Summary

At midyear 2025, M&A activity remains underwhelming. Tariffs and policy uncertainty continue to weigh on dealmaking. After a sluggish April, loan market sentiment gradually improved in May and June, fueled by recovering secondary prices. New-issue spreads tightened to multiyear lows and opportunistic issuance resumed.

Key Takeaways:

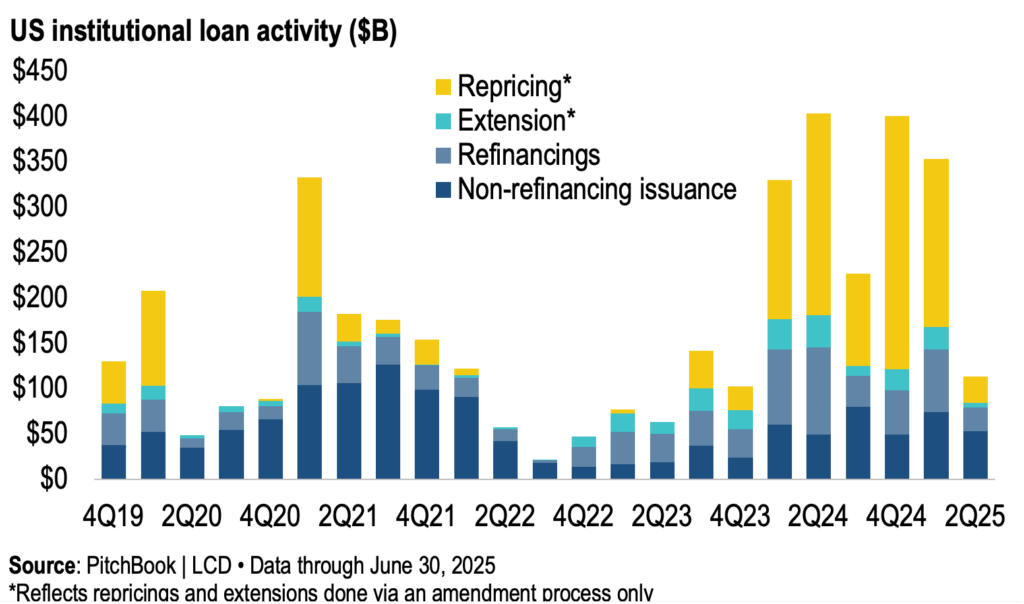

- Q2 loan issuance dropped significantly compared to December 2024 and January 2025, despite strong activity in June.

- Year-to-date institutional loan issuance (excluding repricings and extensions) is down 23% from last year.

- Repricing activity accelerated as the market rallied, with Q2 repricings reflecting stronger overall credit quality than those in Q1.

- Private equity buyout activity remains depressed.

- Spreads widened in early-Q2 before narrowing as secondary prices recovered. They now hover near decade-long lows.

Market Sentiment Rebounds After April Slump

Global private equity deal volume and related loan issuance plunged following the April 2 “Liberation Day” announcement. For 15 consecutive business days through April 21, no broadly syndicated loan transaction launched in the U.S. — the longest dry spell since early-2020.

Market conditions improved in May, driven by a rebound in secondary prices. Total institutional issuance jumped to $32.4 billion, up from $7.5 billion in April. Momentum accelerated in June, with $73.5 billion recorded – a four-month high. Still, Q2 activity remains far below December-2024 and January-2025 levels, when monthly volumes consistently topped $100 billion, according to Pitchbook LCD.

Shift Toward Opportunistic Activity

Q2 institutional loan volume, including repricings and extensions, was $113 billion, the lowest recent reading since Q4 2023. That’s down sharply from $354 billion in Q1 and a record $404 billion in Q2 2024.

Issuance fell across all categories, with opportunistic deals hit hardest amid fading investor risk appetite. Repricings totaled $28.5 billion, the lowest since Q4 2023 and down 85% from Q1. Refinancings fell 62%, to $26.4 billion. In contrast, issuance not tied to refinancings, repricings or extensions fell a more moderate 28%, to $53.3 billion.

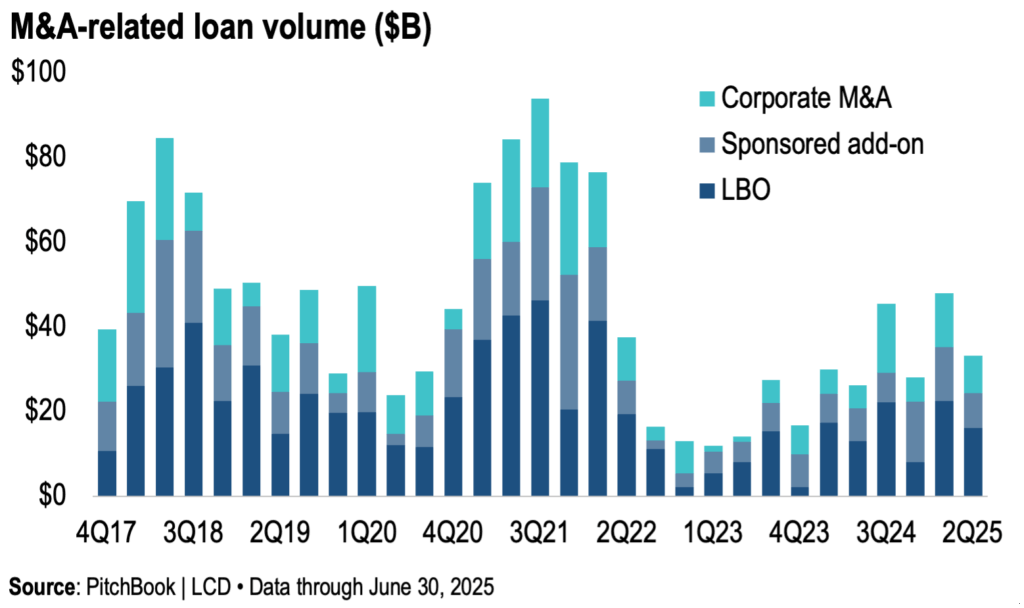

Excluding repricings and extensions, institutional new-issue loan volume fell to $79.7 billion in Q2 – the lowest quarterly total since Q4 2023. LBO and other M&A-related borrowing declined 25% quarter-over-quarter, proving more resilient than activity tied to refinancings and dividend recapitalizations (-62% and -52%, respectively).

Despite the quarterly slowdown, M&A-driven issuance is up by $25 billion year-over-year.

M&A and Private Equity Trends: Sustained Rebound Still Elusive

Sponsor-backed and corporate transactions both similarly declined in Q2, weighed down by heightened market volatility and ongoing macroeconomic uncertainty.

Although Q2 M&A volume declined 31% to $33.1 billion from $47.8 billion in Q1, H1 is up 44% year-over-year due to a strong Q1.

PE Exits Fall by 25% in Q2 as Deal Flow Stalls

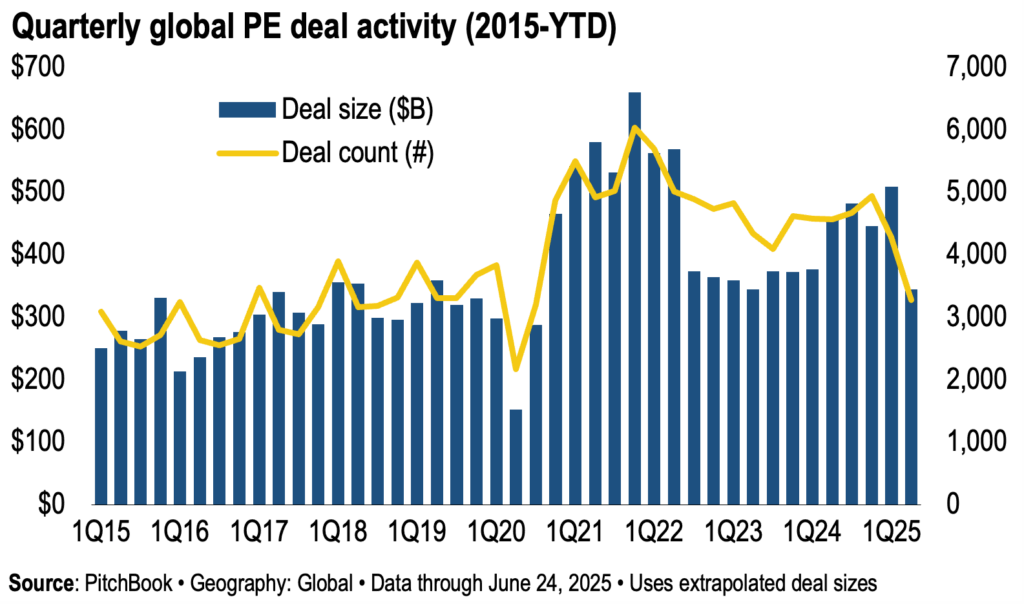

The expected resurgence of private-market deal activity didn’t arrive in Q2, according to PitchBook’s Global PE First Look and corroborated by private credit providers. The number of private equity exits declined 25% quarter-over-quarter in Q2 – the third straight quarter of declines – as sponsors opted to hold off on sales. Uncertainty over U.S. regulatory policy and tariffs has caused market volatility and paused dealmaking activity.

H2 2025 Credit Market Outlook

- Loan issuance recovery will be uneven.

- Expect a modest rebound in syndicated loan issuance, especially in Q4, as policy clarity improves.

- M&A-driven issuance may strengthen, though opportunistic activity will likely remain muted unless spreads tighten further.

- Key risk: Prolonged policy uncertainty or an escalation in trade tensions could stall recovery.

- Private equity will stay cautiously opportunistic.

- Deployment will remain disciplined, focusing on bolt-on acquisitions, structured equity and distressed opportunities.

- Fundraising will become more competitive, favoring managers with strong track records and sector specialization.

- Key risk: Valuation mismatches and limited exit opportunities may constrain capital recycling and reduce flexibility.

- Private credit will continue to gain share.

- Direct lenders will remain active, especially in upper-middle market- and bespoke-financings.

- Club deals and unitranche structures will stay popular among sponsors seeking execution certainty.

- Key risk: Asset quality deterioration and aggressive covenant structures could lead to higher default rates during economic stress.

- Regulatory and policy signals will be pivotal.

- Tax reform, trade policy and regulatory clarity will be key factors for deal activity and credit sentiment.

- Key risk: Sudden or unclear policy shifts could dampen investor confidence and disrupt transaction pipelines.

About our Authors

Mike Rudolph is a Managing Director at Sikich Corporate Finance. He has nearly 25 years of experience orchestrating senior debt (cash flow and asset based), junior capital and equity financings for leverage buyouts, recapitalizations, private placements and balance sheet restructurings.

Doug Christensen is a Director at Sikich Corporate Finance and provides capital advisory services to his private clients. He provides value through capital structure advisory and capital raises of senior debt (cash flow and asset based), junior capital and equity financings.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.