Do you plan to include a gift to charity as part of your financial and estate plan? If so, make sure you’re leveraging a Qualified Charitable Distribution (QCD) – a tool that allows you to give from your IRA during your lifetime. It offers the opportunity to save on income taxes while making philanthropic contributions.

The Tax Cut and Jobs Act (2017) made significant changes to the tax code, including nearly doubling the standard deduction for married couples over the age of 65 to $30,700 in 2023. This higher standard deduction decreased the tax advantages of some charitable donations that were traditionally given with after-tax dollars. To combat this, below we explore how to reduce your taxes and still donate to charity through a QCD.

Qualified Charitable Distributions

Under the SECURE Act 2.0, those born in or after 1951 do not need to begin taking Required Minimum Distributions (RMDs) from traditional IRAs until age 73. Prior to the Act, individuals had to start taking the RMD at age 72.

Note that IRA distributions are taxable to an individual when paid to an individual.

For tax planning purposes, if you have some of your charitable donations made directly from your IRA, rather than directly from other funds, this action could result in tax savings in 2023. With a QCD, you authorize your IRA custodian to make a distribution directly to a charity you select, rather than to you. This is an important distinction for the distribution. The QCD must go directly to the charity to qualify. Further, the QCD is treated as part of your RMD for the year.

While the SECURE Act and SECURE Act 2.0 changed the age to begin taking an RMD, the Acts did not change the age that you could begin using a QCD. The QCD is available to those over the age of 70 ½.

Tax Treatment of a QCD: You do not include the amount of the QCD paid to charity in your income. Further, you are not entitled to a charitable tax deduction for the QCD amount. You will receive a year-end Form 1099-R for the total IRA distributions, including QCD amounts. However, the taxable IRA amount on a return will not include the QCD amounts. Individuals are limited to $100,000 of QCDs in a year.

One other possible non-tax benefit with a QCD relates to individuals on Medicare. If you have a high income, the law requires an adjustment to your monthly premiums for Medicare Part B (medical insurance) and Medicare prescription drug coverage. Higher income beneficiaries pay higher premiums for Part B and prescription drug coverage.

This affects less than 5% of individuals with Medicare, so most people do not pay a higher premium. If your adjusted gross income (AGI) is above $194,000 for 2023 using the married filing jointly status, your Medicare premiums are increased (the tier for 2024 is not yet set but is expected to be approximately $205,000).

Depending on your situation, and since the amount of a QCD is not included in your AGI, using a QCD might keep your Medicare premiums from being increased. Click here to view the Social Security website’s explanation of this adjustment (please note these thresholds and premiums are adjusted each year).

Using this QCD approach, you direct your IRA custodian to send a check to your favorite not-for-profit as either a one-time donation or a monthly payment, depending on your preference. Some IRA custodians now provide their clients with an IRA checkbook, rather than having to contact the custodian each time.

At the end of the year, you will receive a Form 1099-R for the full amount of your IRA distributions. You will need to let your accountant know what QCD amounts you made from your IRA, as your tax return will reflect the gross amount received (QCDs are subtracted to arrive at the net taxable amount). You will also need a charitable acknowledgement of the QCD amount from the charity.

One important caveat is the charity cannot provide you with any goods or services in exchange for the QCD. This includes state tax credits. If making a charitable contribution that provides you with a state tax credit, such contribution should be made from your after-tax funds, not an IRA.

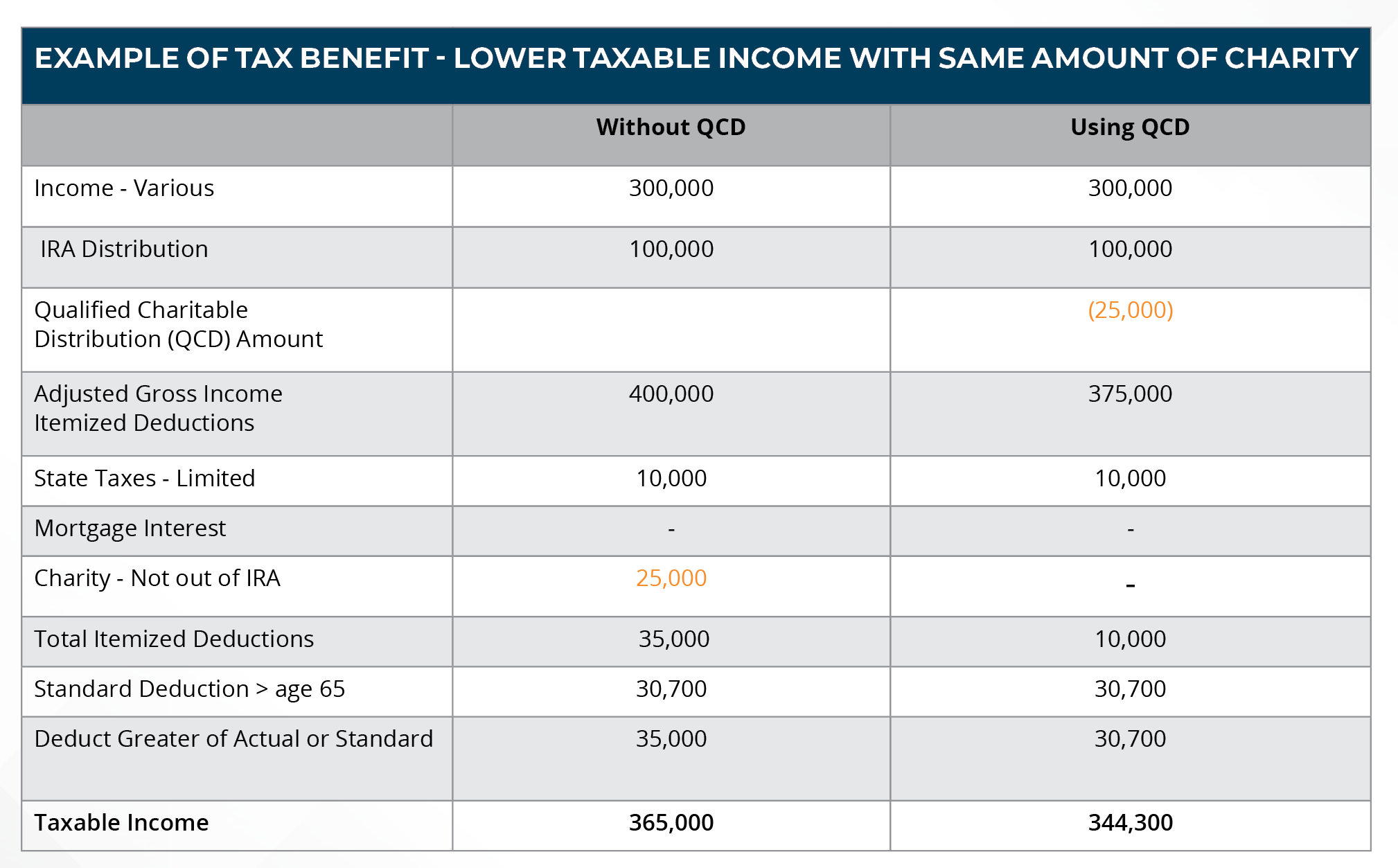

Here is an example of the tax savings when using a portion of your RMD as a QCD from your IRA:

A taxpayer has an RMD of $100,000 for the year and plans to make $25,000 in charitable contributions. Using the QCD strategy would benefit such an individual.

As you can see in our example, the same $25,000 amount was given to charity, but the overall taxable income is decreased by $20,700 when using the QCD alternative. This generates lower federal and state taxes. If your marginal tax rate is about 32%, you would save approximately $6,624 in this example (or, $320 for every $1,000 given to charity through a QCD).

The SECURE Act 2.0 has also authorized a one-time $50,000 QCD to a charitable remainder trust (CRT) or a charitable gift annuity (CGA). These gifts allow an individual to receive income in exchange for their QCD. There is no charitable income tax deduction for a CRT or CGA gift from an IRA account since it uses pre-tax dollars to fund the annuity and charity during your lifetime. The use of a CRT or CGA will count toward the RMD, and annual income received from the CRT or CGA will be taxed as ordinary income in the year received. Additional rules apply, so please consult your tax advisor and charity to further explore this opportunity.

Key Takeaways

This tax strategy is powerful and allows those over the age of 73 to continue giving to charity and reduce their overall tax implication. This may even allow you to leverage larger charitable contributions while staying within your budget.

Please consult your personal tax and financial advisors to discuss the QCD and your options.

About our Authors

Wesley Whamond

With over 20 years of experience in the financial services industry, Wesley Whamond, MBA, CFP®, CPFA®, is a financial advisor on Sikich’s wealth management team. Wes has a passion for partnering with clients to navigate the financial world. In his role, he takes an encompassing, goals-based approach to tailor solutions to the needs of his clients. Wes has in-depth expertise in financial planning, investments, financial education and portfolio reviews. He works with clients from all backgrounds, guiding them along their financial journey.

David Sauerburger

David P. Sauerburger, CPA, is a partner with nearly 30 years of tax consulting and leadership experience. David has expertise in tax planning, preparation and business development consulting. He works with individuals, small to medium-sized business clients, trusts and estates.