Key takeaways:

- FY 2025 Review:

- Primary market loan issuance remained highly active at $1T but retreated from its 2024 peak, as loan repricings pushed spreads to a post-Global Financial Crisis (GFC) low.The leveraged loan market expanded to $1.55T, buoyed by significant net new money issuance, lower repayments and a modest M&A-related borrowing recovery.

- M&A-related issuance increased 9% year-over-year to $142B, driven by higher-rated corporate debt demand amid macroeconomic uncertainty.

- The 2026-2028 maturities wall is a record-high $344B, skewed to lower-rated borrowers, heightening refinancing risk.

- Q4 2025 Review:

- Market conditions sharply weakened in Q4, with secondary prices softening and lenders imposing tighter terms, causing syndicated loan activity to drop 61% from Q3 to $156B.

- M&A and leveraged buyout (LBO) issuance slowed to a multi-quarter low, reflecting higher risk aversion and stricter underwriting, while some deals moved to private credit.

- Collateralized loan obligation (CLO) issuance remained a stabilizer, offsetting broader seasonal slowing.

- 2026 Outlook:

- Leveraged credit market fundamentals will improve.

- Refinancing pressures will intensify.

- Credit dispersion will persist.

Full-year 2025 review

Primary market activity

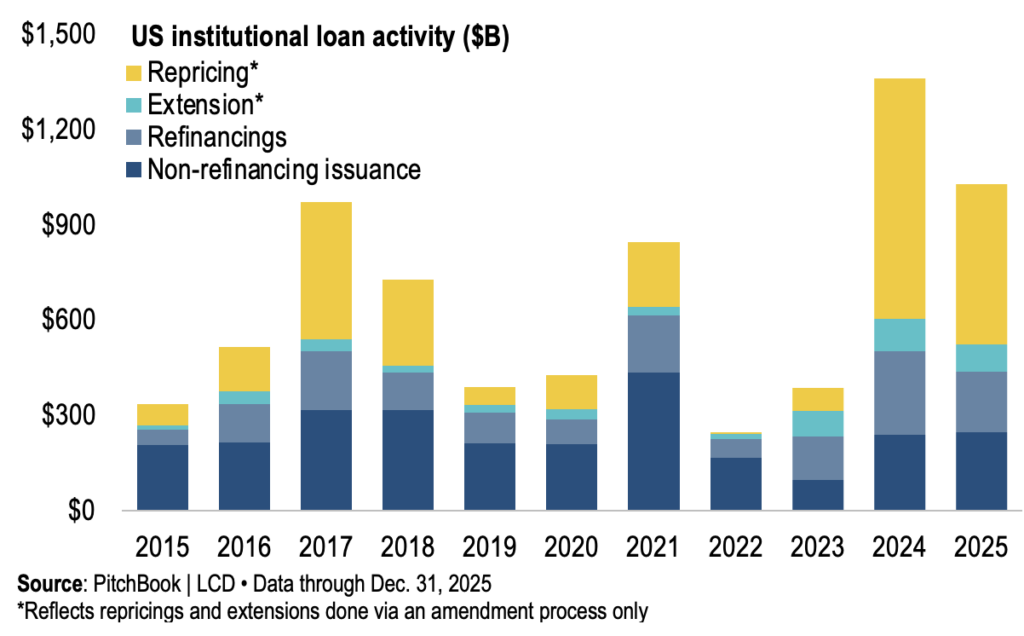

Primary broadly syndicated loan (BSL) issuance declined 24.5% year-over-year to $1 trillion in 2025, still the second-highest year on record. Opportunistic transactions, including repricings, refinancings and dividend recapitalizations, continued to drive supply.

Borrowers repriced approximately $504 billion of term loans, the second-largest annual total on record. Nearly $1.3 trillion of loans were repriced from 2024 through 2025, approaching the size of the entire institutional loan market outstanding at year-end 2023. This activity pushed the weighted average nominal spread down by 50 basis points to S+319, the lowest level since the GFC.

New issue volume excluding repricings and extensions totaled $439 billion, down 13% year-over-year but still above the ten-year average. Refinancing activity slowed from 2024’s surge, yet remained historically elevated at $192 billion. Dividend recapitalizations reached $43.6 billion, the highest annual total since the GFC.

Asset class growth

Despite ongoing macroeconomic uncertainty and elevated base rates, the leveraged loan market grew 9.2% to a record $1.55 trillion, the third-strongest annual expansion of the past decade. Growth was supported by a four-year high in net new money issuance, a sharp year-over-year repayments drop to $296 billion from $390 billion, and a modest M&A-related borrowing recovery.

M&A and LBO activity

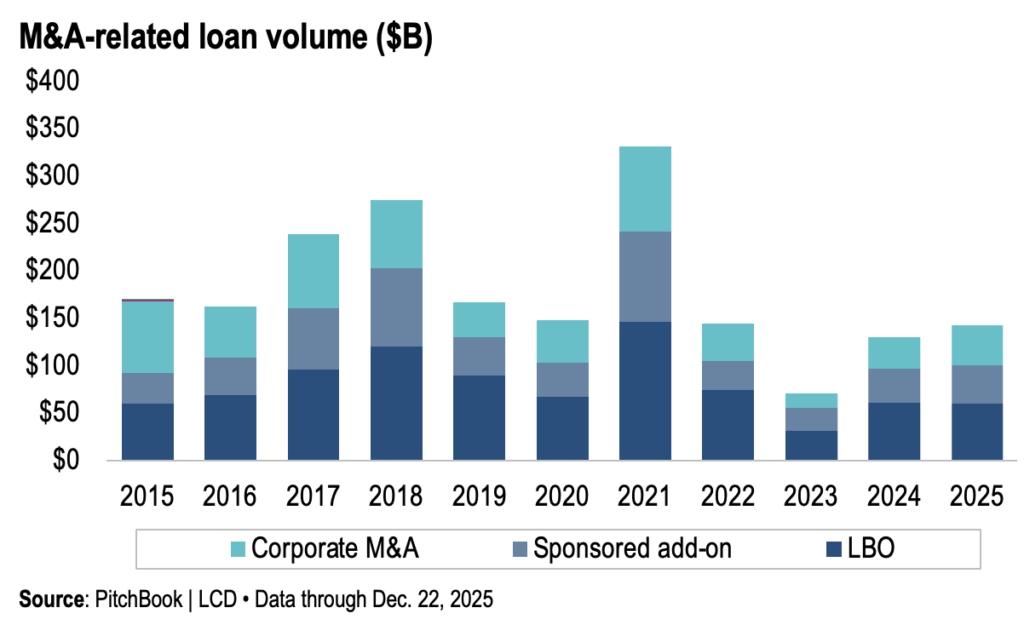

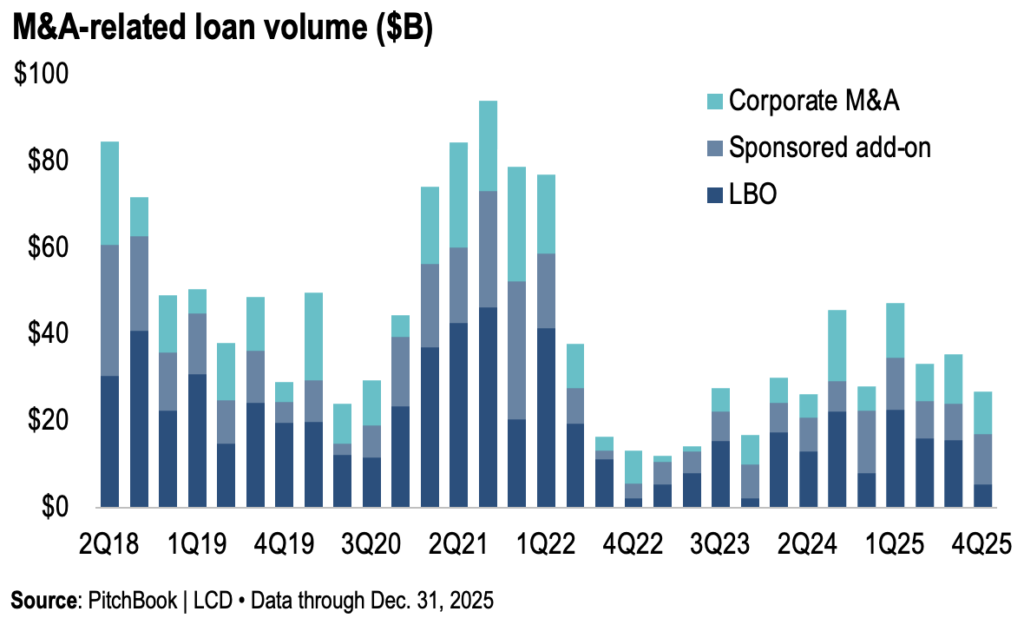

M&A-related issuance increased 9% year-over-year to $142 billion, nearing 2022 levels. The recovery was led by higher-rated corporate borrowers, while leveraged buyout activity remained subdued. Buyout financing totaled $59.4 billion, about 30% below the ten-year average. Corporate M&A borrowing rose 28% year-over-year to $42.5 billion, while add-on acquisition financing increased 12% to $40.5 billion. Large-scale transactions also returned, with 46 deals exceeding $1 billion, up from 36 in 2024.

Credit quality and market composition

Issuance favored stronger credits in 2025. Borrowers rated BB- or higher made up 27% of M&A and LBO volume, the highest share in a decade. In contrast, only 25% of issuance was B-, the lowest share since 2017. This shift reflects lenders’ preference for higher-quality credits amid ongoing macroeconomic uncertainty.

Maturity wall and refinancing risk

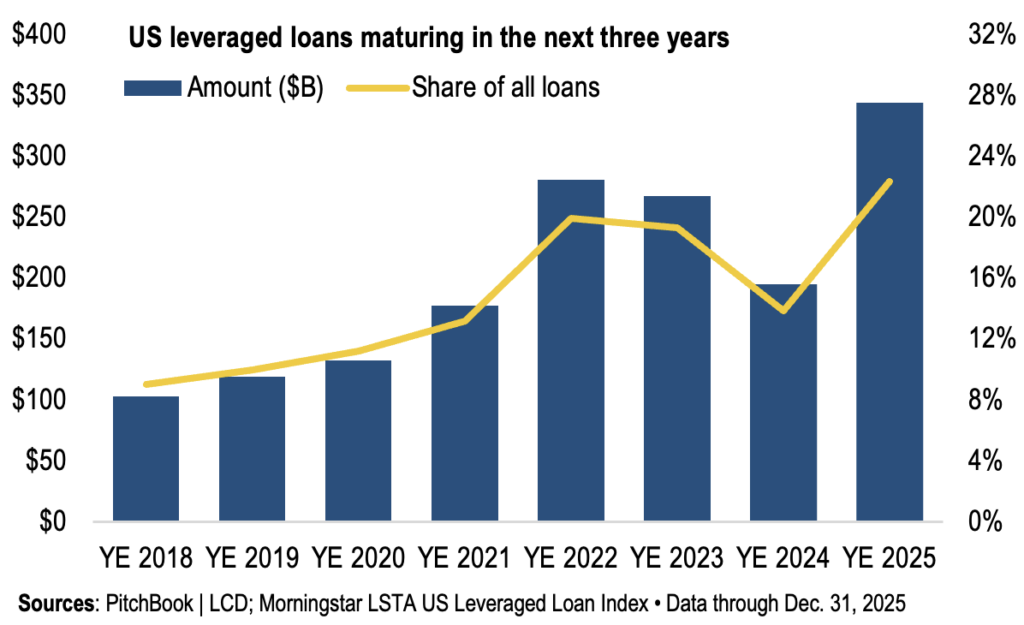

Borrowers meaningfully reduced near-term maturities in 2025. 2027 maturities dropped 63% year-over-year to $50.4 billion, while 2028 maturities fell 35% but remained elevated at $288 billion. Still, the combined 2026-2028 maturity wall totals $344 billion, the largest three-year concentration in LSTA history. About 52% of these maturities are rated B- or lower, highlighting heightened refinancing risk. Private credit played an increasingly important role, refinancing roughly $37 billion of institutional loans, mainly for lower-rated issuers.

CLO market

CLO issuance hit a record $208.8 billion in 2025, surpassing the prior year’s high. Q4 volume totaled $55.3 billion, supported by strong October and November activity and resilient investor demand despite isolated credit events.

Q4 2025: market conditions deteriorated

Market conditions sharply weakened in Q4 as secondary prices softened and lenders demanded more conservative terms. Total syndicated loan activity fell to $156 billion, down 61% from Q3’s record $404 billion. Total repricings fell 73% quarter-over-quarter, refinancing activity declined 69%, and new-issue volume excluding amendments dropped to a two-year low of $70.7 billion. Several deals were postponed or redirected to private credit as BSL market technicals deteriorated.

M&A and LBO slowdown

Q4 was the year’s weakest quarter for M&A-related issuance. M&A volume declined to $26.7 billion, the lowest level since Q2 2024. LBO issuance fell to $5.4 billion, the lowest since Q4 2023. This slowdown reflected heightened risk aversion and tighter underwriting standards.

Private credit: large transactions, lower volume

Direct lending volumes declined despite several high-profile deals, including the $55 billion LBO of Electronic Arts. Q4 activity totaled $56.1 billion across 187 transactions, the lowest quarterly volume in two years. For the full year, buyout financing hit a record $81.4 billion, although overall deal count decreased.

CLO market remains resilient

CLO issuance remained a stabilizing force, with strong October and November activity offsetting the typical December seasonal slowdown.

2026 market outlook

The leveraged credit market enters 2026 on firmer footing, supported by easing financial conditions, a growing M&A pipeline and improving technicals. Yet, the sizable maturity wall is the year’s defining challenge.

M&A and LBO activity should reaccelerate as borrowing costs fall and market stability improves. Corporate acquirers and private equity sponsors are poised to drive more new-money issuance.

The technical backdrop should normalize as the repricing wave of 2024- 2025 fades, reducing market friction. Continued CLO demand is expected to support liquidity.

Refinancing pressures will intensify as the $344 billion maturity wall drives issuer behavior. Higher-rated borrowers are likely to refinance proactively, while lower-rated credits face tighter underwriting standards and elevated refinancing risk.

Credit dispersion is expected to widen. BB and B+ issuers should benefit from improved market access, while B- and CCC borrowers face heightened downgrade and default risk. Private credit will remain a critical outlet for borrowers unable to access the BSL market and continue to play a central role in LBO financing, particularly for larger club transactions.

Bottom line

2026 is shaping up to be a transition year. Improving financing conditions and stronger M&A activity should support healthier new-money formation, but refinancing risk and credit bifurcation will remain key themes for market participants.

Our Q3 2025 credit market update can be found here.

About our authors

Mike Rudolph is a Managing Director at Sikich Corporate Finance. He has nearly 25 years of experience orchestrating senior debt (cash flow and asset-based), junior capital, and equity financings for leveraged buyouts, recapitalizations, private placements, and balance sheet restructurings.

Doug Christensen is a Director at Sikich Corporate Finance. He provides capital structure advisory and capital raising support for private clients, with expertise across senior debt, junior capital and equity financing.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.