Are we headed into a recession? With negative returns in several asset classes and discussion of the Fed’s interest rate campaign putting further pressure on the stock market, some economists are calling for a recession. But what does that actually mean? A common definition of a recession is two consecutive quarters of declining Gross Domestic Product (GDP). More broadly, recessions are considered as significant declines in economic activity lasting more than a few months.

When it comes to the future of your portfolio, it might not matter if we are officially in a recession. Unlike GDP, the stock market is forward looking. We have already experienced a drop in prices as investors have incorporated new information about inflation, the Fed, Ukraine and beyond. Buyers and sellers are reflecting their expectations about future cash flows, including any impact of an economic downturn, into their trades.

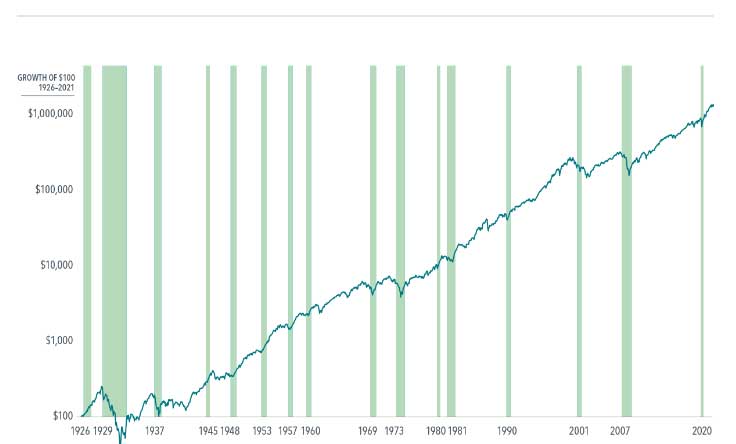

A century of economic cycles (See graphic here: Dimensional – Market Returns Through a Century of Recessions) teaches us that we may well be in one before economists make that call. But one of the best predictors of the economy is the stock market itself. Markets tend to fall in advance of recessions and start climbing earlier than the economy does. As the chart below shows, returns have often been positive while in a recession.

A recession is not a reason to sell. You can’t control what the Fed does or what happens to a sector’s profits. Rather, you can control how you react. The future is uncertain. Fortunately, lessons learned from the past should bring comfort to those who stick to their plan. To speak with our team of financial planners, please contact us.

Investment advisory services offered through Sikich Financial, an SEC Registered Investment Advisor. This is not a solicitation or recommendation to purchase or sell any investment product or service, and should not be relied upon as such.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.