How much do I need to retire?

Sikich’s thorough assessment process includes a personalized review of your situation and provides recommendations for a comprehensive action plan for business succession and personal wealth.

business succession plan

Personal and financial freedom

From the first discovery meeting, our integrated team helps shape a succession plan tailored to your retirement lifestyle. With valuation, M&A, wealth advisory, insurance, retirement, estate, and tax experts working together, we build a strategy aligned with your personal and financial goals, honoring every relationship and milestone you value.

business succession plan

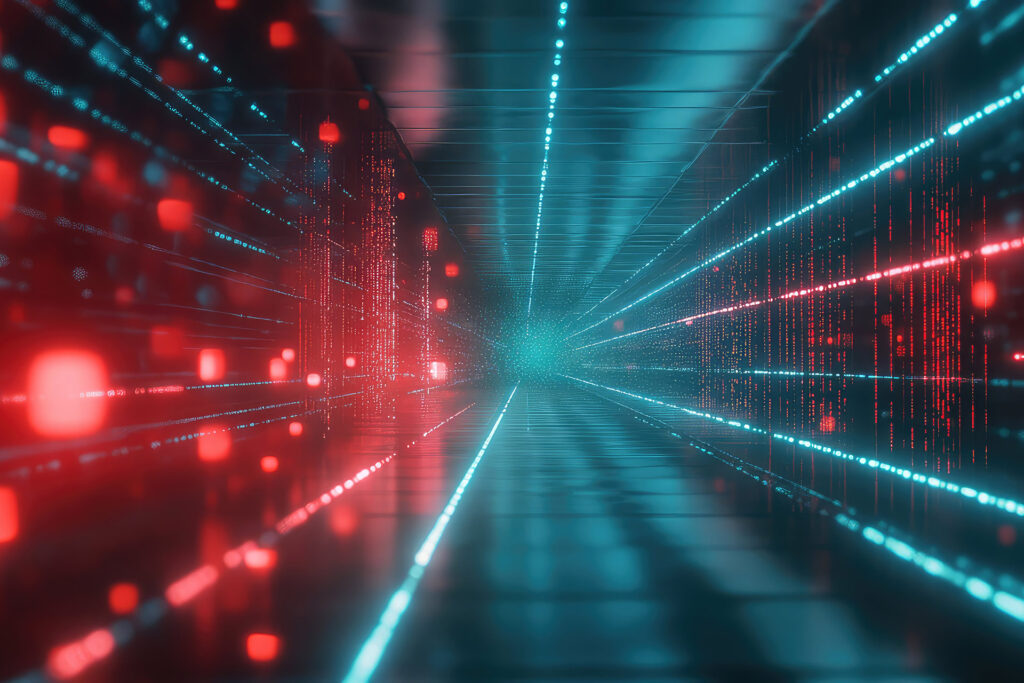

Creating your wealth strategy

Our investment consulting helps clients make smart, personalized financial decisions. Through relationship management, we align with each client’s needs, family, and professional team. Evaluation ensures long-term goals are met, covering wealth growth, protection, transfer, and charitable giving.

business succession plan

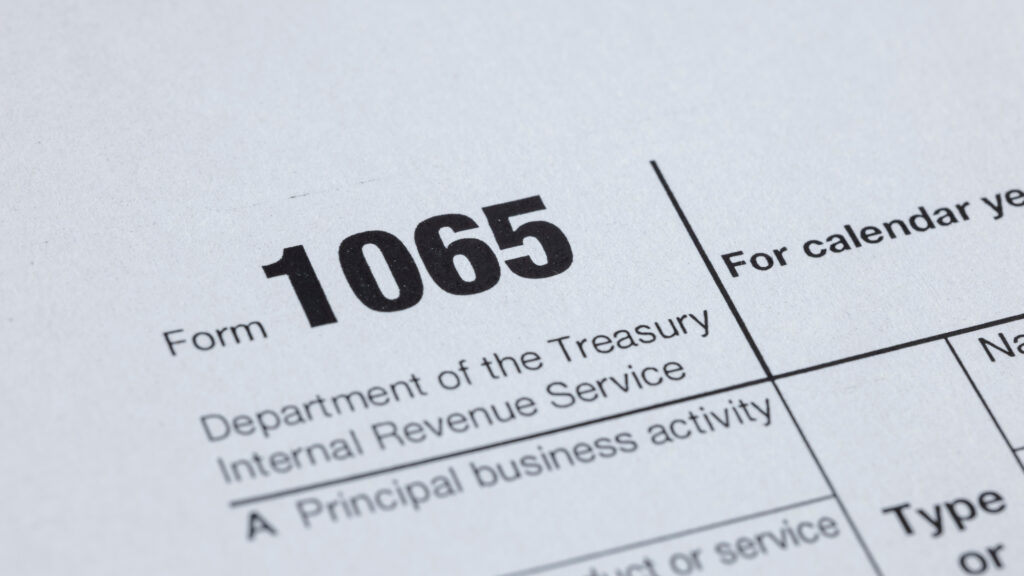

Developing your exit plan

Sikich’s succession planning advisors create tailored strategies to protect and grow your wealth before and after transactions. We help you build a clear timeline, breaking the process into manageable steps aligned with your lifestyle goals. From financial planning to tax minimization, asset transfer, retirement, charitable giving, risk management, and estate planning, we ensure every business and personal priority is addressed to support your long-term vision.

contact us

Are you ready?

Our business succession and wealth management experts can help you determine a plan that works best for you, your family and your business.

Experts