Reduce accruals by using the payment hold field instead of approval status field in NetSuite!

With NetSuite’s SuiteFlow (workflow) tool, companies can implement custom approval workflows to help automate accounts payable approvals. Typically, companies leverage the Approval Status field on Vendor Bills to track the status of approvals. When a Vendor Bill has a status of Pending Approval or Rejected, it does not have a G/L Impact. It is not until the Vendor Bill is approved that it appears on the G/L. As a result, before the books can be closed at month’s end, a company must accrue for all unapproved Vendor Bills.

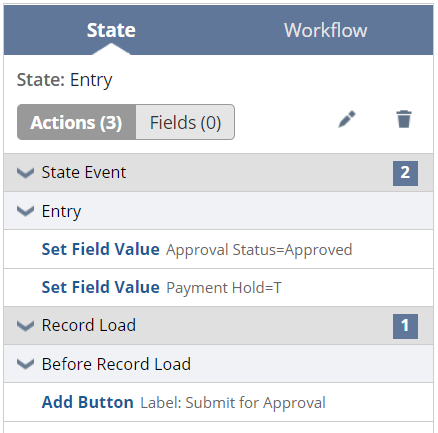

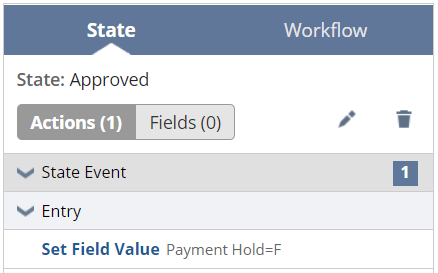

Accruals related to unapproved Vendor Bills can be avoided by leveraging the Payment Hold field instead of the Approval Status. Using SuiteFlow, the Approval Status can be set to Approved on entry of the Vendor Bill and the Payment Hold field can be checked Yes. The Vendor Bill immediately appears on the G/L; however it cannot be paid until the Payment Hold is unchecked.

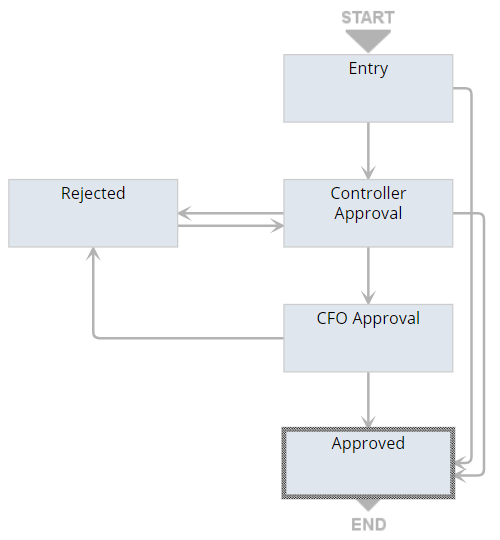

Below is a sample workflow and the actions that can be configured in the Entry and Approved states.

If your company chooses to use the Payment Hold field instead of the Approval Status, below are two points to take into consideration:

- Approval of Vendor Bill in Locked/Closed Periods – to uncheck the Payment Hold field when the Bill is in a Locked/Closed period, you must use the Allow Non-G/L Change functionality.

- Payment Hold field display type – within the workflow, you should consider changing the display type to disabled up until the Vendor Bill is approved.

Vendor Bill Approvals is just one of the great things you can do in NetSuite, so be sure to check out our blog for more! If you would like more information about NetSuite, please contact us at any time! You can also learn about more great tips for NetSuite on our YouTube playlist or our other blog posts.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.