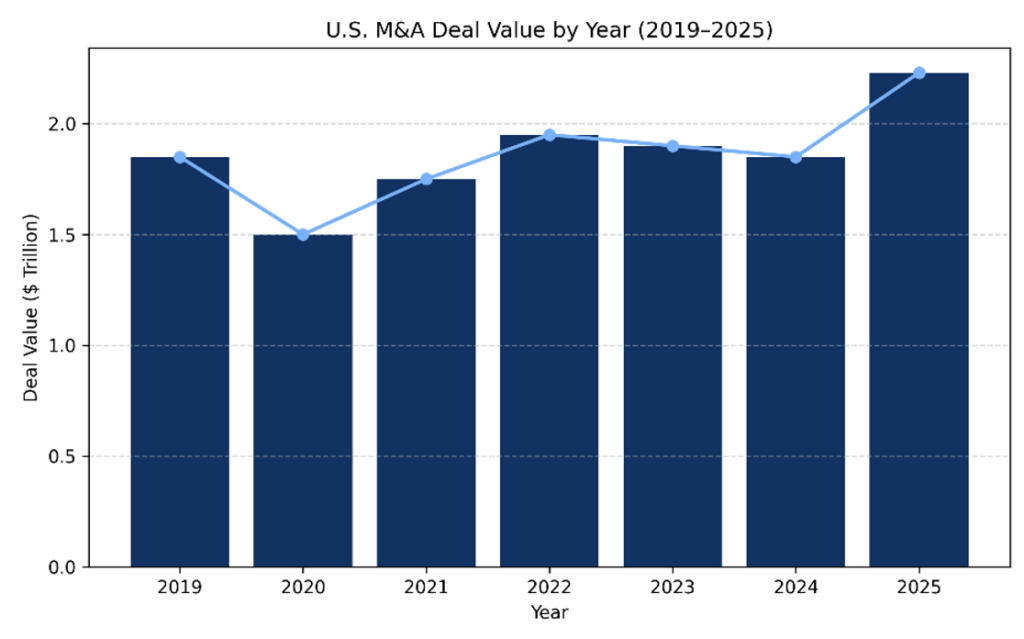

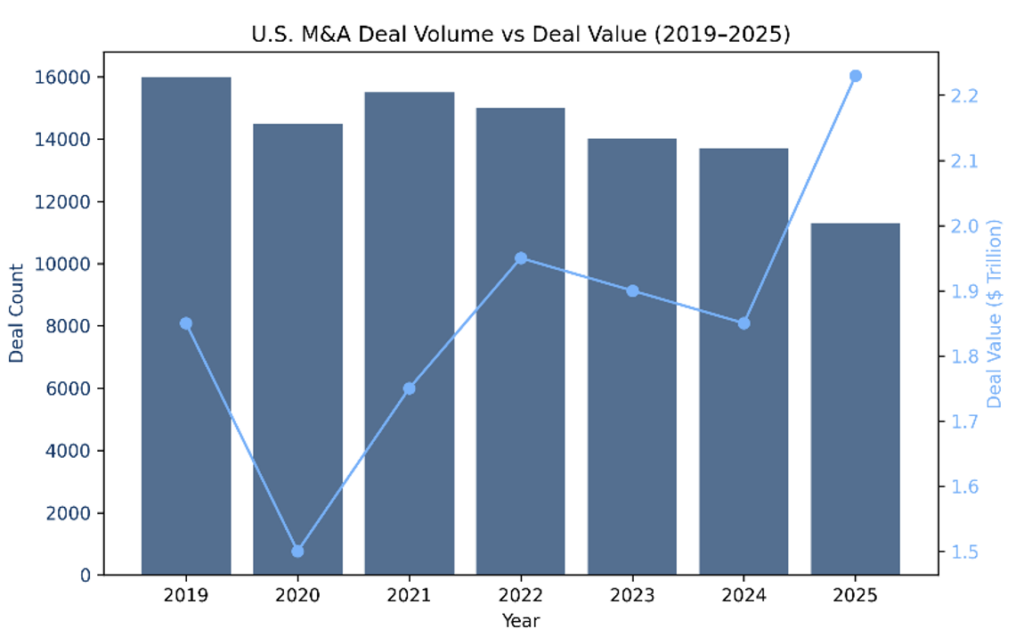

2025 was a landmark year for U.S. M&A. Total deal value reached approximately $2.23 trillion, one of the strongest performances in recent history. While overall deal volume was modestly lower than in previous years, the focus shifted to strategically significant, high-value transactions – particularly in technology, healthcare, and consumer sectors. Looking ahead, 2026 is expected to continue this trajectory, with growth driven by mega-deals, AI-related acquisitions, and strategic private equity (PE) investments.

2025 U.S. M&A recap

Despite a slight year-over-year decline in deal count, total U.S. M&A value increased from approximately $1.85 trillion in 2024 to $2.23 trillion in 2025, underscoring a continued concentration of capital in larger, high-value transactions. This divergence between deal volume and aggregate value highlights ongoing selectivity and strategic deployment of capital into scaled, resilient assets.

Sector highlights

- Technology and life sciences sectors: These sectors led the market with transformative deals, particularly in the AI, cloud solutions, and healthcare innovation themes.

- Consumer and retail sector: There was strong consolidation activity, especially among large strategic acquirers seeking scale and market differentiation.

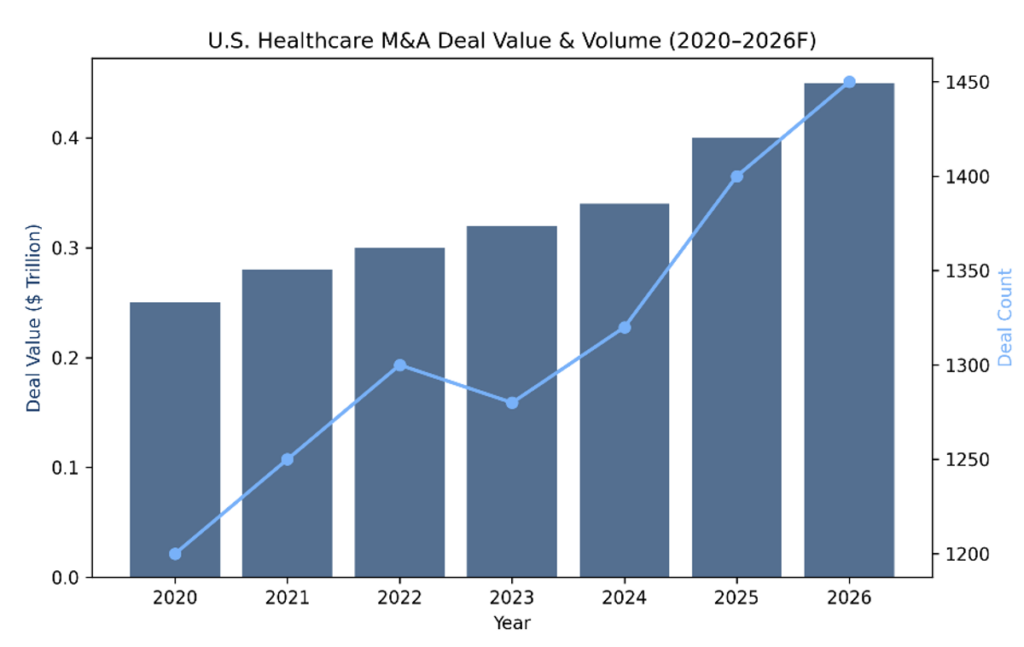

2025 healthcare sector recap

There was a significant volume of healthcare sector M&A in 2025, driven by consolidation among hospitals, health systems, outpatient services, and technology-enabled care providers. PE firms pursued acquisitions to expand service lines and improve operational efficiency, resulting in robust aggregate transaction value across the sector. The most active sub-sectors were biopharmaceuticals, medical devices, healthcare IT, and telehealth. Market-wide dynamics that influenced deals included regulatory pressures, reimbursement changes, and demand for value-based care models.

PE and corporate activity

- PE sponsors deployed capital selectively, focusing on deals that offered strong operational upside.

- Corporate buyers pursued acquisitions to expand capabilities, enter new markets, and accelerate digital transformation.

Market dynamics

- Mega-deals drove deal value. A small number of very large transactions accounted for a significant portion of total value.

- Policy and macro factors influenced activity. Market participants navigated regulatory and economic uncertainty while capitalizing on liquidity and favorable financing conditions.

2026 U.S. M&A outlook

Macro tailwinds and market momentum

Despite ongoing uncertainty, the U.S. M&A market enters 2026 with strong underlying momentum. Strategic acquisitions, PE capital deployment, and sector-specific growth continue to support deal activity, even as buyers and sellers navigate a more complex risk environment.

The role of PE dry powder

PE firms’ substantial amount of undeployed capital is a significant catalyst for U.S. M&A activity in 2026. This creates strong momentum for dealmaking across sectors.

- Record levels of dry powder: U.S.-focused PE funds are estimated to hold well over $1 trillion in available capital, increasing pressure to deploy capital efficiently.

- Aging fund vintages: Many funds are approaching the later stages of their investment periods, incentivizing sponsors to accelerate deal activity.

- Competitive processes: Abundant capital is expected to drive competitive auctions, particularly for high-quality middle-market assets.

- Focus on value creation: PE buyers will prioritize targets where operational improvements, technology enablement, and add-on acquisitions can drive returns.

Implications for the market

Deal volume is expected to increase as sponsors aggressively re-enter the market. Valuations may stabilize or increase for attractive assets, especially in resilient sectors such as healthcare, technology, and business services. Speed, diligence quality, and certainty of close will become key differentiators in competitive transactions.

Tariffs and geopolitical risk

Tariffs and evolving U.S. trade policy are expected to play an increasingly important role in shaping M&A strategy in 2026. Leading advisory firms consistently highlight trade policy uncertainty as a key factor influencing corporate strategy and transaction timing.

- Supply chain realignment: Companies are accelerating nearshoring and onshoring strategies, driving acquisitions of domestic manufacturers, distributors, and logistics providers.

- Margin pressure and portfolio optimization: Tariffs can increase input costs and compress margins, prompting divestitures, carve-outs, and restructuring transactions that create acquisition opportunities.

- Sector-specific exposure: Industrials, manufacturing, automotive, and consumer products face the greatest tariff sensitivity, while healthcare, software, and technology-enabled services remain relatively insulated.

- Deal structuring considerations: Buyers are placing greater emphasis on purchase price mechanisms, working capital protections, and earn-outs to manage tariff-related volatility.

Market implications

- There may be increased deal activity tied to restructuring, supply chain diversification, and domestic capacity expansion.

- There is a heightened diligence focus on cost structure, supplier concentration, and tariff exposure.

- Buyers and sellers who proactively quantify and mitigate trade-related risks have an advantage.

Supply chain, inflation and EBITDA impacts

Persistent inflation and ongoing supply chain disruption have affected EBITDA margins, creating a heightened focus for PE investors.

- EBITDA margin compression: Rising labor, logistics, and input costs have compressed EBITDA across the U.S. middle market.

- Normalization and add-backs: PE buyers are scrutinizing which costs are temporary versus sustainable, affecting valuation and deal structuring.

- Supply chain realignment: Reshoring and vertical integration are driving acquisitions to secure inputs and improve operational control.

- Sector EBITDA resilience: Healthcare generally shows stronger margin stability than industrials or consumer sectors, influencing sector preference among buyers.

- PE implications: Greater emphasis on normalized EBITDA, cost structure sustainability, working capital efficiency, and operational resilience.

Forecasted trends

- Deal volume should grow modestly as confidence and clarity in the market support strategic decision-making.

- Deal value should rise at a faster pace than volume, fueled by high-value and transformative transactions.

Sector outlook

- Technology & AI integration continues to drive high-value transactions, with companies acquiring capabilities to strengthen competitive positioning.

- The healthcare sector should remain a key M&A environment, fueled by digital health adoption, ongoing provider consolidation, and strategic cross-sector partnerships.

- Consumer and financial services are active M&A sectors due to scale, portfolio expansion, and digital transformation initiatives.

Strategic drivers for 2026

- Technology and AI integration : These themes will drive transformative acquisitions.

- PE deployment: Sponsors will deploy capital strategically, especially in healthcare and technology.

- Sector momentum: Healthcare, financial services, and consumer sectors are expected to maintain strong activity.

- Tariffs and trade policy: These accelerate supply chain-driven transactions and portfolio realignment.

- Geopolitical risk management: This will influence deal timing, valuation, and diligence depth.

Implications

- Value outpaces volume: Companies will prioritize impactful transactions that unlock strategic and operational value.

- Risk-adjusted decision-making: Tariff exposure, inflation, supply chain issues, and geopolitical considerations will be central to valuation, deal structure, and timing decisions.

- Due diligence is critical: Successful deals will rely on thorough financial, operational, tax, and technical diligence to mitigate macro, trade, and geopolitical risks, and support confident decision-making.

Partner with Sikich Transaction Advisory Services to accelerate deal execution, gain clarity and confidence with buyers or investors, identify and mitigate risk early, and improve negotiation outcomes. Connect with our team to explore how Sikich can help you navigate your next U.S. M&A opportunity with confidence and insight.

Sources: Axios, Statista

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.