Is your Human Capital Management and Payroll technology and operations meeting your organization’s needs? View our four-part webinar series recordings below where Sikich’s experts covered the current state of HR technologies, payroll year-end processes, looked ahead to 2020, and uncovered what employers can expect with recent federal law changes.

The State of HR Technology

Bill Larkin, Managing Director, reviews the current state of HR technology, including which HR/Payroll vendors to consider, the time it will take to go through the vendor evaluation process and the investment it will take to complete the implementation. He also covers the suggested steps to take to prepare for the implementation, how to determine which resources you’ll need, and how to budget for the approximate costs associated with implementing a new solution.

https://youtu.be/pRk8bEVxALk

Payroll 2020

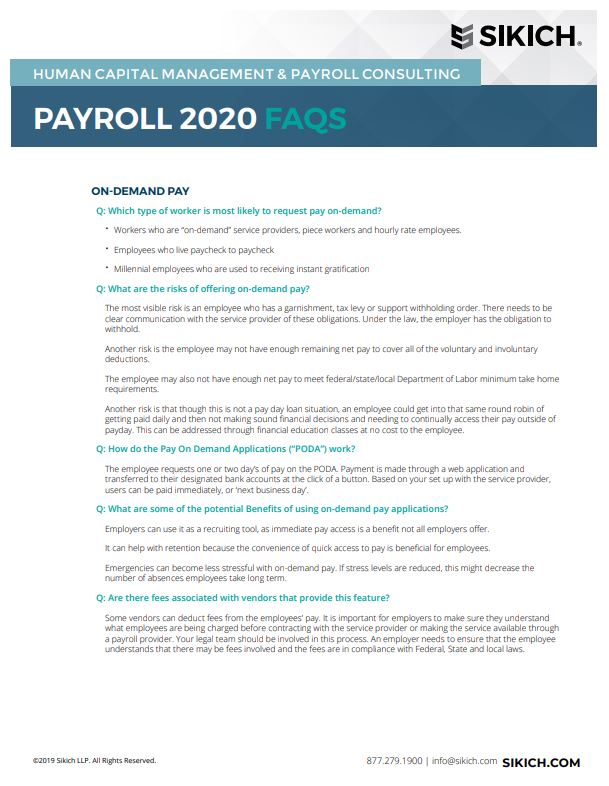

Michelle Vass and Kristine Willson discuss payroll changes coming in 2020 such as what to be aware of with On Demand Pay, advantages of same-day ACH, critical steps in creating an M&A playbook, and how to successfully setup a project plan for your next merger or acquisition. Download our PDF to get the answer to your payroll FAQs.

Payroll Year-end

Our expert, Neil Koplitz, shared important factors to consider when preparing for year-end, such as the new W4 and its effects on both employees and employers, the new year-end and calendar year process for exempt employees and all things W2-related, including how to effectively produce accurate W2s.

https://youtu.be/ateKVu7IxKI

What Employers Should Expect in 2020

Kicking off this webinar in the new year, our compliance expert, Jenny Andrews takes a look back at all state and federal law changes from 2019 and analyzes what employers’ responsibilities include. Take a look ahead to what employers should expect as we head into 2020.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.