Key takeaways:

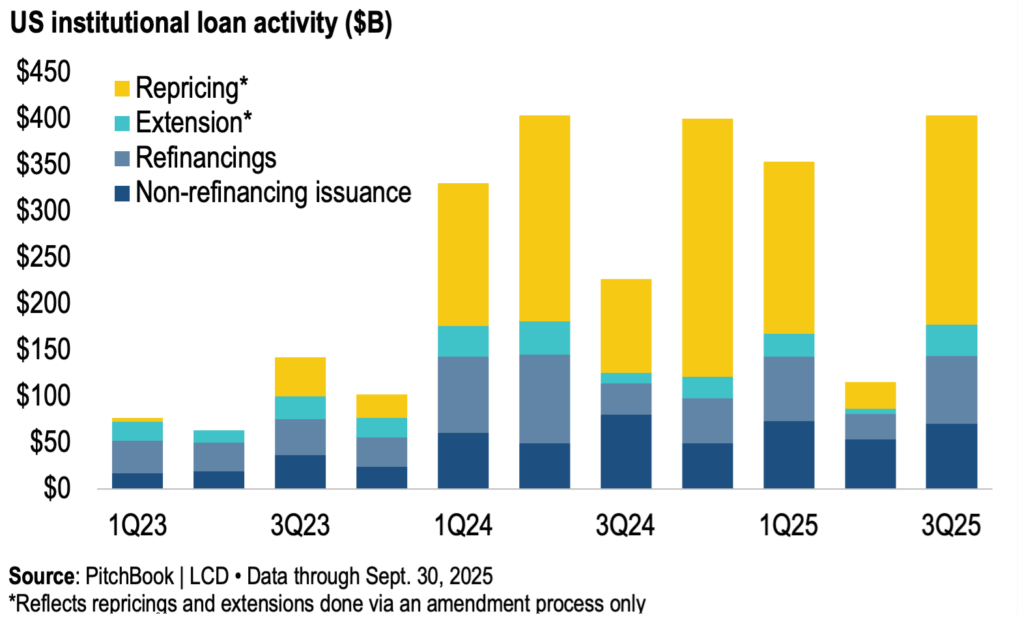

- Record issuance: $404.2B in Q3 primary market volume, an all-time high.

- Opportunism over expansion: 82% of issuance was refinancings or repricings; only 18% funded new deals. YTD repricings have reduced average spreads by 50 bps, saving issuers $2.3 billion annually.

- Middle market momentum: B- rated borrowers accounted for 43% of all refinancing activity as they proactively address 2028 maturities.

- Sponsor distributions surge: Private equity sponsors extracted $35B in dividends, the most in at least seven years.

- Spread compression: New B-minus loan spreads tightened to S+366, the lowest since the financial crisis.

Market rebounds sharply, driven by opportunistic activity

After a sluggish first half of 2025, the U.S. leveraged loan market roared back in Q3. Primary issuance surged to $404.2 billion, the highest quarterly total on record. But beneath the surface, the rebound was fueled less by new-money deals and more by opportunistic refinancings, repricings and dividend recapitalizations.

Investors, flush with cash and starved for supply, kept demand high, pushing spreads to new post-crisis lows and tilting market dynamics decisively in the borrowers’ favor.

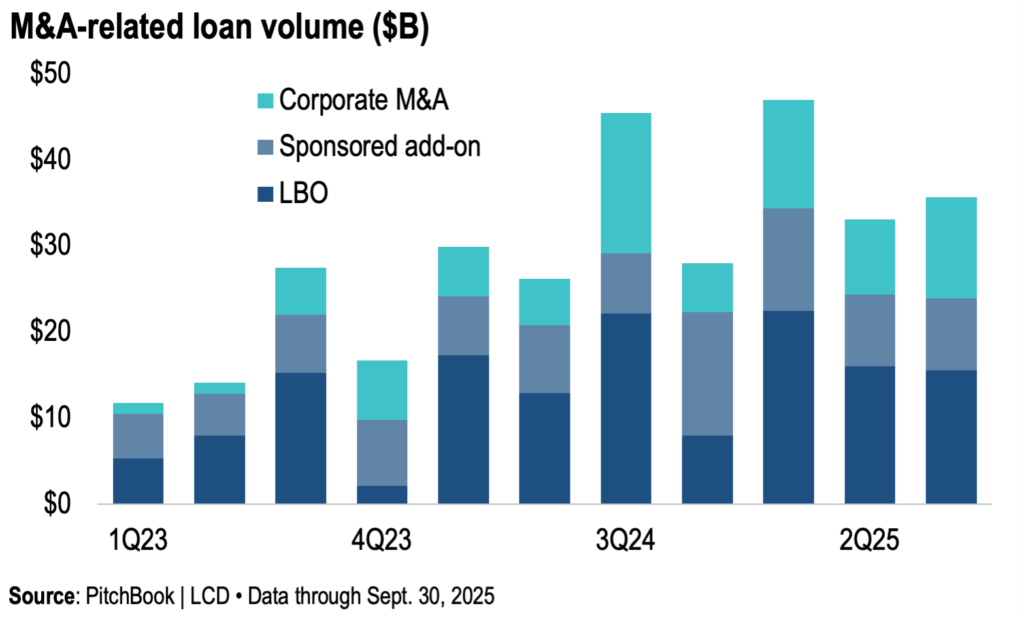

M&A activity: sponsors pull back as corporates step In

Dealmaking continued to feel the ripple effects of tariff-related uncertainty in Q3. Sponsor-backed issuance fell18% year-over-year, as private equity funds turned cautious and pivoted toward portfolio support.

In contrast, corporate M&A activity rose 34% from Q2, supported by strong balance sheets and pent-up strategic demand. Corporates are increasingly filling the gap left by subdued sponsor activity, using inexpensive debt to fund acquisitions and balance-sheet optimization.

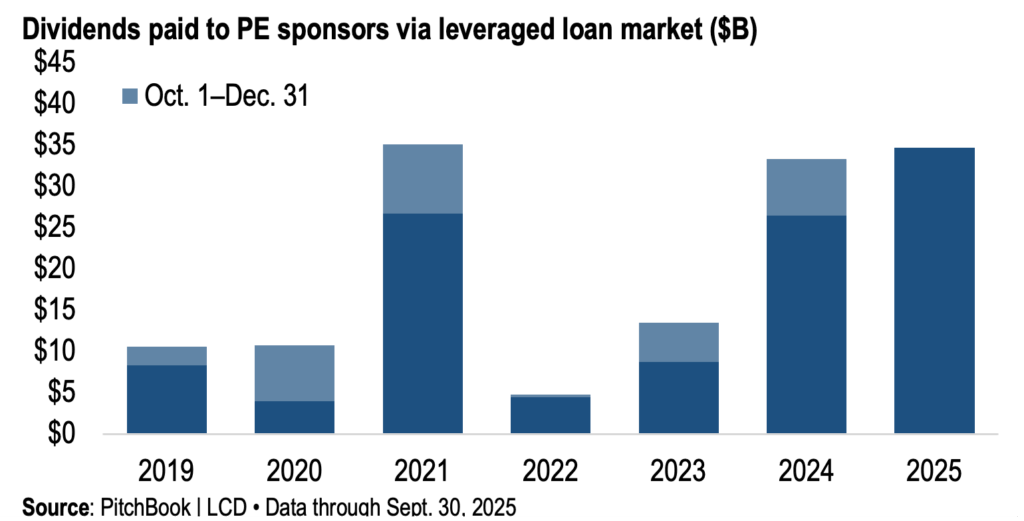

Dividend recaps provide liquidity for sponsors

Private equity sponsors leaned heavily on dividend recapitalizations to deliver returns to limited partners.

- Q3 recap volume: $29.1B—the second-highest quarterly total ever recorded.

- YTD dividends financed through loans: $34.7B, the most in at least seven years.

While these transactions provide liquidity, they also increase leverage and extend maturities, raising questions about future credit performance if growth slows.

Outlook:

The Q3 rebound highlights the market’s resilience, but fundamentals suggest opportunism—not organic growth—is driving activity. As spreads remain tight and liquidity ample, investors are well-positioned for an uptick in M&A-driven issuance once deal pipelines rebuild.

Themes to watch heading into Q4:

- Potential LBO activity revival: Sponsors may re-enter the market as valuations and leverage expectations normalize.

- Further spread tightening: Strong investor demand could push spreads even lower if issuance stays muted.

- Sector shift: Healthcare, software, and business services are expected to lead new-money issuance.

- CLO demand remains firm: CLO issuance continues to underpin loan demand and stabilize pricing.

- Refinancing wave: Borrowers are likely to continue extending maturities through early 2026.

- Macro watchpoints: Fed rate policy, tariff impacts and performance among lower-rated credits.

About our authors

Mike Rudolph is a Managing Director at Sikich Corporate Finance. He has nearly 25 years of experience orchestrating senior debt (cash flow and asset-based), junior capital, and equity financings for leveraged buyouts, recapitalizations, private placements, and balance sheet restructurings.

Doug Christensen is a Director at Sikich Corporate Finance. He provides capital structure advisory and capital raising support for private clients, with expertise across senior debt, junior capital and equity financings.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.