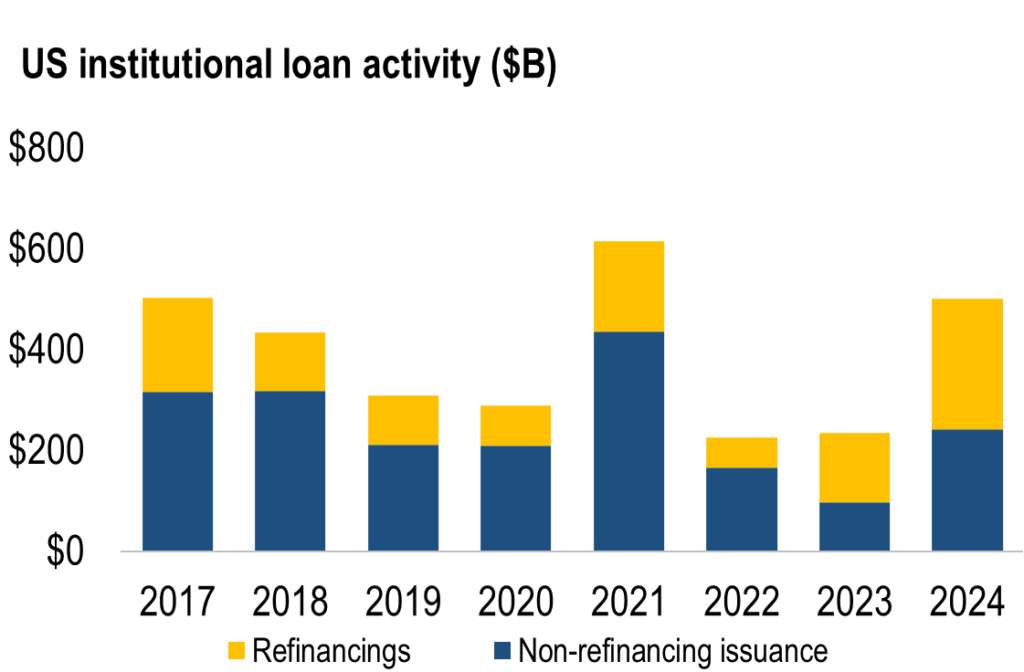

New Issuance Momentum

While repricing and extension activity dominated 2024, new-issue institutional loan volume remained resilient, totaling $501 billion last year. This marks more than double the issuance levels seen in both 2023 and 2022, which signals strong investor appetite for institutional loans.

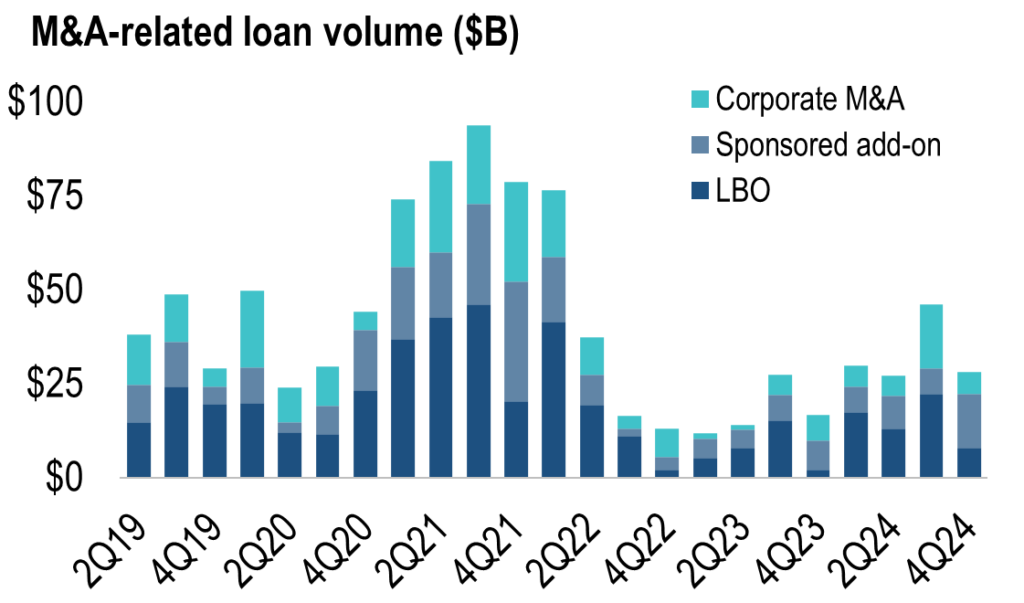

M&A Loan Activity Ups and Downs

The leveraged loan market supporting M&A transactions has struggled to regain momentum. Higher debt costs and a challenging private equity exit environment have tempered activity. Key data points include:

- Quarterly Decline: M&A loan issuance fell to $28 billion in Q4, down from $46 billion in Q3.

- Historical Lag: While rate cuts have eased some financing constraints, M&A loan issuance remains significantly below historical levels, demonstrating a continued cautious approach from dealmakers.

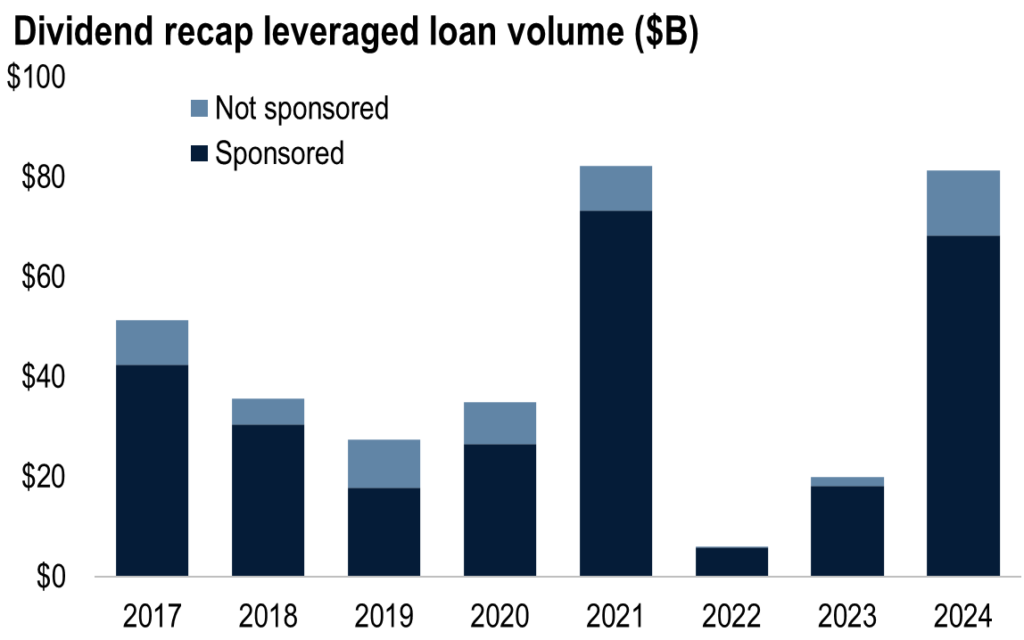

Dividend Recap Trends in 2024: Strategic Responses to Exit Challenges

Dividend recapitalization volume jumped to $81 billion in 2024, as private equity sponsors continue to face challenges in achieving successful exits.

- Private Equity Focus: A notable $68.3 billion of this activity came from private equity-backed companies leveraging dividend recaps to extract value amid a constrained exit environment.

- Portfolio Strategy: Private equity sponsors divested their highest-quality assets to capitalize on favorable market conditions while deferring the sale of less mature or riskier holdings.

Middle Market Lending Conditions Remain Competitive

- Liquidity: Liquidity in the private market shows record levels of dry powder combined with lighter-than-usual deal flow, making for intense competition for quality deals.

- Credit Spreads and Leverage Levels: As a result, credit spreads have contracted and leverage levels have widened.

Middle Market Leverage and Pricing

| Total Leverage | 3.00x-5.00x |

| Senior Cash Flow Pricing | S+3.50%-5.00% |

| Uni-tranche Pricing (One-stop) | S+5.00%-8.00% |

| Subordinated Debt Pricing | 13.50%-14.50% |

Predictions for 2025

Looking ahead, several key trends and predictions are likely to shape the institutional loan market:

- Shift Toward Quality Assets: With credit conditions remaining unclear, investor demand is expected to favor high-quality assets. Borrowers with strong credit profiles are likely to benefit from competitive pricing and favorable terms.

- Continued Focus on Maturity Management: The success of 2024’s maturity extensions will likely inspire continued efforts to manage maturities proactively. This trend could extend into 2025 as companies look to create financial flexibility and reduce refinancing risks.

- Potential Rate Volatility: While 2024 saw rate cuts, potential inflationary pressures or macroeconomic developments in 2025 could lead to shifts in monetary policy. Borrowers and investors will need to stay vigilant in what could be a volatile interest rate environment.

- Revival of M&A Activity: As market conditions stabilize, M&A transactions could grow, potentially driving new loan issuance activity. Companies may begin to prioritize strategic acquisitions, fueling further market growth.

- Strategic Implications for Stakeholders: For borrowers, the lessons of 2024 highlight the importance of proactive financial management and adaptability. Meanwhile, for investors, the sustained demand for institutional loans offers an opportunity to capture attractive returns, particularly when alternative fixed-income instruments may offer limited yields.

Sikich Capital Advisory Services

Raising debt and equity capital with a strategic investment banking partner at your side allows your capital structure to support your business goals now and into the future. At Sikich, our capital advisory professionals assist leaders through every part of a capital raise. To learn more or to get in touch with our team, please contact us.

About Our Authors

Mike Rudolph is a managing director at Sikich Corporate Finance. He has nearly 25 years of experience orchestrating senior debt (cash flow and asset based), junior capital, and equity financings for leverage buyouts, recapitalizations, private placements, and balance sheet restructurings.

Doug Christensen is a director at Sikich Corporate Finance and provides capital advisory services to his clients. He provides value to private clients through capital structure advisory and capital raises of senior debt (cash flow and asset based), junior capital, and equity financings.

Source: PitchBook Data, Inc.

Securities offered through Sikich Corporate Finance LLC, member FINRA/SIPC

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.